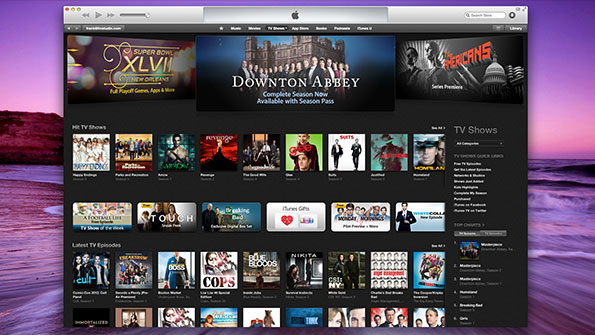

Apple’s iTunes is king of Online Video, VOD and Mobile TV

The NPD Group just released a new report this week which includes some surprising numbers concerning on-demand video in relation to DVD and Blu-ray. A lot of this points to some growing trends pertaining to mobile video and how we’ll all be consuming content in the next several years.

Most telling from the report is that VOD and digital downloads continue to increase, with downloads (against disc) rising up 16 percent and VOD (video on demand) increasing 12 percent. While much of the VOD business is through pay-TV operators, a slice also pertains to mobile, which is a growing segment on many fronts. The four big players as far as marketshare are iTunes with 45%, Amazon Instant Video with 18%, Vudu with 15% and Zune/Xbox Video coming in with 14%. There are other brands and services, but those combined captured less than 8% of the market. Some of these include the Google Play store and Sony’s PlayStation Network store. Although Apple’s lead may look good, the percentage was actually higher a couple years ago, mostly due to the fact that that back then there was considerably fewer options to grab movies and TV shows. In fact, two years ago, the report stated that even though Apple was still number one, number two was Microsoft and number 3 was Sony (not even near the top of the chart this time).

The correlation to mobile is telling because all services at the top of the chart have a mobile TV equivalent, usually in the form of an app or service or both. Also on the rise is actual purchases of TV shows and movies. With TV shows, the cost between rentals and purchase is negligible typically, so it often makes more sense to just own the show rather than rent, and potentially re-rent, the title again.

The biggest change is the latest marketing aspect used by companies such as Apple and Sony called “Early Digital Release”. This impulse buy coaxes the consumer into purchasing (with more revenue generated) than renting. For example say a movie becomes available on the 14th of the month, available to rent and buy. Apple and others now offer an early-release purchase-only on the 7th of the month, a week (or two) early. Fans eager to watch on mobile, or on devices such as Apple TV, often choose the purchase option as opposed to waiting the extra weeks to rent. This generates more of a library of content for the consumer as opposed to one-off rentals. Just as traditional disc-based media hopefully pushes people toward buying rather than renting (30-day holds on new rentals via Netflix and others are imposed by several studios), so now too is the new tactic in the digital domain of watching movies on mobile, set-top boxes and on demand.

A year from now Apple may well still be on top, fueled by continuing iPad and iPhone sales, but there is a good chance that the others in the top 5 could shuffle around, some could drop and others could appear. Perhaps Samsung may show up with a dedicated video store branded across all its devices. We’ll know in due time. The consistent fact is mobile video and on demand digital content shows no signs of slowing down anytime soon.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.