2024 in Review: Streaming Into Deals and Turmoil

The final painful phase of the transition to streaming will likely be a wave of mergers that will revamp the M&E landscape

After starting 2024 with hopes that the transition to streaming might finally produce a more stable, profitable businesses, the media and entertainment industry ended the year with a painful reality check. Major media companies laid off employees, restructured operations and prepped for a wave of mergers and acquisitions that are likely to produce even more trauma and turmoil in the next two years.

Whether all this is the final spasm of a dying traditional TV industry or the birth pains of a new M&E industry restructured around streaming is open to question.

But there is little doubt that the ongoing transition from the traditional TV business to streaming drove recent decisions by Comcast and Warner Bros. Discovery to spin off or split their dying cable networks from their rapidly growing streaming operations. Both companies hope the new structures will position them to sell off assets or craft mega-mergers to make themselves larger, more competitive players in a streaming media-dominated landscape.

And they aren’t alone. Other deals potentially tipped for 2025 involve the sale of Rupert Murdoch’s Fox Corp., streaming platform Roku, various TV station groups, ad agencies and a variety of other assets in the declining cable network sector.

The $13 billion Omnicom Group deal for Interpublic Group of Cos. illustrates how ad companies are looking to consolidate their market share of the lucrative CTV ad business, while a potential bid by Amazon or The Trade Desk for Roku would create a CTV ad powerhouse. Even the potential deals involving TV stations, cable networks or other nonstreaming operations will be part of a larger chess game to rejigger assets and create companies built for an M&E industry dominated by streaming.

2024 Hopes Deferred

Only a year ago, all this turmoil wasn't such a foregone conclusion.

Going into 2024 there was hope that media and entertainment companies might be finally putting the painful, loss-making decade-long transition to streaming in their rearview mirror.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

And this wasn’t just wishful thinking. By any measure, companies made great strides in 2024 toward putting streaming on firm financial footing, thanks to a spike in advertising, subscription revenues and viewing. Consider a few numbers:

- Nielsen reported that streaming accounted for record 41.6% of time spent viewing content on TVs in November, a big spike from streaming’s 36.1% share a year earlier and 27.4% in June of 2021.

- The Hollywood studio-backed Digital Entertainment Group reported subscription streaming revenue hit $11.94 billion in third-quarter 2024, up 26.7% from $9.43 billion in the year-ago period.

- Digital TV Research predicted U.S. advertising-supported video on demand (AVOD) streaming revenue would grow by $6 billion from 2023 to $21.6 billion in 2029.

- Adtaxi’s 2024 Streaming TV Survey found that streaming is in many ways already the new normal for media and entertainment in the U.S. Its annual survey found that streaming levels surpassed 80% of U.S. adults in 2024 and that Americans are now choosing streaming as their default source for viewing content. Nearly three in four (73%) list streaming as the first destination for content, versus cable (15%) and broadcast (6%).

- Meanwhile, free ad-supported streaming TV (FAST) channels continued to proliferate. A report from FASTMaster shows that the total number of unique FAST channels available in May 2024 in the U.S. hit 1,943. That marks a 13.1% increase from May 2023, with 225 added channels, and a 47.3% increase since May 2022, with 624 channels added.

- FAST channel providers and platforms also reported widespread gains in viewing. Samsung, for example, said its free ad-supported TV (FAST) and ad-supported video-on-demand (AVOD) service Samsung TV Plus is now attracting 88 million monthly active users, and that global viewing on the free streaming platform has grown by more than 50% year-over-year.

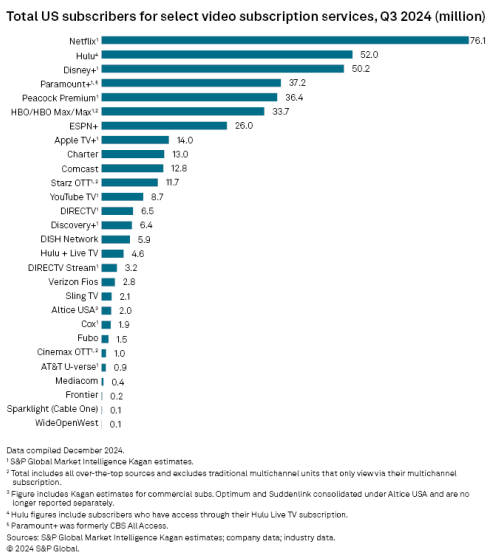

Those impressive growth statistics seemed to indicate the worst financial problems and turmoil of the streaming wars were over. During 2024, all the major streaming players—Netflix, Disney, WBD, Paramount Global and even Comcast see improved profits or at least reduced losses in their streaming and direct-to-consumer (DTC) operations, thanks to widespread efforts to hike prices, force consumers into ad supported tiers, boost ad revenue, expand internationally, crack down on password sharing and cut costs.

In a notable milestone, Disney reported its first streaming profits in 2024 for its third fiscal quarter, which ended on June 30, while Netflix added more than 5 million new subscribers in the third quarter as revenue increased by 15% year-over-year and operating income increased by 52% to $2.9 billion.

But such encouraging numbers are only part of the story. A closer look at the finances of the streaming and M&E industry in 2024 explains why the industry continues to be disrupted in ways likely to fuel a wave of consolidation in 2025.

Much of this comes back to the ongoing painful transition from traditional TV to streaming.

For more than a decade, traditional TV players have been caught between a rock and hard place in their hopes of putting the media and entertainment business on new, more profitable foundations.

On one hand, Wall Street expected media companies to invest massive amounts in money-losing streaming services to ensure their future survival; on the other, those companies struggled to maintain their traditional, very profitable businesses that were being slowly destroyed by the shift to streaming media. During this process, their traditional businesses had to last long enough to fund the transition into streaming, which everyone believed would become as profitable as it was popular.

A good example of that dynamic can be found at Warner Bros. Discovery, which has seen its stock hammered by the impact of cord-cutting and is now restructuring its operations to separate streaming from its legacy cable networks.

In Q3 2024, WBD reported impressive gains in its global streaming subscriber numbers in Q3 2024, adding more net Max subs than during any quarter since the streaming service launched.

Overall, global direct-to-consumer subscribers hit 110.5 million at the end of Q3, as DTC revenues increased 9% year-over-year, DTC ad revenues jumped 51% year-over-year and DTC operating expenses increased by only 1% and DTC adjusted EBITDA was $289 million, a $178 million increase in adjusted EBITDA versus the prior year.

Unfortunately, large parts of its other businesses were in rapid decline. Total corporate revenue declined by 4% YoY as WBD’s networks segment saw distribution revenue decline by 8% year-over-year while advertising dropped a whopping 13% and adjusted earnings before interest taxes depreciation and amortization (EBITDA) in the division fell by 12% from a year earlier.

The New Normal

Turmoil is only part of the story of 2024 and its impact on 2025, though

If the final phase of the transition to streaming media is likely to fuel megadeals that will undoubtedly see thousands and thousands of employees lose their jobs, many other things about the streaming industry are likely to remain the same.

As the industry prepares to reshape itself around streaming media, it is becoming increasingly apparent that streaming’s new normal just happens to look a lot like the old pay TV and broadcast TV businesses.

In other words, the traditional pay TV practices of bundling content, spending heavily for high-profile sports, relentlessly hiking prices, forcing people to watch more ads, ramping up ad sales and cracking down on privacy have all been adopted as central operating tenets of the streaming industry.

This is most obvious to consumers with price increases, a major factor in convincing people to abandon pay TV for streaming services in the 2010s.

During 2024, Disney+, Max, Hulu, Paramount+, Peacock and others increased prices, generally much faster than inflation. “The years of prioritizing user growth with low prices are over,” Mike Proulx, vice president and research director at Forrester, told CNBC.

Ad-free tiers saw particularly hefty price increases as companies pushed to drive consumers into less costly ad-supported offerings. Disney+’s ad-free tier, for instance, jumped from $6.99 in 2019 to $15.99 now, while Peacock’s ad-free tier rose $9.99 in 2020 to $13.99 in 2024. Netflix increased its Premium plan from $15.99 in 2019 to $22.99 today, while its Standard With Ads tier has remained at $6.99 since 2022.

As the industry prepares to reshape itself around streaming media, it is becoming increasingly apparent that streaming’s new normal just happens to look a lot like the old pay TV and broadcast TV businesses.”

These price hikes are closely tied to the industry-wide push to boost ad revenue.

During a November call with analysts, Disney CEO Bob Iger noted about 60% of all new U.S. streaming subscribers are selecting ad-supported or AVOD tiers. In addition, “I think right now … 37% of total subs in the U.S. are AVOD subs—37% in the U.S. and 30% globally,” he said.

Meanwhile, Netflix in November celebrated the second anniversary of the launch of its advertising business by releasing new data showing its ad-supported tier now reaches 70 million monthly active users worldwide. Even better for the future of its ad revenue, 50% of new Netflix signups are for the ads plan in countries where it is available.

The Bundling Game

Another major trend has been the push towards bundling and acquiring sports rights.

In 2024, the ongoing shift of sports rights to streaming continued, with Amazon and NBCU’s Peacock gobbling up NBA rights starting in 2025. Netflix acquired rights to WWE’s “Monday Night Raw” in a $5 billion deal and will stream its first NFL game this Christmas. Both deals raised serious questions about the ability of streaming platforms to handle hefty traffic from major sporting events, given that the Netflix stream of the Mike Tyson-Jake Paul fight on Nov. 15 was widely considered a disaster.

Bundling continued to be a major strategy for operators and for the streaming players themselves. During a November quarterly earnings call with analysts, Disney's Iger said Disney+ would add content from ESPN+ to its offerings starting Dec. 4. That’s a notable step forward in the company’s plan to bring a full sports offering to Disney+ and to launch ESPN’s direct-to-consumer offering in fall of 2025.

After acquiring full control over Hulu, Disney has also been tweaking its bundles of Disney+, ESPN+ and Hulu.

Meanwhile, operators continue to push forward with a strategy of bundling streaming services with traditional cable networks as a way to stanch at least some losses in their video subscribers and as a way to bolster the value of their broadband services, which have been under threat from 5G providers like T-Mobile.

Streaming platform Xumo, a joint venture between Charter Communications and Comcast, has been adopted by some connected-TV manufacturers and five pay TV operators now offer it to their broadband subscribers.

Both Charter and Comcast have made streaming rights a central part of their negotiating strategies for content, with Charter launching Disney streaming services and WBD’s Max streaming service at no extra charge, as part of traditional video packages.

The biggest bundling and sports streaming story of 2024 is however looking more and more like a bust.

In February, ESPN, WBD and Fox shocked the sports and streaming industries with plans to pool their NFL, NBA, MLB, NHL and other sports rights in a new sports streaming service, Venu, which was eventually priced at $42.99 a. month. While its backers insisted the service, targeted at cord-cutters, would not harm their traditional pay TV revenues, Venu raised fears that the last popular programming holding together the traditional pay TV bundle was about to unravel.

Instead, the service seems to be in danger of unraveling due to legal challenges. After the virtual MVPD Fubo an antitrust lawsuit against the service, U.S. District Court Judge Margaret Garnett in Manhattan issued a preliminary injunction in August blocking its launch.

While Venu’s owners are appealing the decision, the delayed launch could make it less likely to succeed or even to launch, given ESPN’s plan to launch a more-expansive streaming service in 2025. The case is currently scheduled to trial next October.

Bigger Big Tech?

On the tech side, the industry is also seeing the first hints of major consolidation.

In November, programmatic ad giant The Trade Desk jumped into the streaming technology business with a new operating system called Ventura. The Ventura platform aims to better integrate and streamline CTV advertising into streaming offerings. The launch—which will face stiff competition from operating systems from Google, Roku and others already in hundreds of millions of smart TVs—highlights the growing importance of connected TV operating systems as well as CTV advertising.

In launching Ventura, The Trade Desk hopes to leverage its position as the largest independent demand-side programmatic ad platform and a major provider of ad technologies to improve the streaming technologies used by CTVs and streaming media players in ways that would streamline and boost the CTV ad business.

With the incoming Trump administration bringing a more lax regulatory attitude towards mergers, there has also been increased speculation that Roku, the most widely used largest U.S. streaming platform, might be sold. The Trade Desk and Amazon have been tipped as potential bidders, according to a report issued by Guggenheim analyst Michael Morris.

Nearly two-thirds (65%) of U.S. internet households now use either Roku, Samsung or Amazon Fire TV as their primary CTV platform, Parks Associates reports.

Also in December, Brightcove, a major supplier of streaming technologies and services, said it has entered into a definitive agreement to be acquired by Bending Spoons in an all-cash transaction valued at about $233 million.

Broadcast Left Behind?

On the broadcast side, the impact of streaming has been mixed.

For local stations, streaming remains a tiny part of their business, which means that they continue to lose out on one of the fastest-growing ad markets at a time when their core advertising revenue continues to decline. The BIA has predicted that TV digital revenue would hit about $2.23 billion in 2024, up 25.4% from 1.78 billion in 2023, which is just a fraction of the total $20.7 billion in TV OTA revenue.

However, the collapse of the regional sports network business, which has been largely fueled by the rise of streaming and the decline of the pay TV industry, has helped broadcasters like Gray and Tegna grab lucrative pro-sports rights, returning many games that once were only available on pay TV to free broadcast.

NBC, CBS and other broadcasters have also been ramping up their streaming efforts, launching a slew of FAST channels and beefing up programming, with CBS rebranding and adding new programming to its CBS 24/7 streaming service in 2024. In some cases, added investments in streaming have also helped fund new technologies for better local newscasts.

While the difficult climate for local TV ads and the news business in general forced E.W. Scripps to shut down the over-the-air feed of Scripps News, which remains on streaming in a more modest form.

Despite the lack of progress many local TV stations have made in building up their streaming operations, there is clearly a demand for it. Zeam Media said its hyperlocal streaming service has increased its daily viewership by 168% since its February launch, and the company’s advertising solution, Adsync, delivered more than 5 billion advertising opportunities.

With a focus on hyperlocal content and news, Zeam also said it has partnered with more than 300 local broadcasters and other content creators this year to bring stories from towns across the U.S. to viewers everywhere.

In a notable expansion of how viewers can watch local PBS stations, the network and Amazon announced that more than 150 public TV stations and the PBS Kids channel will launch ad-free over the coming months as a Prime Video FAST offering. This marks the first time this programming will be available for free on a major streaming service to customers across the country.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.