FAST, AVOD Driving New Ad Tech Options

The challenge of matching viewers with the right ads

As content creators, aggregators and distributors continue to finagle their respective paths around the constantly changing video-consumption desires of global audiences, the race to monetize content and engage audiences with relevant advertising might be getting some much-needed help from the ad tech vendors.

Part of the need for advanced technology solutions is driven by the tremendous growth in ad-supported streaming, whether via free ad-supported television (FAST) channels or ad-supported video-on-demand (AVOD) tiers offered by subscription services like Amazon Prime Video and Netflix. More and more channels and options for viewers have created an interesting dilemma—there’s way more ad inventory available than there is supply. For companies relying on programmatic ad models to fill this inventory, the user experience must be considered.

“With traditional linear TV, the measurement we’re still looking at is ratings,” said Steve Reynolds, president of Imagine Communications. “But, ‘ratings’ has started to evolve into ‘reach’ and ‘frequency’ and pacing of advertising. Delivering the same message to the same household 30 times may not be any more effective than delivering that message five times.”

Balancing Act

Addressable advertising inventory available on subscription services and other media offer the ability to match ad content with very specific viewer demographics, but a careful balance has to be struck to maintain brand quality and avoid doing more damage than good.

“We’ve always had good tools for managing frequency and pacing in the linear world, but we’re now seeing our customers’ need to bring those capabilities into the connected TV (CTV) world,” Reynolds continues. “The targeting enabled by programmatic systems works great.

“The problem is it’s almost too perfect—to the point where advertising can become ineffective if it creates negative viewer perception,” he adds. “To counteract this, we’ve taken the traditional business rules we’ve applied to linear TV for years, like frequency, category separation and brand safety rules and incorporated them into what we describe as a broadcast-quality digital ad server.”

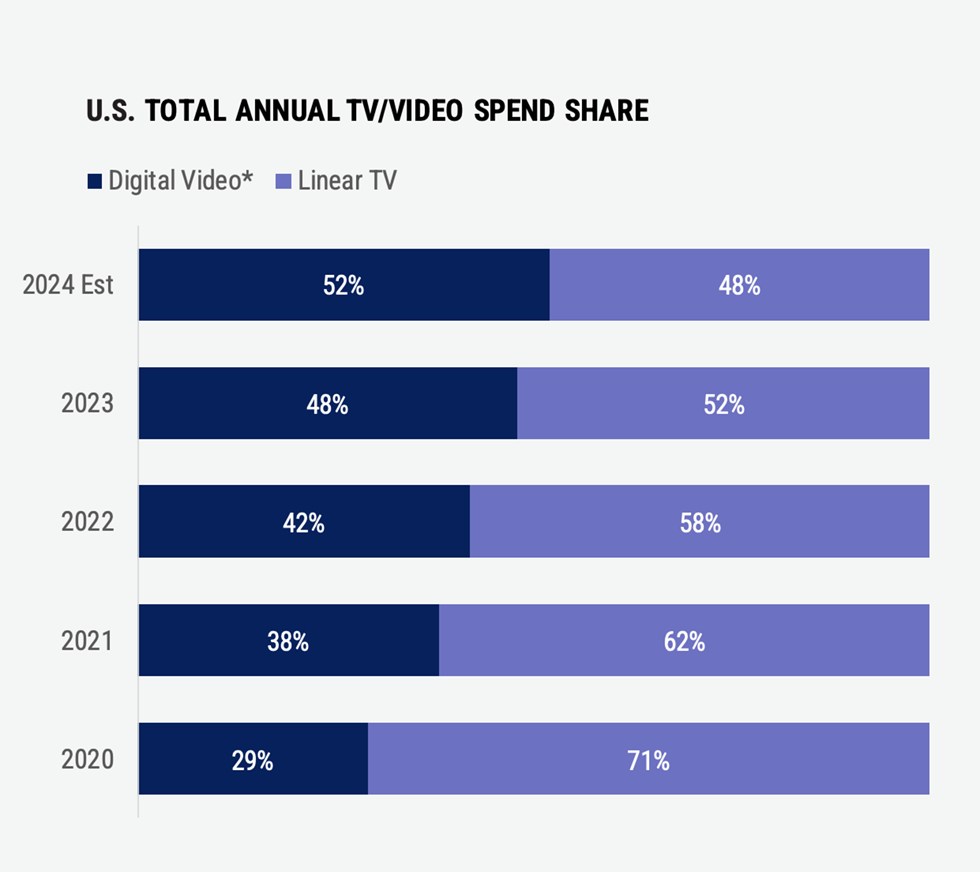

The system exemplified in this scenario is designed to make life easier for broadcasters and distributors transitioning from traditional selling of ad inventory to converged selling of linear and digital ads. This transition is ongoing, but it’s not new.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

In fact, according to a recent report from the Interactive Advertising Bureau, “2024 IAB Digital Video Ad Spend & Strategy Report,” three-quarters of CTV advertising is already bought programmatically, much of it transacted through systems offered by suppliers like Imagine, Operative, WideOrbit, Boostr and many others that simplify the sales process and drive revenue growth.

What’s AI Got to Do With It?

Technology is being applied to do more than simply create efficiency. Despite the apparent imbalance between inventory supply and content available to fill it, there are significant efforts to introduce new types of inventory—ones with greater opportunity for branding and viewer engagement—many of which are leveraging AI.

In a recent interview with IBC365, BroadView Software President Michael Atkin said: “[Using AI] you can now do real-time identification of new spots to insert advertising in backdrops that we couldn’t do even this time last year. Every year we get better and better at being able to identify the piece of content. And the better we can identify the user, the better you can target the materials they want to see.”

In fact, recent improvements in AI’s ability to analyze video content has opened up a number of unique opportunities for engagement and new revenues.

In the past several years, major events, especially sports, have begun including new sponsorship opportunities during lulls in game action (think “Playing Through” during NBC’s golf coverage). Capitalizing on this trend, Sportradar, a data and insights company focused on sports analytics and betting, offers an API to broadcasters that pushes real-time game information that triggers on specific game events. Productions can use this data to automatically run branded graphics to celebrate a big home run or touchdown.

AI promises to take this type of “in game” engagement even further.

“We use AI to create a transcript of the commentaries coming from sports broadcasts,” explained Jean Macher, senior director, global SaaS solutions at Harmonic. “We then feed that text into OpenAI to come up with a summary and highlights of the live action.”

This solution, currently still in development, will be able to autonomously create catch-up packages and highlights of big plays during the game, offering further opportunities for audience engagement.

Moving forward, the company hopes to capitalize on GPT 4.0’s next-gen capability to natively analyze video content.

“Now that the AI is able to understand the notion of the passage of time and make inferences based on that content, the hope is that if you combine the video analytics together with the audio analysis, you could achieve decision-accurate inferences,” Macher explained. “This workflow would then feed actionable metadata into the company’s VOS 360 platform to provide contextually accurate ad spot opportunities.”

The Audience Is Still the Thing

With all of these moves toward creating additional, and more relevant opportunities for brands to engage with audiences, regardless of the platform, it would stand to reason that the entire business model has been reimagined. Unfortunately, that’s not really the case.

“The need to be able to make dynamic ad decisions thanks to addressability—and now we’re doing unicast addressability—[has led to] new products coming along like ad servers, like Imagine’s Surefire,” Reynolds said. “But it’s not a fundamental change to the way things are done. The business model still hasn’t changed because advertisers still want to buy audience.”

The battle for improved brand engagement and action associated with this engagement is being fought on the frontlines like never before between agencies/brands and the folks with multiplatform inventory available.

“What we have to do,” Reynolds added, “is flip it 90 degrees and start thinking about the value of the inventory. There’s premium inventory and there’s non-premium inventory. People need to wrap their heads around optimizing the premium inventory on the basis of price and delivery value while optimizing the non-premium inventory on the basis of utilization and getting the highest yield possible out of it.”

Advertisers are seemingly open to the idea of new ways to engage and improve the impact of the impressions they’re getting.

“Dynamic brand insertion is something we do to insert the brand directly inside the video content,” Macher described. “Sometimes called ‘virtual product placement,’ we can create a placement opportunity where you’re going to see a bottle with a specific brand or a billboard with a specific message. We can use AI to analyze the video programming and find those placement opportunities in advance and then dynamically—and frame accurately—stitch that alternate content that now includes the brand placement into the program.”

Fortunately for those trying to balance market pressures like this, a wide range of tools are available to make this process both easier and more efficient. Leading cross-platform digital ad servers such as Google Ad Manager and FreeWheel work closely with other industry suppliers to ensure the products used to manage the sales process are smoothly integrated and ready to help ad sales folks sell more, instead of wasting time on administrative tasks.

This improved communication between the supply side and demand side leverages advanced tech that should lead to a more efficient system that takes everyone’s needs into account.

David Cohen is a longtime member of the media technology community, having worked in strategy and marketing for some of the most influential solutions providers in the industry including Harris, Miranda and Grass Valley. He’s currently president of Pinpoint Consulting LLC, a firm that specializes in improving executive-level communications and assisting in brand transformations.