360 Video: VR’s Path to the Mainstream

Immersive and interactive games tend to get top billing at this stage of the virtual reality market’s evolution, but 360-degree video could be the category that unleashes VR to the masses.

Nick DiCarlo

Video sets a “baseline of usage” that establishes a gateway of discovery for VR consumers, offering a path to games and other immersive apps and experiences provided by the platform, Nick DiCarlo, vice president of immersive products and virtual reality at Samsung Electronics America, said.

“No matter what kind of game or other content you’re interested in, you watch video,” said DiCarlo, who will be the opening keynote speaker at NewBay Media’s Virtual Reality 20/20 event at The TimesCenter |in New York on Oct. 17.

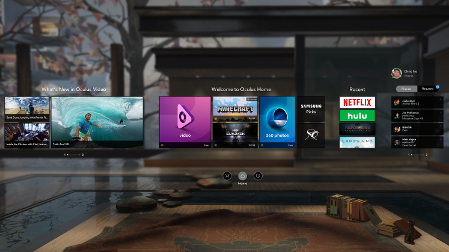

Samsung is approaching its first full year with a commercially available VR product — the Gear VR, an Oculuspowered headset that connects to compatible smartphones and a curated ecosystem of apps and services.

“Video, we thought, was going to be really important for VR,” DiCarlo said of Samsung’s opinion as it analyzed how the market might evolve following the launch of its “Innovator” edition of Gear VR in November 2014, followed by the consumer version about a year later. “We believed in 360-degree video as a way to help VR become really mainstream.”

Inspired by the television model, Samsung’s ambition early on was to release one new VR video a day. It turns out that the company’s goals underestimated its ambitions.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“We thought that VR needed … something new every day,” DiCarlo said. “By the end of 2015, we were releasing five videos a day.”

The growing reach of specialized 360-degree cameras and stitching software keeps filling the VR pipeline. And YouTube and Facebook have fully embraced 360 video.

“The creation and release of 360 video has absolutely blown away our expectations for how rich and creative and capable of an ecosystem that was out there,” DiCarlo said.

The numbers also bear out video’s popularity: Though it’s still early days, only about 40% of the apps available for Gear VR are games.

That’s surprising, DiCarlo said, because all of the early talk about VR content centered on games, with 360 video seen as a smaller complement. It turns out that 360 video is a “little bit bigger” than games on Gear VR.

“If you love games, you also watch video. But if you watch video you don’t necessarily love games,” DiCarlo said, noting that other categories such as social VR (AltspaceVR, for example) and VR real estate and entertainment systems from companies like Matterport will also factor heavily into the direction of the market.

Likewise, the broader VR ecosystem — from the headsets and the smartphones that power them, to the apps to the content contained in those apps — has evolved rapidly.

“All of these things need to happen all at once before you can sell one unit,” DiCarlo said. “What’s happened in the last year is nothing short of extraordinary.”

“Millions” of hours of VR video have been consumed on Gear VR, he said; the platform recently eclipsed 1 million active monthly users. “It has started to hit some big, key milestones,” DiCarlo said.

Video has proven to be an early driver of Samsung's Oculus-powered Gear VR.

Samsung has been partially helped in hitting those numbers by a promotion which gave free Gear VR headsets to customers who pre-ordered the company’s new Galaxy S7 and S7 Edge smartphones.

That promotion “exceeded our expectations,” DiCarlo said. “It took a lot of people by surprise how effective that was.”

Of course, Gear VR is far from alone in an increasingly competitive market. While PC-connected platforms such as the Oculus Rift and the HTC Vive target the highest end of VR’s consumer category, the mobile sector of the market, where Samsung lives today, already contends with relatively cheap Cardboard viewers. Google’s Android- powered Daydream system is also expected to debut later this year.

DiCarlo is convinced Gear VR’s performance will give it the edge, noting that the headset-smartphone combination supports 20-milisecond “motion-to-photon latency,” referring to how quickly the display updates and changes when people move their heads.

“The best VR headsets in the world are equal to that,” he said. “There isn’t a mobile-powered headset that’s even close to that.”

He also said consumers find the device itself comfortable to wear — something that’s necessary if it’s to appeal to a mass audience.

“If you want regular people to use this product, it has to be comfortable. It’s not even an option,” he said. “That’s a critical, though often misunderstood, differentiating feature that we have yet to see matched by any mobile device in the marketplace that you can actually buy.”

The platform’s app ecosystem is also key. Gear VR’s compatible smartphones are designed to download software automatically, removing some manual processes.

At the same time, explaining these differentiators is a challenge at retail. When HDTV came on the scene, it took some seeing for would-be buyers to believe. For VR, consumers will likely want to try before they buy.

Gear VR is featured in as many as 18,000 retail stores, with 15,000 of them offering hands-on demos, DiCarlo estimated.

“Trying it and experiencing it and understanding what it really means is super-critical,” he said.

Looking ahead, DiCarlo sees bigger and better things ahead for mobile VR as consumers gain easier access to products that can create and share 360-degree content. Mobile VR will also lend itself to more advanced features such as hand- and position-tracking.

“There��s room for that in mobile, but it will just be on a different time scale,” he said.

This story originally appeared in the Sept. 19 issue of Multichannel News.