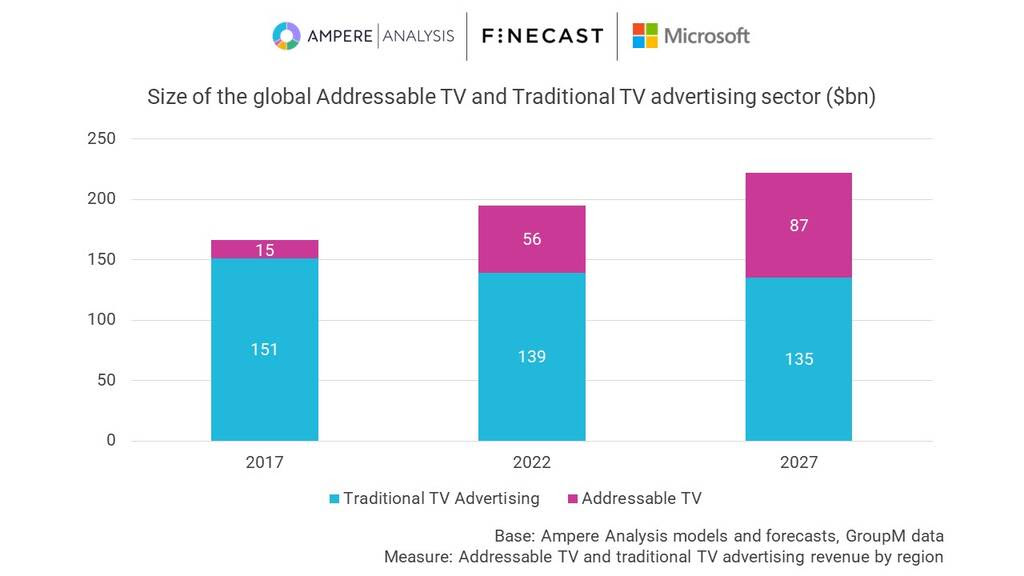

Addressable TV Ad Spend to Hit $87B in 2027

Global revenue will grow by more than 50% from $56B in 2023 according to Ampere Analysis

LONDON—The global addressable TV sector is set to continue its rapid growth with the $56 billion 2023 global spend set to rise by more than 50% to $87 billion by 2027, according to a new report on the addressable TV market published today by Ampere Analysis in partnership with GroupM Nexus’s addressable TV solution Finecast and Microsoft Advertising.

The report, which was informed by over 100 interviews with advertisers, streamers and agencies, also highlighted a number of emerging technologies, such as connected autos and generative AI, that could spur growth.

Even so, the researchers cautioned that the rapidly growing sector still faces a number of major challenges that could slow growth.

Richard Broughton, executive director at Ampere Analysis, explained that “[t]he extent to which addressable TV advertising is now being used by non-traditional TV advertisers, including smaller companies and B2B brands, is illustrative of how the medium can support TV service providers in their push to reach beyond traditional broadcast TV budgets and to open entirely new revenue streams. But it’s clear that there is still work to be done by the industry in challenging entrenched opinions and in countering common misconceptions.”

Key takeaways from the analysis included:

- An average of a sixth of advertisers’ video advertising budgets are currently being spent with addressable TV service providers. This is as high as a fifth in mature markets like the US, with all major industry categories represented among addressable TV advertisers.

- Both B2B and B2C marketers are using addressable TV to support performance marketing and brand-building objectives, targeting specific audience segments or geographies.

- Brands are using addressable TV to extend campaign reach beyond broadcast TV. This is key in younger groups for whom the aggregate reach of addressable TV services provides a nearly 25% incremental reach boost over total monthly broadcast TV reach in developed markets.

- While both small and large brands are using addressable TV, smaller advertisers devote less of their marketing budget to addressable TV. Addressable TV service providers need to work to remove non-cost barriers to using the technology, simplifying the purchase and planning process to support uptake.

- Addressable TV typically commands higher pricing, which is attractive for service providers, but there are also incentives for service providers to deploy addressable TV to support viewer satisfaction and retention. Viewers who believe their TV service offers relevant advertising rate their streaming service higher in terms of user satisfaction – with an average Net Promoter Score 16 points higher than those viewers who don’t feel they are receiving relevant commercials.

“The exponential expansion of the addressable TV advertising market serves as a clear indicator of the immense prospects awaiting service providers and brands,” explained Kristian Claxton, managing partner, innovation and strategy at Finecast. “This research illustrates the inherent potential of addressable TV as a powerful tool for targeted communication with previously hard-to-reach audience segments. The seamless integration of such capabilities with the storytelling possibilities and brand protection mechanisms inherent in broadcast TV is well demonstrated,”

Despite the rapid growth of the addressable TV market, the researchers said that interviews conducted for the study revealed an array of attitudes and opinions that could hold back future growth if not countered by the industry.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

One problem is that in emerging markets, there was a lack of clarity about the capabilities of addressable TV. Some brands were unaware of the targeting capabilities of addressable TV platforms in their region, leading them to spend with alternative media.

Even in developed markets, where addressable TV technologies are more mature, some marketers were not aware of the reach of addressable TV services, believing it to still be limited compared to broadcast media, the researchers noted.

The report also found that among those advertisers not yet purchasing addressable TV there was a widespread perception that addressable TV services were expensive. This contrasts the belief of brands already purchasing via addressable who felt that addressable TV was just as cost-effective as other formats, the study found.

The report forecasts that as case studies filter through to the wider market, those advertisers who are still wary of the technology will begin their addressable TV journey, contributing to the sector growing to an $87 billion industry by 2027.

The research also highlights emerging technologies and screens that will support future addressable campaigns.

Interviews revealed that connected cars have already debuted as an addressable TV channel in some markets, with some brands taking advantage of geotargeting opportunities to reach passengers with messaging. And some agencies and brands were thinking about how targeted QR code-based formats support a level of follow-through and sales attribution, the researchers

The report also suggests that new technologies such as generative AI may begin to support the creative process in the next few years, helping to address the practical challenges associated with developing the multiple creatives required for dynamic or addressable creative campaigns.

“Addressable creatives already allow media buyers to adapt messaging by audience group and in response to events, keeping commercial messages fresh and relevant,” explained Dave Osborn, general manager, sales at Microsoft Advertising. “However, many of the most exciting developments in the addressable TV market have yet to be fully explored by brands. As many advertisers now see addressable TV as a core part of their media mix, their focus will shift to take full advantage of the capabilities of addressable TV and innovations such as generative AI and emerging technologies.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.