African-American Audiences Embrace vMVPDs, FAST and Black-Targeted Streamers

Over 4 in 10 (42%) have access to at least one Black-targeted SVOD and are heavy users of FAST channels

NEW ROCHELLE, N,Y.—A new study from Horowitz Research indicates that streamers and content providers who want to attract African-American audiences need to provide culturally relevant content and that Black audiences are already embracing vMVPDs, FAST channels and Black-targeted streamers.

“Culturally relevant content has always been an important piece of the media pie for Black audiences,” notes Adriana Waterston, executive vice president, Insights & Strategy Lead for Horowitz Research, a division of M/A/R/C Research. “With retention being a challenge in the SVOD and vMVPD spaces and engagement a challenge for FAST/AVOD, offering top-notch Black content can be an important differentiator.”

Horowitz Research’s new annual report, FOCUS Black Volume I: Subscriptions 2024.which tracks the evolution of the pay and free TV, streaming, internet, and mobile environment among Black Americans, finds that content geared toward Black audiences is important for over 6 in 10 (62%) Black households.

The study also found that as traditional cable/satellite subscriptions decline, penetration of subscription streaming services has remained steady among Black households. About two thirds (67%) of Black TV content viewers subscribe to at least one SVOD, which is about the same as total U.S. viewers.

While Netflix and Amazon Prime Video top the list of most popular SVODs, Black audiences also use a range of Black-targeted SVOD services: Over 4 in 10 (42%) have access to at least one Black-targeted SVOD, such as BET+, Zeus, Black World Cinema, ALLBLK, etc.

The new Horowitz study also finds that Black audiences are more likely to watch content on free, ad-supported TV (FAST) channels than the general audience.

Three quarters (75%) of Black TV content viewers use FAST services (compared to 67% of total market consumers). That’s more than a five-fold increase from 2019, when only 13% of Black households reported using these services.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

In comparison, the total market usage of FAST services increased 25% during the same time span.

The researchers also noted that the array of Black-focused content available on FAST channels is an important driver of viewership. Notably, 2 in 3 (66%) Black FAST viewers say that they watch content geared toward Black audiences at least weekly, according to the new FOCUS Black Volume II: Viewing Behaviors 2024 report from Horowitz. In the past month, Black households over-indexed for usage of Tubi, Pluto TV, and XUMO.

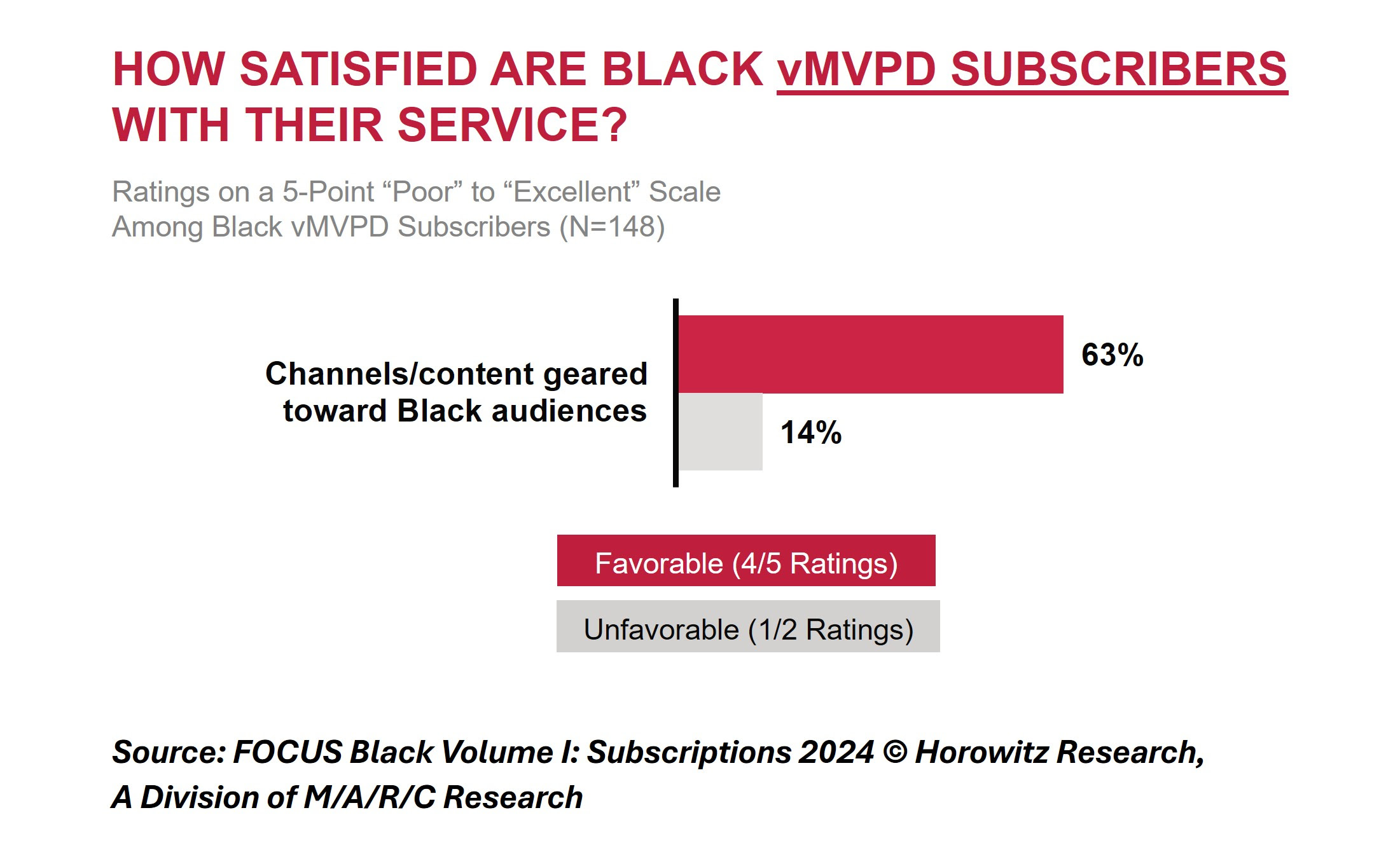

Virtual MVPD services like YouTube TV, Sling, and Hulu with Live TV are also gaining traction among Black households. Almost 1 in 3 (32%) Black TV content viewers subscribe to at least one vMVPD service (over-indexing compared to 23% of consumers overall). Notably, almost 2 in 3 vMVPD subscribers report high satisfaction with the channels and content geared toward Black audiences on their vMVPD service.

Horowitz also announced that the importance and value of content for diverse audiences will be a key focus of Horowitz’s upcoming Cultural Insights Forum, which is coming back in Fall of 2024 after a 6-year hiatus. The Forum, focused on how brands and media companies can drive ROI by reaching and serving America’s diverse, multicultural, and intersectional audiences, will be hosted on November 14, 2024, at Telemundo Center in Miami. Sponsorship and speaking opportunities are now open, and registration will open soon.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.