ATSC 3.0 Offers Broadcasters Substantial Revenue Growth Opportunities, Says Ducey

As a new platform, 3.0 will support new services that drive future revenue growth higher

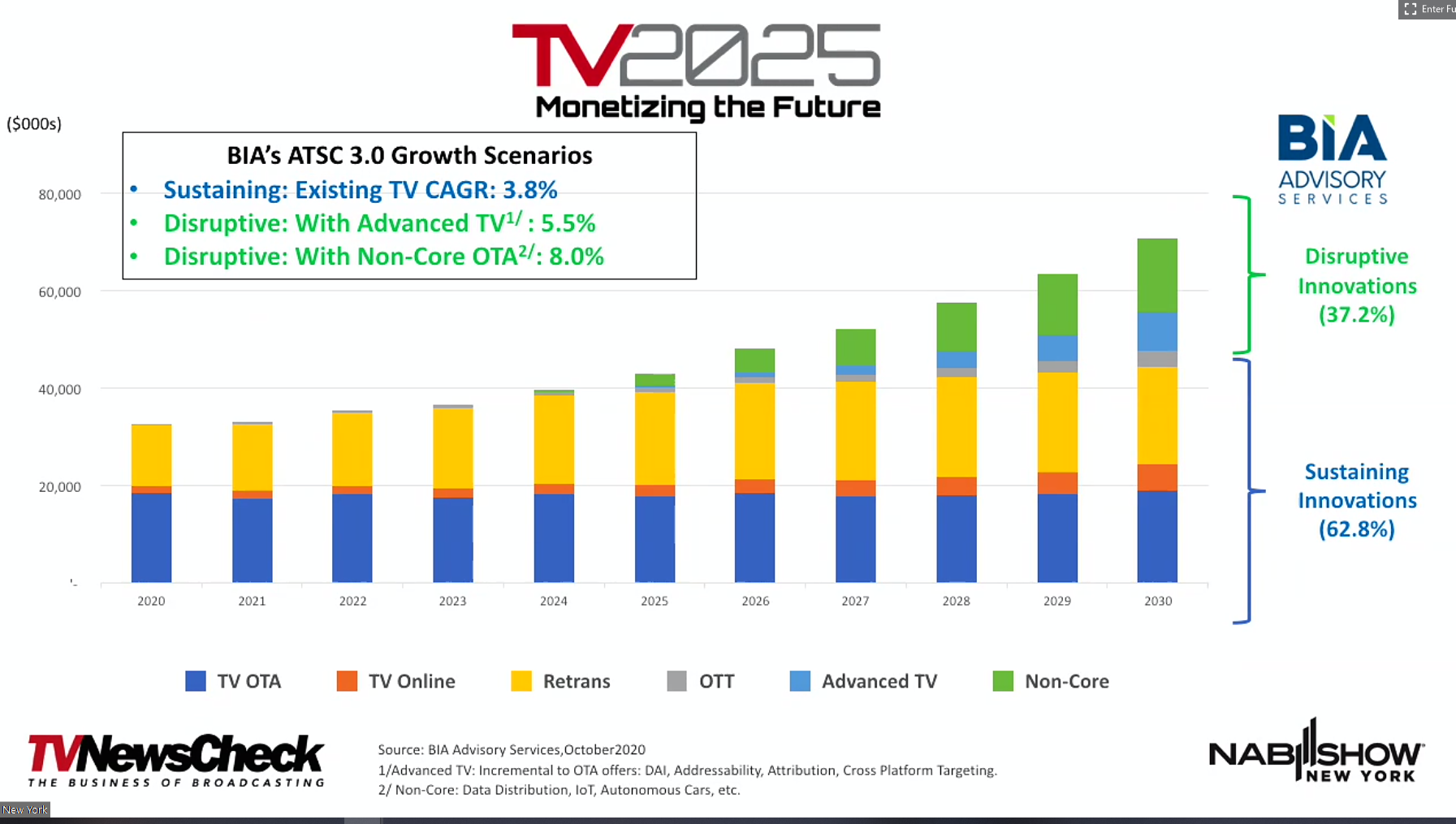

NEW YORK—The ATSC 3.0 standard offers television broadcasters a means toward doubling anticipated revenue growth over the next decade from a 4% bump if they “stick to their knitting” to 8% if they seize on the new service opportunities it offers.

That scenario-based forecast from Rick Ducey, managing director, BIA Advisory Services, is one of the ATSC 3.0 insights offered by the four panelists participating in the “NextGen TV: Ready for Primetime?” session Oct. 20 during the TV2025 Monetizing the Future track at the virtual NAB Show New York conference.

Ducey was joined on the panel by John Hane, president of BitPath; Todd Achilles, co-founder and president and CEO of Edge Networks; and Erik Langner, president of Public Media Group. Glen Dickson, contributing editor at TVNewsCheck moderated the discussion.

Ducey was asked to compare Diginet revenue to that from new services made possible by the NextGen TV standard.

“Diginets, that business has matured, but it is probably on the order of $400 to $500 million, which is not bad revenue. But it’s, you know, not the kind of scale that we’re hoping to see in 3.0,” said Ducey.

Each of the other panelists laid out how their organizations currently are leveraging 3.0’s technical superiority to ATSC 1.0—or plan to do so in the near future—to offer new services and generate added revenue.

ON THE EDGE

Edge Networks, a broadcaster that is building a hybrid over-the-air, over-the-top wireless pay-TV service based on ATSC 3.0, launched to a select number of residents in Boise, Idaho, in September. Since then, the company’s market research has revealed two groups of people are particularly interested in its Evoca service: cord-cutters and those who are thinking about becoming cord-cutters, said Achilles.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

People in smaller American communities—what Achilles describes as Tier 2 and Tier 3 markets—don’t have a lot of TV service choices. “When we look at the opportunity, we see 50 million-plus TV households across the country that are in sort of similar situations to consumers in Boise,” he said.

ATSC 3.0 makes Evoca possible. “We use a pretty aggressive modulation code rate to maximize the capacity over the air, and then of course you’ve got another level of efficiency in terms of using H.265,” he said.

The service makes HD content—1080p and 720p—as well as 1080i ATSC 1.0 channels broadcast in the market available to subscribers. Last week, Evoca announced the addition of a 24/7 4K channel from Dutch programmer Insight TV, said Achilles.

Evoca will cost consumers $49 per month. Currently, introductory subscribers are paying less. A $100 set-top box with both 1.0 and 3.0 tuners and DVR storage along with an off-air antenna are necessary to receive the service, which offers a channel mix comparable to what’s available via cable or satellite, he said.

DATACASTING AND MORE

BitPath’s Hane discussed the central role datacasting will play for broadcasters in a 3.0 world. “…[O]ur mission is to build a nationwide data broadcasting network as a for-profit business for the benefit of our partners, which are broadcasters, but operating entirely outside of the core over-the-air television business.”

To make that happen, BitPath is working to aggregate spectrum from broadcast partners and offer that capacity on a lease or for-purchase basis to third parties wanting to deliver data over the air. It also is working on developing its own data services where BitPath owns “the entire value chain top to bottom,” he said.

Over the past year, BitPath has worked to advance the 1.0-to-3.0 transition. “In spite of the pandemic, we’ve launched several [3.0] markets,” said Hane.

Launches this year have or will include: Las Vegas, Pittsburgh, Salt Lake City, Portland, Ore., Austin, Texas, San Antonio, Oklahoma City, Pensacola, Fla., Raleigh, N.C., Columbus, Ohio, Seattle and Denver, he said.

Public Media Group (PMG) is also at work building out a 3.0 infrastructure across the country that leverages single frequency networks to deliver robust over-the-air service, said the company’s Langner.

“We're a technology infrastructure company that's designing, building, financing and operating single frequency networks throughout the country—predominantly for commercial broadcasters, but also with public broadcasters,” he said.

Engineering studies conducted with PMG’s clients show the potential of 3.0 transmitted via an SFN to grow viewers, especially when the audience has its antennas at a height of 1.5 meter—i.e. handheld—rather than 10 meters on top of a roof as envisioned by the Federal Communications Commission, he said.

“So just as an example, in Los Angeles and San Francisco, we're seeing over 2 million POP increases, and actually that's going to grow in L.A.,” said Langner.

“In Dallas and in Boston, which we just completed, we're seeing a 70% increase … on deep-in-the-home penetration. And in Boston, that number is 100%. We're seeing a 100% increase in home penetration in Boston,” he said.

PMG has formed an alliance with American Tower for initial deployment on 300- to 500-foot towers with high-power transmitters—a “relatively light footprint” compared to what is planned for 5G deployment, he said.

“We strongly believe broadcasters will be far more efficient in terms of what they charge per gigabit than what the 5G providers are able to do,” said Langner, adding that data distribution will be a tremendous opportunity for broadcasters electing to pursue it.

Commenting on the business plays of both BitPath and PMG in partnership with broadcasters, Ducey noted the ramifications of 3.0 on future revenue growth. “You know, those are different marketplaces that can open up [new] markets to broadcasters,” he said.

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.