Battle Among Networks, Affiliates and Streamers Heats Up

Broadcasters want more FCC oversight on vMVPDs

WASHINGTON—Sometimes in Washington the best indicator that something big is brewing is when suddenly everyone clams up.

Such is the case with the long simmering effort to impose retransmission consent regulations on streaming video carriage of local stations. Recent sub rosa negotiations are not very well hidden, since affiliate groups and lobbyists (including the National Association of Broadcasters) have submitted ex parte filings about their Federal Communications Commission meetings on the topic. Both FCC Chair Jessica Rosenworcel and NAB President Curtis LeGeyt have acknowledged that decisions are overdue on streaming retransmission policies for video via virtual multichannel video programming distributors.

10 p.m. Up for Grabs?

Moreover, the issue is bubbling up as the entire nature of the network/affiliate relationship is undergoing major revisions—from chatter about ceding the 10 pm (ET) programming hour back to affiliates (the network has decided to keep it for now) to the intense appeals from NBC, CBS, Fox and ABC for viewers to tune in directly to their streaming services, such as Peacock, Paramount+ and Hulu, thus bypassing local affiliates entirely. In addition, stations’ adoption of ATSC 3.0 and its IP implications could affect the retransmission requirements.

The current chatter about vMVPD revenues comes amid forecasts that traditional retrans revenue to affiliates may drop from 50% to 39% of station income in the next few years, according to research firm BIA. Adding to the clout of networks’ (and other) streaming services is their libraries of off-network syndicated content, formerly a mainstay of independent stations (e.g. episodes of popular series such as “Seinfeld,” “The Office,” “NCIS” and “Friends”). Analysts wonder if audiences will tune into broadcast reruns if they can choose what to watch via streaming platforms.

Yet, NAB, NCTA – The Internet & Television Association, American Television Alliance (ATVA), the FCC and attorneys for stations and affiliate groups have all ducked TV Tech’s queries about what what’s going on, sometimes after initially agreeing to share updates on their negotiations but later saying that they couldn’t discuss activities because of current, unspecified conditions.

NAB declined to respond to TV Tech’s questions about its streaming stance, but later that same week the association submitted an ex parte filing at the FCC describing its meeting at which it urged the commission to examine “current streaming advancements [that] may affect the Commission’s calculus in determining whether virtual MVPDs should be deemed to be MVPDs.”

At the same time, LeGeyt asked the FCC to classify vMVPDs as carriers that are subject to program-negotiation obligations. NAB took that message directly to commissioners and their staffs in a series of November meetings.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Some advocates had hoped that Congress would address the issue via new laws for retransmission fee guarantees, but those dreams were dashed by the mid-term election. A divided House and Senate are considered unlikely to agree on any communications financial issues and will “not pass much legislation,” a veteran media lawyer/lobbyist told TV Tech.

Much of the current effort is focused on the 2014 FCC proposed rulemaking that then-FCC Chairman Tom Wheeler initiated, which sought to determine if video services that are not facilities-based should be subject to the agency’s rules for traditional MVPDs, such as cable or telco systems. In an interview with Politico Pro, LeGeyt said the NAB’s board wants the FCC to collect new feedback on the Wheeler proposal given “changes in the marketplace.”

Separately, Rosenworcel told Congress in November that she would welcome the chance to become involved in retransmission consent issues, particularly in disputes that affect viewer’s access to programs during blackouts of broadcast signals on MVPD systems. She said the FCC would work with Congress, but emphasized that the FCC’s role would be to protect consumers if vMVPD fees or terms are excessive—with no mention of helping affiliates.

Affiliate Rift

The retransmission situation also puts the spotlight on the growing rift between affiliates and networks. In a presentation to the FCC, four major networks’ affiliate groups pointed out that, “Unlike negotiations with traditional MVPDs where local television affiliates negotiate directly for the carriage of their FCC-licensed signals, the national Big Four broadcast networks have asserted near-total control over carriage negotiations with vMVPDs.” The group emphasized that deals are conducted “without any meaningful input from its non-owned Affiliate stations.”

Affiliates’ dissatisfaction with how networks are treating them is surfacing from multiple sources. There are unconfirmable reports that the networks have negotiated retransmission consent agreements with YouTube TV on behalf of the affiliates, but affiliates contend that their slice of that payment is too small. Other reports indicate that Comcast recently loaded all the NBC affiliates onto its Peacock streaming platform, after which NBC affiliates’ leadership issued a supportive statement. Analysts told TV Tech that lethargic support suggested that Comcast/NBC offered a good-enough deal, but no match to conventional cable retransmission fees.

The network vs. affiliates tension regarding vMVPD deals was especially vivid at the Big Four networks’ affiliate associations session at the FCC. When executives of the groups met virtually with FCC Commissioner Nathan Simington and his staff earlier this year, they urged the commission to consider making online video distributors abide by the same retransmission consent rules as traditional MVPDs, according to the subsequent report of their law firm, Brooks Pierce.

A new retransmission analysis by financial firm Matthew Lochte of Bond & Pecaro concludes that overall retrans fees have reached “mature equilibrium” thanks to cable cord cutting. The analysis, distributed by the Media Financial Management Association (MFM), points out that especially “for smaller broadcast companies” the affiliation fees could “exceed total retrans revenues” from MVPDs and vMVPDs.”

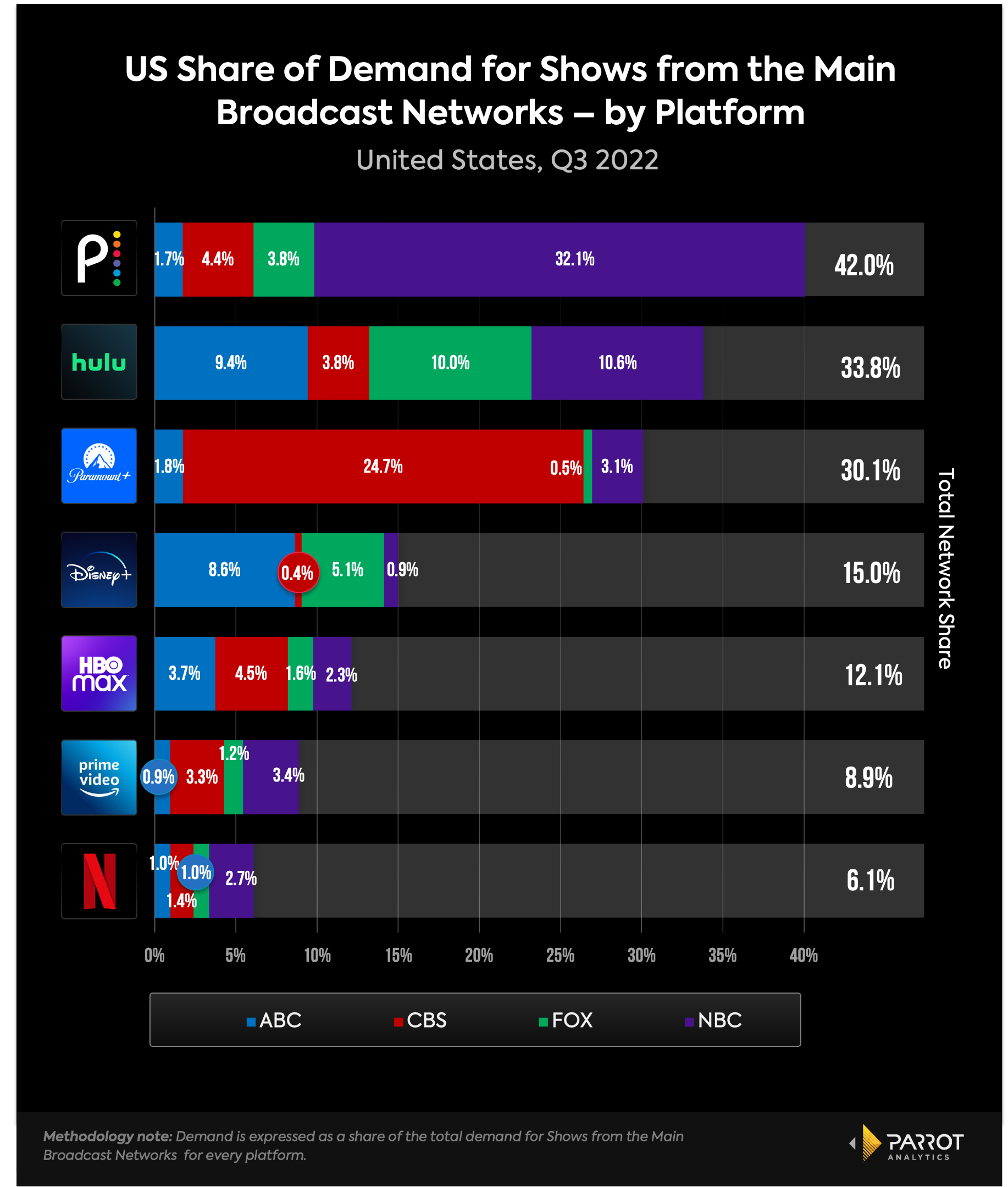

Parrott Analytics, in its latest, lengthy analysis “The Value of Broadcast Television,” builds a case for the symbiotic relationship between streaming video and broadcasting – although it focuses entirely on networks.

Parrott points out that in 3Q22, “a whopping 33.8% of its U.S. audience demand” of streaming content is based on broadcast network series. Viewers easy “access to new recent installments of mainstream network programming is a major selling point, providing consumers with a convenient on-demand option and providing networks with extended exposure,” says Parrot’s study.

“The networks themselves, and their significant domestic reach, can help expand a streamer’s audience demographic while raising additional awareness,” the report continues. “Once users are exploring broadcast titles within a digital ecosystem, they tend to stay there. Linear network shows provide a strong affinity halo effect that keeps audiences on track for related consumption. “

Emily Barr, former president/CEO of Graham Media Group and a vigorous defender of local stations and network/affiliate collaboration, acknowledges the complications because “there are so many players in streaming.” She said she’d like to see a “more cooperative relationship” as vMVPD develops since the network/affiliate relations is based on local stations receiving retransmission revenue.

“If the networks want to keep a relationship with affiliates, they [must create} a way to let the affiliates partake in the revenue,” Barr says, noting that, “There have been some discussions in that direction on behalf of some of the networks,” but that nothing conclusive has emerged.

Barr concedes that cord-cutting will continue to affect cable/satellite retrans revenue, but she foresees considerable revenue as the process unfolds, pointing out that networks are playing both sides, with investments to nurture some streaming services. “They’re trying to have a little bit of both [traditional retransmission plus direct-to-consumer streaming]” she said. But Barr stops short of predicting how the game will play out.

Slowing Retrans Fee Growth

Rick Ducey, managing director of BIA, underscores affiliates’ growing reliance on retransmission fees, which “will continue to be a substantial” factor, now accounting for more than 50% of local stations’ revenue. BIA’s forecasts envision that retransmission revenues could go down to 39% by 2026, and that local stations will receive a “decreasing share of it” as networks demand higher reverse compensation fees because of ever-increasing programming rights costs.

As for the current quiet ballet between broadcasters and digital platform operators, Ducey believes that “networks and affiliates boards have to negotiate what goes on the platform and determine what the split is.” He expects that affiliates will get “some economic benefit from vMVPDs” but notes that some major TV groups are already making such deals, much as they’ve done for their conventional retransmission agreements. Obviously, no details are being made public yet.

Ducey acknowledges that the networks have taken the lead in vMVPD negotiations on behalf of affiliates and “are probably not doing the best job for their affiliates.” He points out that local stations see cord cutting as impacting transmission fees, which will lead to “things getting more out of balance in favor of the networks.” Ducey agreed that when he probed into FCC or Capitol Hill involvement in this streaming retransmission issue, he also got “don’t want to talk about that” responses, which he characterizes as “a non-denial denial that’s probably an affirmation of an underlying issue that is brewing. No one said, ‘it is a non-issue.’ Semantics matter.”

Ducey envisions that there will be changes as broadcast affiliates complete deals with local MVPDs. “At some point the cable industry has to say ‘our ability to pay has been in decline, so we have to re-adjust fees,’” he predicts. “Margins are being compressed; looking ahead [there are] different businesses” taking shape.

Growing Recognition of Unfolding Problems

NAB’s meetings with top FCC Media Bureau officials and commissioners’ staff emphasized that “significant developments in the streaming marketplace may impact the Commission’s continued consideration of its pending proposal ‘to modernize [its] interpretation of the term … [vMVPD] by including’ … services that make available for purchase, by subscribers or customers, multiple linear streams of video programming, regardless of the technology used to distribute the programming,” according to the follow-up by Rick Kaplan, NAB’s chief legal officer and executive vice president, Legal and Regulatory Affairs.

Kaplan also pointed out that current streaming advancements may “affect the Commission’s calculus in determining whether virtual MVPDs should be deemed to be MVPDs.” And he emphasized that “must address certain critical implications of its proposal, including how to ensure broadcast signals carried by vMVPDs are protected from piracy, material degradation, and distribution beyond a station’s local market.”

Bolstering broadcasters’ expectations that they can reach deals with vMVPD operators are recent reports from Park Associates analytics firm that emphasize the continuing appeal of conventional video programming.

Adults 55 and older disproportionately favor a linear experience while viewers 18-24 prefer watching content from YouTube, social media, and the like.”

Jennifer Kent, Parks Research

“Adults 55 and older disproportionately favor a linear experience while viewers 18-24 prefer watching content from YouTube, social media, and the like,” Parks Research Vice President Jennifer Kent told TV Tech. “Consumers value live content because it is engaging, sometimes interactive, and personal to their interests.”

She cited a recent 50:50 joint venture between Comcast and Charter Communications (the two largest cable operators in the U.S.), to develop a nationwide streaming platform. Although the competitive strength of such a unified service may affect broadcast network initiatives, Kent says that the arrangement “may help Comcast and Charter pull ahead in subscriber growth and gain an edge in the crowded OTT market.”

Financial Considerations

Amid this regulatory rigamarole, Wall St. is also monitoring the impact of the vMVPD relationship with local broadcasting.

Laura Martin, senior entertainment and internet analyst at Needham & Company, doesn’t believe streaming is undermining local affiliates, contending that stations “will get paid if they have viewership,” but is not specific about how those payments will be made.

“The affiliate has value,” Martin said, but adding that direct-to-consumer viewing is all about generating specific data, so “local TV will be forced to compete on the local data.” It has to be “really good data about what kind of content attracts and keeps a viewer. It must pull its weight.”

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.