BIA: Local TV Advertising To Grow 3.6% to $21 Billion in 2025

Legal, automotive sectors will help fuel the growth in core advertising categories excluding political

CHANTILLY, Va.—New projections from BIA Advisory Services predict that TV advertising will grow by 3.6% to $21 billion next year, BIA Founder and CEO Tom Buono said.

Buono told TVB Forward conference attendees in New York that growth would be fueled by shifts in ad spending patterns, key business categories investing in local television and the prospect of mergers and acquisitions next year.

BIA’s local television advertising forecast—which rolls up linear TV, TV Digital, and connected TV (CTV)/over-the-Top (OTT)—projects local revenue will reach $21 billion in 2025, up 3.6% from 2024 with political advertising is excluded. The data showed that CTV/OTT is the largest-growing local TV segment, bolstering the industry’s digital growth.

“Our review of this year’s spending and our latest forecast for 2025 indicates a pivotal moment in local advertising, with digital media continuing its robust growth trajectory,” Buono said. “While traditional television viewing remains resilient, the surge in streaming services is reshaping the media landscape.”

The analysis also showed that traditional and digital platforms are increasingly interconnected.

It found that traditional TV over-the-air (OTA) revenue continues to demonstrate stability at approximately $16.5 billion (with political) in 2024, though its overall share of wallet has declined from 11.4 percent to 9.6 percent from 2019 to 2025.

Meanwhile TV Digital (i.e. TV-company owned and operated mobile apps and websites) grew steadily from 2019 to 2024. CTV experienced rapid growth during this same time frame.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Legal services is the largest category spender for local TV at $1.85 billion across TV OTA, TV Digital and CTV/OTT.

“The local broadcast television ecosystem is evolving beyond traditional metrics,” Buono said. “We’re seeing local broadcasters successfully adapt their strategies to encompass both conventional and digital delivery methods, creating more diverse revenue streams.”

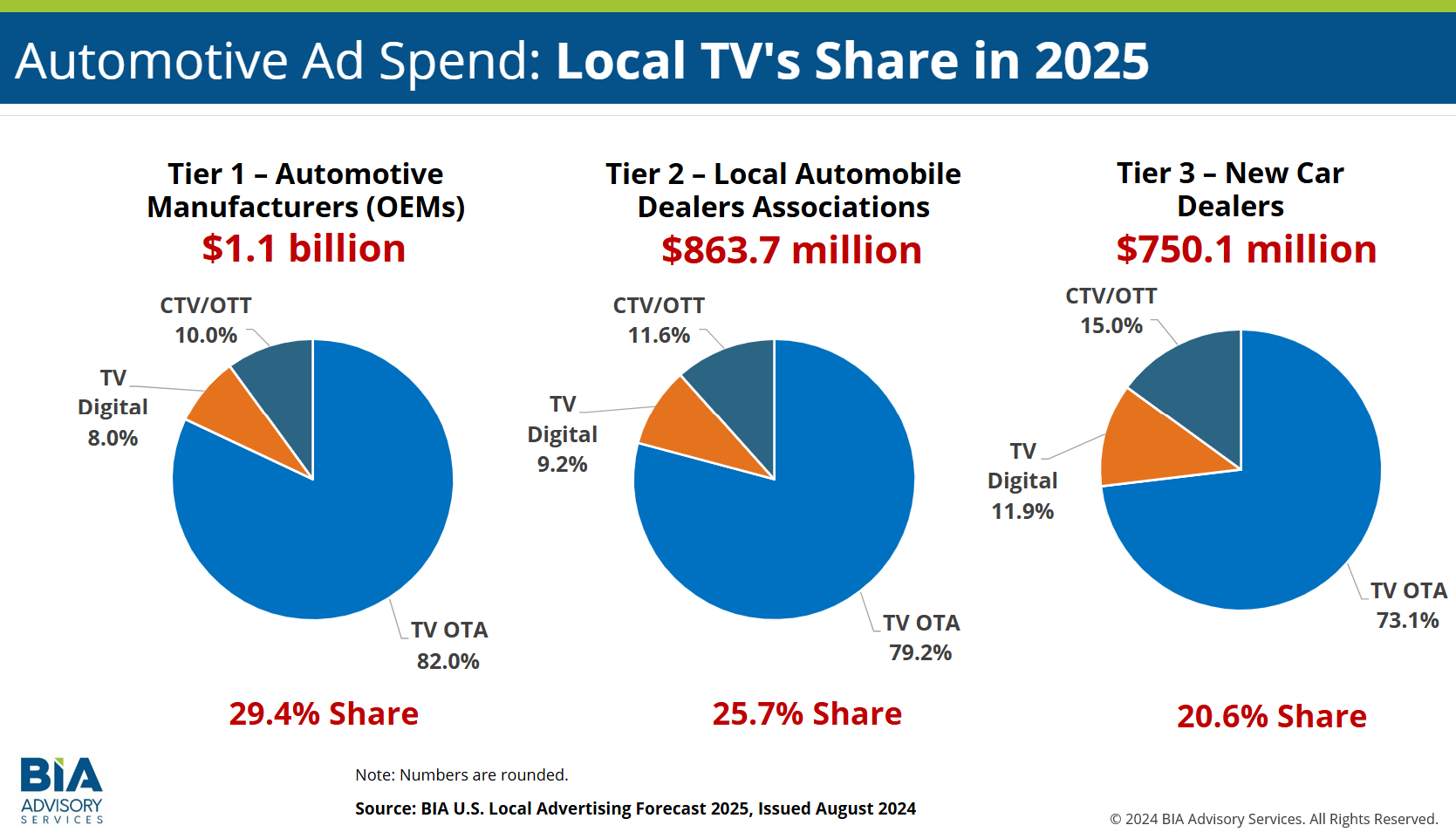

One of the key categories for local television, automotive, is projected to maintain a dominant advertising position in local television with Tier 1, Automotive Manufacturers (OEMs), spending $1.1 billion; Tier 2, Local Automotive Dealers Associations, spending $863.7 million; and Tier 3, New Car Dealers, spending $750.1 million.

The presentation also stressed that another key consideration for local television in 2025 will be the new administration.

Buono anticipates the Trump administration and its nominee for FCC chair, Brendan Carr, will foster a more business-friendly environment for mergers and acquisitions. This shift could empower broadcasters to explore strategic ventures and partnerships, bolstering their position against streaming and tech giants. Additionally, if the new administration addresses Big Tech's market dominance, broadcasters may gain a more level competitive playing field, he said.

BIA’s U.S. Local Advertising Forecast for 16 media, including local broadcast television, and 96 business subverticals is available for all 210 local television markets and is based on a proprietary forecasting methodology of the local advertising marketplace. The nationwide forecast can be purchased here and local market forecasts can be accessed by subscription to BIA ADVantage, BIA’s local advertising intelligence platform.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.