Analysts: Broadband Competition Intensifies

S&P/Kagan predicts the broadband battles for market share will intensify as fiber deployments and fixed wireless eat into cable’s dominance

NEW YORK—New forecasts and analysis from Kagan, the media research unit of S&P Global Market Intelligence, suggests that the U.S. residential broadband outlook will see even greater competition dominated by market share battles as the industry reaches a saturation point with residential service penetrations exceeding 90%.

Amid surging investment and technological advances, a new report written by Ian Olgeirson and John Fletcher at Kagan argues that a number of factors are driving increased competition, with telcos keying in on fiber upgrades, carriers fueling 5G fixed wireless residential and commercial broadband replacement, upstarts readying fleets of orbiting satellite broadband alternatives and cable fortifying its dominate market share a mix of DOCSIS 4.0 and fiber of its own.

“Behind it all is private investment aimed at capturing high-margin revenue and surging public money, most notably the federal push for better high-speed internet accessibility through the $42.45 billion Broadband Equity Access and Deployment, or BEAD, project,” the analysts explain. “The subsidies promise to turn up the heat on the entire sector.

“According to Kagan's update forecast, U.S. residential broadband subscriptions are on track to top 122 million at the end of 2022,” they add. “There simply are not enough subscribers to accommodate the growth ambitions of each segment. Cable operators believe they can continue to take market share, the telcos believe they can steal momentum with fiber, the wireless services believe 5G is their answer to residential substitution and the satellite services believe they can elevate access everywhere.”

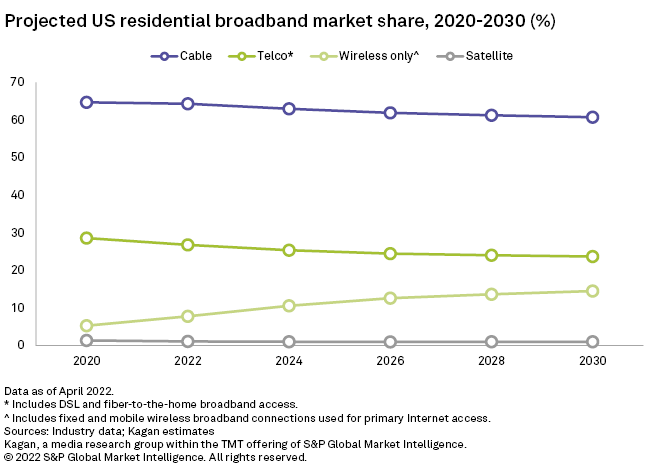

Despite those pressures, the Kagan analysts predict that cable’s hybrid-fiber coax networks will continue to dominate residential broadband and that “the segment is positioned to limit market share loss amid intensifying competition with 61.9% through 2026.”

For telcos, fiber upgrades are revamping their networks, but legacy copper infrastructure limits the potential upside. “We forecast the segment can reverse the pattern of declines but is positioned for share to slip below 25% by 2026,” they wrote.

Meanwhile Verizon Wireless and T-Mobile are ramping up fixed wireless networks and targeting both rural and non-rural areas. “We expect wireless-only homes are poised to grow from 8% to 12.6% of broadband subs by 2026,” they conclude.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

For satellite, the outlook is mixed, they argue. “ The next generation of satellite broadband offers more room for optimism, but unfavorable cost and speed comparisons limit growth expectations,” they write. “A niche service for the residential space, we expect its slice of the pie to hold at 1% through 2026.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.