Broadcast Nets Own 80 Percent of Prime-time Shows

WASHINGTON: The major broadcast networks produce about four-fifths of the programming in prime time, according to the latest report from the Government Accountability Office. That goes for broadcasting and basic cable, the GAO said.

“On the basis of GAO analysis of ownership in the 20 most widely distributed basic cable networks, major broadcasters and companies affiliated with both major broadcasters and cable operators have owned half or more of the top 20 cable networks for each year reviewed,” the report said. “Combining ownership in both prime-time programming and basic cable networks, the major broadcasters have controlled a significant share of television programming over the last decade.”

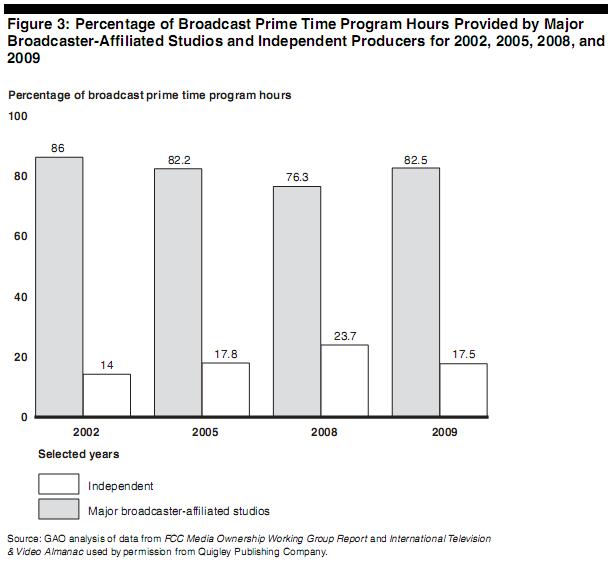

The GAO analyzed data from the fall schedules of 2002, 2005, 2008 and 2009, based on data provided by the FCC. The GAO found that in the fall of 2009, the top five program producers in terms of prime-time hours were studios affiliated with ABC, CBS, Fox, NBC and Warner Bros. Together, the five produced 76 shows comprising 82 percent of the prime-time schedule. Independent producers were responsible for 11.

Those with a stake in programming “cited economic factors” with regard to the availability and use of independent production. Indie producers said funding is hard to come by.

“For example, one report estimated that major broadcasters spent about $120 million forthe 1997-98 season to develop 49 drama pilots and used 14 in their schedules, of which one program returned for a second season,” the report said. The cost of scripted material can range from $21 million to $48 million for 21 episodes per season, with no guarantee of a second season.

Regarding network ownership, broadcasters had stakes in 12 of the top 20 cable networks--in terms of subscriber numbers--in 2004. That number declined to eight by 2008. However, cable operators with no broadcast affiliation owned at least two of the top 20 from 2004 through 2006, after which they owned none.

Independent cable networks said carriage on the big providers is also hard to come by.

“By contrast, cable networks developed by cable operators or major broadcasters are able to negotiate distribution of the network withvideo providers as part of an agreement for distribution of an established affiliated network,” the report stated.

It cited a report that Fox News Network invested more than $150 million by the time it launched in 1996, but was expected to lose $400 million in the first five years of operation.

There’s also the issue of finite bandwidth. Basic cable networks now total more than 75, and “might not be considered the most efficient use of cable operators’ resources and capacity,” the report said. Providers can make more money from providing broadband service with those bits.

Retransmission is another factor filling the cable pipe, the report said.

“Representatives of some video providers told us recently that this practice also fills their systems’ capacity, leaving less capacity for independent cable networks and making it difficult for independent cable networks to gain carriage,” it said. “Television broadcast executives, on the other hand, commented that negotiations in lieu of invoking the retransmission rule may be necessary for them to be fully compensated for their content.”

The GAO noted that the FCC is looking into retrans rules; a solicitation for comments on a related rulemaking was issued last week. (See “FCC Seeks Feedback on Retransmission Consent Rules.”)

The GAO’s report, which includes an analysis of radio programming, is available here.

-- Deborah D. McAdams

(Image by RMIT Uni)

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.