C2HR: Broadcast Engineering Among Hottest Jobs in Content Development

Broadcast techs saw a 25% boost in their pay in 2024, according to annual survey

A new survey among media HR professionals identifies broadcast operations professionals as among the most sought after jobs in the content development sector.

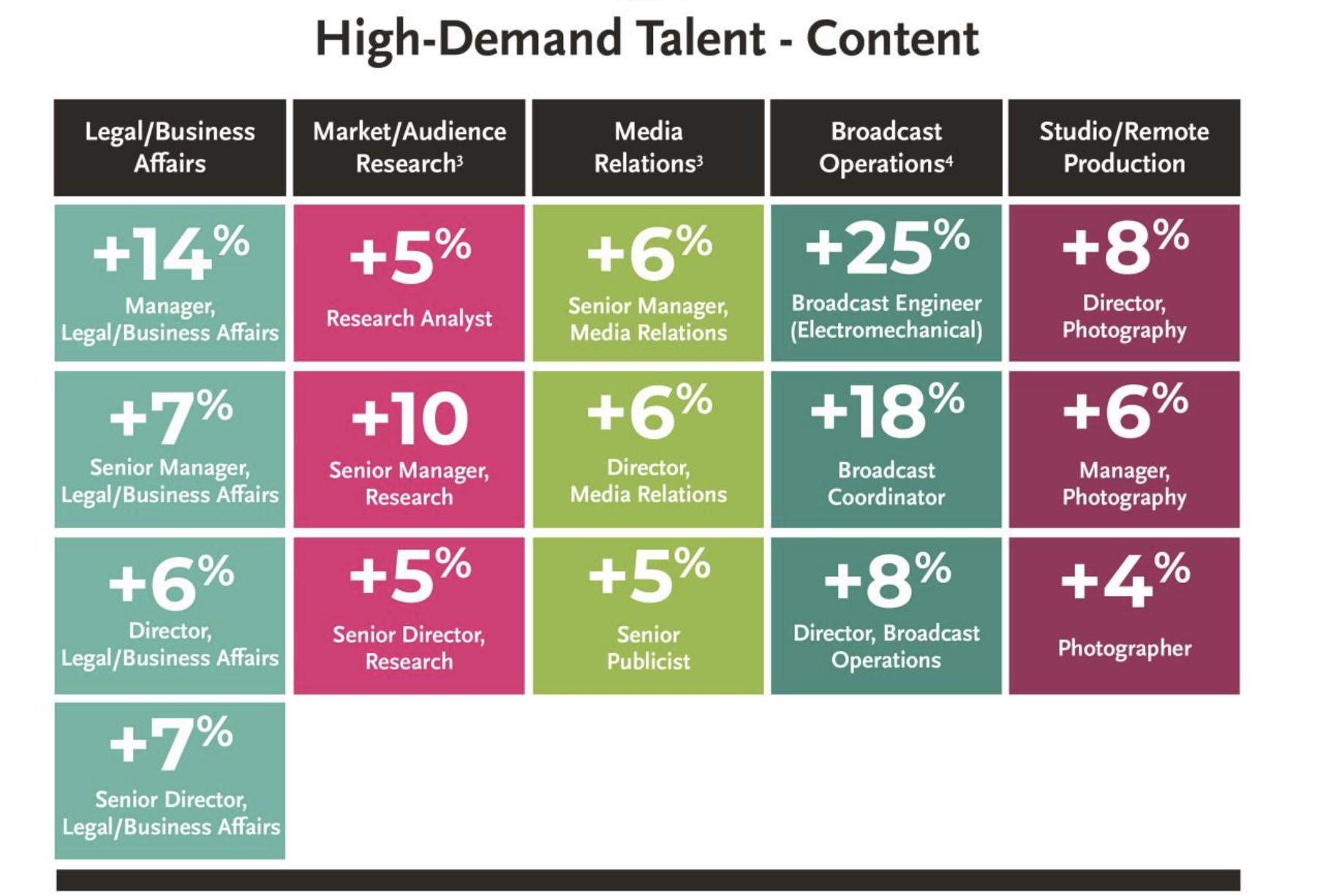

According to The Content & Connectivity Human Resources (C2HR) Association’s Annual Compensation Surveys, content companies paid broadcast engineers (electromechanical) 25% more than last year—the highest among all jobs—which covered business/legal affairs, market research, PR and remote/studio operations. Broadcast coordinator was next highest on the list with 18%, followed by business/legal affairs at 14%.

Overall, the professional association—which serves 4,800 members from 50 companies spanning the technology, media and entertainment sectors— reported that compensation growth among connectivity providers (i.e. cable, telco, fiber) was moderate. Base salary increases were smaller than last year, but bonuses and long-term incentives pushed total compensation higher for management and salaried employees. For the third year running, customer care reps claimed a spot on the “high-demand” talent list at connectivity companies, as did construction positions and senior marketing jobs.

“Streaming continues to shape the compensation landscape for C2HR members,” said Parthavi Das, C2HR’s executive director. “The C2HR Compensation Surveys revealed that participants continued to reward talent with specialized skills necessary to excel in the fiercely competitive streaming market while simultaneously ensuring pay raises for all employees.”

Steady Growth for Content Developers

2024 compensation growth was consistent across content jobs, with the exception of executives, who made up for a sluggish 2023. For executives, average total direct compensation (TDC), which comprises base, bonus and equity, increased 8.9%, compared to 2.6% in 2023. The preponderance of that increase came from larger bonus and equity distributions, although base salaries also increased a healthy 4.1%.

In 2024, content middle management accrued 3.1% base salary raises and professional and operating individual contributors (ICs) (non-managers) garnered 3.2% base increases. TDC rose slightly for middle management: 4% versus 3.8% in 2023. TDC for professional ICs rose 3.1%, lagging last year’s 5.2%; and operating IC/support personnel garnered 3% TDC bumps in 2024, versus 3.7% in 2023.

Thirty-eight content developers, employing 39,357 workers, with 889 positions and representing a mix of cable programmers; television, satellite and radio broadcasters; and digital content creators participated in C2HR’s 2024 Compensation Surveys. (See list at end)

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Moderate Raises for Connectivity Providers

The C2HR Compensation Surveys also revealed that pay among connectivity providers rose in 2024. Average TDC rose 4.5% for management, up from 3.8% in 2023. Management base salaries increased by 2.0%. Salaried employees achieved 4.4% TDC gains, up from 2023’s 3.1% TDC. Base pay for salaried workers rose on average 3.1% in 2024, which was lower than last year’s 3.9%. Hourly workers accrued modest hikes in 2024: base pay rose 2.6% compared to 3.8% in 2023; total cash compensation (TCC) rose 2.2% compared to 5.6% last year, signifying that bonuses were smaller.

Eleven connectivity companies with 623 positions participated in the survey, including multiple system operators, satellite cable providers and security companies. Together, they represent 98,487 employees.

Specialized Skills Spike Pay

Among the significant findings of C2HR’s Annual Compensation Surveys was the eagerly anticipated list of high-demand talent in content creation and broadband connectivity companies. Positions requiring sought-after skills, particularly those related to streaming, captured the largest salary increases.

“The hot jobs data allow us to identify whether we have any compensation problems at the moment or will in the future for these important positions,” noted Fernando Sanchez, compensation manager at TelevisaUnivision. “This knowledge allows us to take preventive or follow-up actions.”

Predicted Trends

What else can HR professionals expect in 2025? Sanchez expects to see the elimination of siloed jobs in linear and digital programming. “Currently, more dynamic positions are required that can serve both media types on different platforms,” he said. “I also expect to see increased growth of analytics positions that can provide key information for decision-making, trends and new market niches.

Renee Hauch, principal at JM Search and a member of C2HR’s board of directors, expects job candidates to continue valuing chemistry and company culture. “While pay remains an important factor in the decision-making process, it’s often not the ultimate deciding factor,” she said.

“Recently, we worked on a senior-level operations role where the candidate received two comparable offers. Their decision came down to how they felt about their prospective boss, the company culture, and their ability to make an impact,” Hauch continued. “Today, companies are operating with fewer resources and leaner teams. Ensuring the right fit has become more critical than ever.”

2024 C2HR Content Developers Compensation Survey Participants:

A+E Networks

Amazon.com Inc. (Reporting for: Amazon Prime Video)

AMC Networks Inc.

BBC Studios Americas Inc.

Charter Communications Inc.

Chicago Sports Network (“CHSN”)

C-SPAN

DIRECTV LLC

Disney Entertainment Television (Reporting for: ABC Disney Entertainment Television)

ESPN Inc.

FanDuel Group (Reporting for: FanDuel TV)

Hallmark Media United States LLC

INSP LLC

Jet Propulsion Laboratory, NASA

Lions Gate Entertainment Corporation (Reporting for: STARZ)

MLB Network LLC

National Basketball Association

National Football League

NBCUniversal Media LLC

Paramount Global (Reporting for: CBS Paramount Global)

PGA Tour Inc.

Playfly Sports

Public Broadcasting Service (“PBS”)

Qurate Retail Group (Reporting for: HSN and QVC)

REVOLT Media and TV LLC

Riot Games Inc.

Sony Pictures Entertainment Inc.

TelevisaUnivision Inc.

The Church of Jesus Christ of Latter-day Saints

The E.W. Scripps Company (Reporting for: Scripps Networks)

TKO Group Holdings LLC

Warner Bros. Discovery Inc.

WGBH Educational Foundation (“GBH”)

2024 C2HR Connectivity Providers Compensation Survey Participants:

ALLO Communications

Armstrong Group

Cable One Inc.

Charter Communications Inc.

Comcast Cable Communications Inc.

Cox Communications Inc.

DIRECTV LLC

Google Fiber Inc.

Schurz Communications Inc.

TDS Telecom

Ziply Fiber

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.