In a 48-page report, the Center for Digital Democracy cast a critical eye on the rapidly growing connected TV industry, noting that with the rise of AI and ad-supported streaming channels, TV viewers’ privacy is being threatened like never before. The report, “How TV Watches Us, Commercial Surveillance in the Streaming Era,” was authored by Jeff Chester, executive director and founder of the CDD, and Kathryn C. Montgomery, Ph.D., professor emerita at American University’s School of Communication and senior strategist at CDD.

With the rise of ad-supported streaming, CTV has helped prime the television industry, with advertisers investing $25 billion in the U.S. alone in 2023. As the overall TV ad market is expected to grow to nearly $41 billion by 2027, CTV has become “one of the fastest-growing ad sectors,” the authors said, citing EMarketer’s InsiderIntelligence.com.

Using Tubi as an example, the authors noted that the Fox-owned free streaming service offers 270 FAST channels to 78 million viewers and that “in many ways … Tubi is now the dominant way that people get television in the U.S.” And though Tubi’s programming doesn’t offer anything viewers can’t get elsewhere, its dominance in the CTV market is driven by its technology—in essence, it’s not a programming distributor but rather a data company.

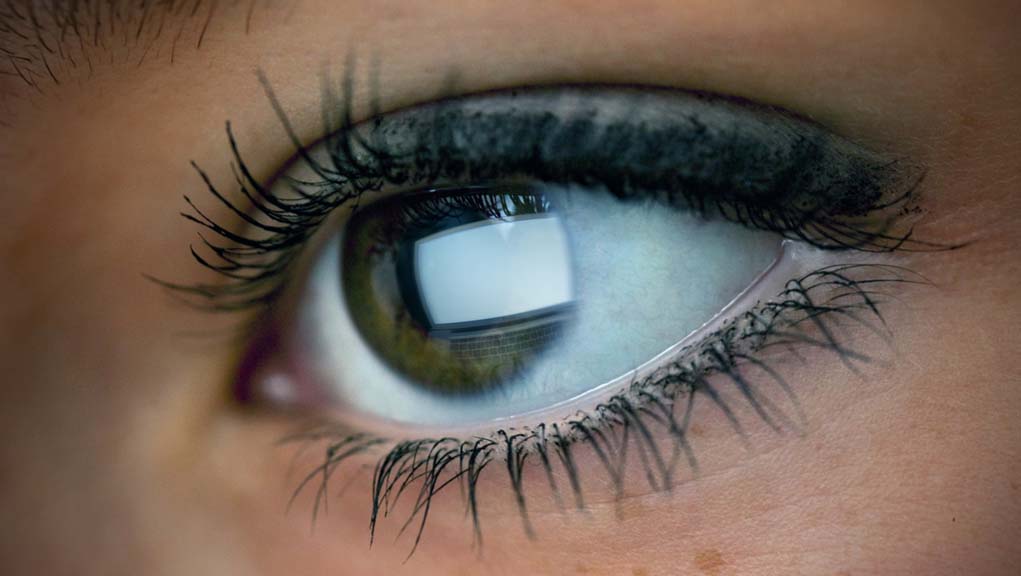

“Tubi is a key player in a massive data-driven surveillance system that has transformed the television set into a sophisticated monitoring, tracking and targeting device,” the authors wrote, using Tubi’s own words. “ ‘We are an ad tech-first platform. Everything we do is based on data,’ ” the company boasts as quoted in the report, adding, “ ‘Tubi promises advertisers access to ‘billions of rows of data on its customers, gathered from their viewing behaviors.’ ”

The authors describe CTV’s rise as a “transformation of television” and said its ability to granularly track viewers has gone largely unnoticed by policymakers despite the rise of similar concerns over social media.

“The U.S. CTV streaming business has deliberately incorporated many of the data-surveillance marketing practices that have long undermined privacy and consumer protection in the ‘older’ online world of social media, search engines, mobile phones and video services such as YouTube,” they wrote.

While there can be some advantages to improved viewer tracking—with more personalized ads, lower subscription costs and access to a far wider array of programming—the advantages go to the advertiser and not the viewer, the authors said.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“All of the pleasures and conveniences that this new medium offers come with a steep price,” they wrote. “And it goes beyond the rising monthly rates that consumers have to pay to access many of these streaming services, or the annoyance of commercial interruptions in some of their favorite programs. The widespread technological and business developments that have taken place during the last five years have created a connected television media and marketing system with unprecedented capabilities for surveillance and manipulation.”

In response, the authors—who describe the report as a “call to action” for regulators—offer several areas of improvement to protect consumers.

First, they call for more robust privacy protections, noting that while “there has been some progress at the federal and state levels on privacy regulation, a great deal more work is going to be needed in order to curb the expansion of ubiquitous data gathering, profiling, tracking and targeting of individuals.” They also recommend that regulators and policymakers get more involved.

“Both the Federal Trade Commission and the Federal Communications Commission should investigate the practices in connected television, and should consider building on laws and enforcement actions that are already on the books, including the 1988 Video Privacy Protection Act and the 2017 settlement by Vizio with the FTC about its data practices,” adding that regulators and lawmakers will also “need to conduct research on the structure and operations of the connected television industry.”

The authors also call for more extensive safeguards against dangerous surveillance practices when it comes to political, health and children’s advertising, citing the regulation of political advertising in the U.S. as “already very weak.” They also point out the impact of CTV’s data mining practices on young viewers.

“Because they are such avid users of connected television, children and adolescents require particular attention from regulators,” they wrote.

The authors also called for increased “competition and diversity in the digital and connected TV marketplace,” citing the example of big tech monopolies such as Facebook, Google and Amazon, as well as the studios themselves. As an example, they cited the new Venu sports streaming joint venture between The Walt Disney Co., Warner Bros. Discovery and Fox, noting the impact its potential monopoly on big-league live sports could have on the market.

“Policymakers, advocates and sports CTV company Fubo have raised concerns about Venu’s impact on competition, although there has been little attention paid to how the potential integration of all the CTV-related data harvested by these three companies working in concert may be having a harmful impact on the marketplace,” they wrote.

While the process of oversight and regulation of the CTV industry will be difficult, the authors concluded the television industry's size, scope and influence exemplify the importance of action.

“Undoubtedly lobbyists and trade associations for this very influential industry will turn to the same ‘it’s too early to regulate’ mantra that has repeatedly thwarted efforts to enact laws and regulations the U.S. communications system so badly needs,” they wrote. “In addition to protecting consumers, the connected TV industry must do more to serve our democracy, especially as CTV continues to move into such a central and influential position in the media landscape.”

The report can be read here.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.