CES 2021: Stage Set for NextGen TV Inflection Point

The CTA’s chief researcher laid out the numbers during an ATSC-organized virtual panel discussion

WASHINGTON—2020 proved to be a banner year for TV shipments in the United States, topping the annual average by more than 6 million units and foreshadowing a couple more years of above average growth—the same timeframe NextGen TV will be approaching a consumer adoption inflection point, said Steve Koenig, vice president of Research for the Consumer Technology Association.

Speaking during an Advanced Television Systems Committee-organized virtual CES conference Jan. 12, Koenig predicted what he called a “massive tailwind” for NextGen TV.

“If there’s one truism in the TV market, it is that it is hypercompetitive,” he said. With more than 20 NextGen TV models shipped last year by LG Electronics, Samsung and Sony, the stage is set for more vendors to join in. Once they do, “the dominoes are going to fall very, very quickly because the market is so competitive,” he said.

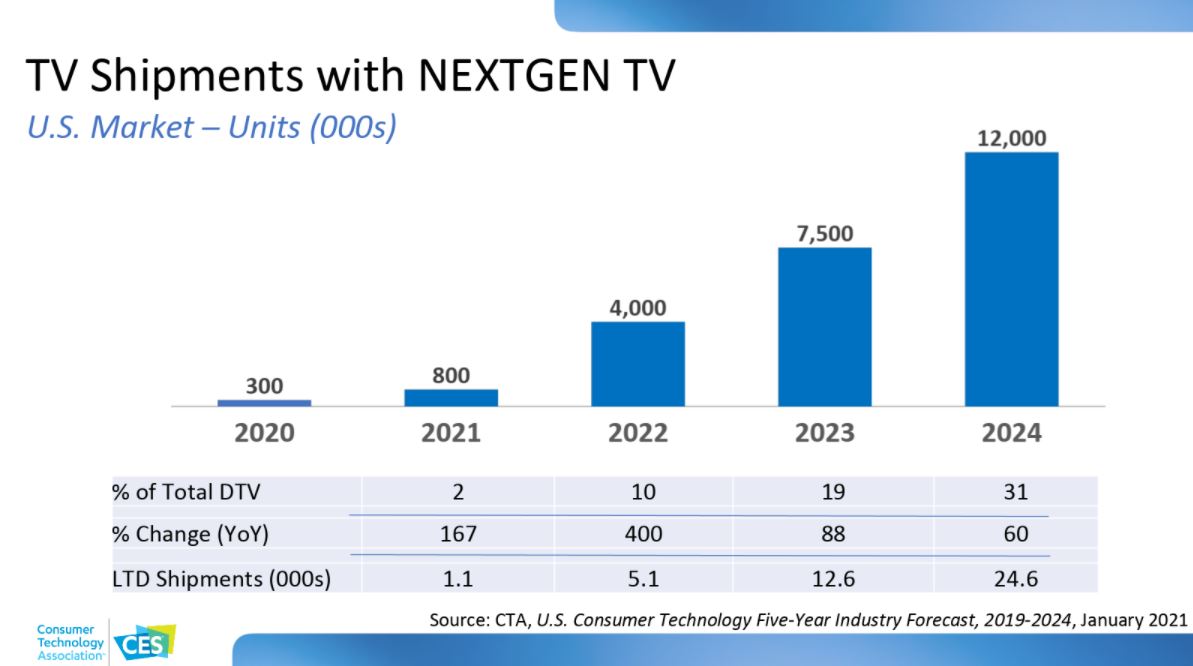

According to CTA data gathered for its biannual industry forecast published in January and July, NextGen TV shipments in the U.S. will approach 25 million units by the end of 2024, Koenig said, adding that an aggressive rollout of ATSC 3.0 by broadcasters could encourage TV manufacturers to hasten their launch plans for NextGen TV models. “I think there’s a lot of potential for these sales to be pulled forward [in time],” he said.

Koenig was one of five panelists during the virtual “ATSC 3.0 At The Consumer’s Fingertips” session moderated by ATSC President Madeleine Noland. The others included Mark Aitken, senior vice president of Advanced Technology, Sinclair Broadcast Group; Alfred Chan, vice president of TV and Smart Home Business Unit, Mediatek; Nick Kelsey, CTO, SiliconDust; and John Taylor, senior vice president, LG Electronics USA.

NEXTGEN TV INFLECTION POINT

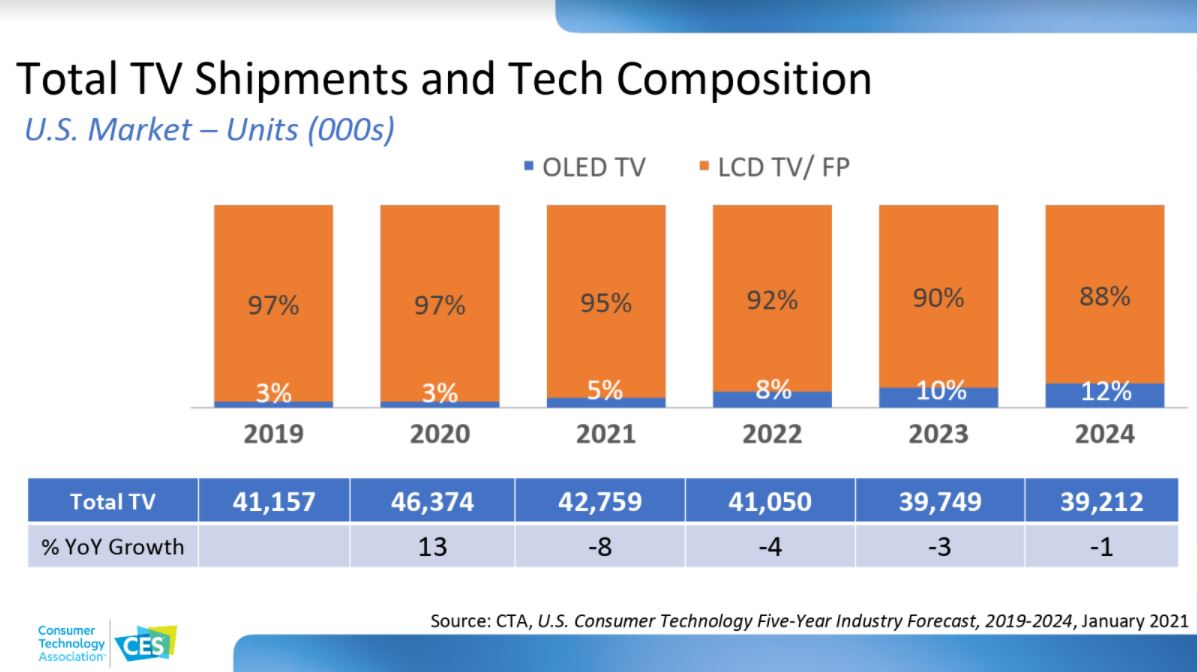

The predicted NextGen TV inflection point, which Koenig expects to occur sometime in 2023 or 2024, will follow what he described as “a historic year by a number of measures” for U.S. television shipments in 2020 when 46.4 million units were shipped—a dramatic increase over the annual average of 40 million units.

“2020 just saw massive COVID-19 effects [on TV purchases],” he said. The “stay-at-home-culture” thrust upon Americans in response to the pandemic motivated consumers to upgrade their “flagship displays,” and buy additional TVs for others in their households, he said.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Some parents even constructed online classrooms for their children using large screen TVs, and many employees forced to work from home purchased TVs—especially in March and April 2020—in place of hard-to-find computer monitors, he added.

“All of these reasons combined for an epic peak year in terms of shipment volume,” he said, adding that elevated shipments are expected for the next couple of years.

4K, 8K AND NEXTGEN TV

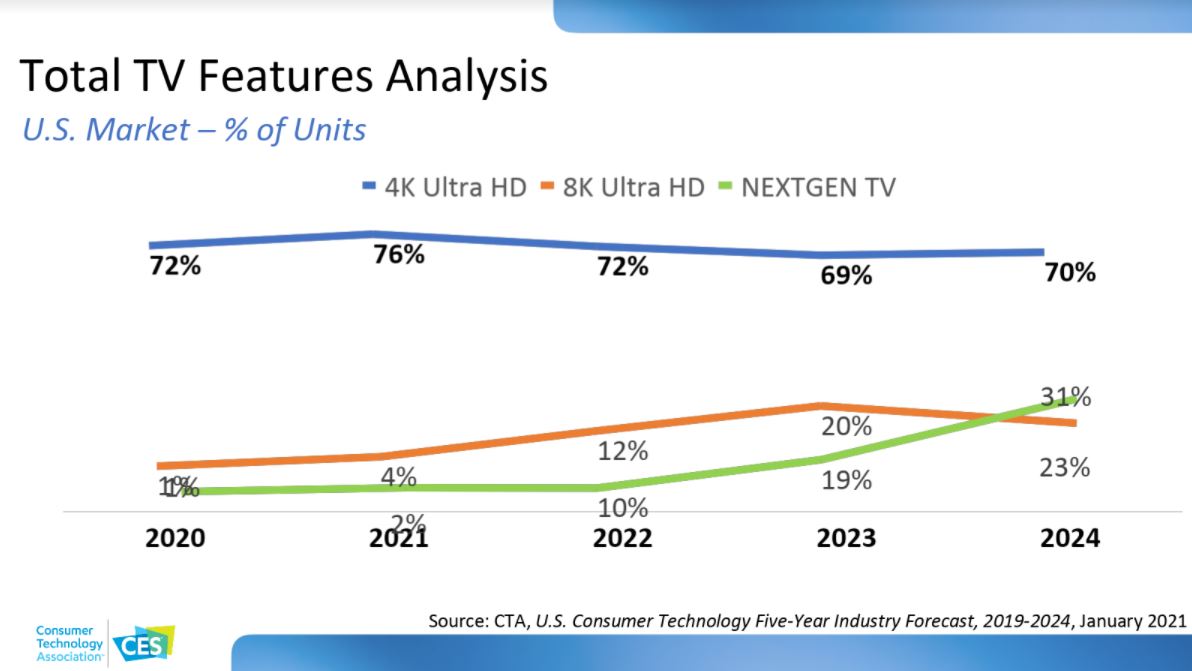

The CTA data also predicts the share of 4K Ultra HD television shipments will decline moving forward as 8K resolution sets capture a larger piece of the pie.

A “perennial dynamic” of the TV market is the reason, said Koenig. Consumers have demonstrated they want bigger and bigger TV screens, as long as they remain within their budget. “We see 8K evolving along with those so-called ultra-large displays [70-inch and larger],” he said.

Koenig noted that 2020 was the first time U.S. shipments of 70-inch or larger TVs crossed the 3 million unit mark. Shipments are expected to reach 3.3 million this year and approach 4 million annually in 2024, when 8K unit sales will reach a crest.

However, that’s not the case for NextGen TV. While currently both 8K and NextGen TV are positioned in the market in the premium tier of television features, unlike 8K, there is an opportunity for NextGen TV to be “democratized so that the size constraint is really not in play …,” he said.

BEYOND TV SHIPMENTS

Sinclair’s Aitken updated attendees on the station groups’ NextGen TV progress, including the availability of a broadcast app, which is essentially a 3.0 browser of broadcast television, making Advanced Emergency Alerting and Informing available to viewers and offering additional information—like news, sports and weather—targeted at individuals.

Sinclair also has integrated its STIRR over-the-top offering with NextGen TV, offering three channels of video-on-demand and bringing that into the broadcast environment through the broadcast application, enabling viewers to navigate between live broadcast content and OTT content, he said.

The broadcast group plans to launch eight more ATSC 3.0 markets in Q1 2021 and 12 more in the second quarter, with more launches anticipated throughout the year, he said.

SiliconDust’s Kelsey discussed the company’s HDHomerun 4K NextGen TV gateway. “The thing that’s really unique here is this is a gateway, and a gateway beats a set-top box,” said Kelsey. Rather than every TV in a household having a set-top box, a single HDHomerun 4K gateway delivers NextGen TV to every TV in the home.

In March 2021, the company plans to launch the HDHomerun Scribe 4K, a multichannel gateway with a whole-home DVR. DVR storage is easily expanded by dropping in more memory, he added.

Mediatek’s Chan discussed the company’s complete solution for ATSC 3.0, including its 3.0 demodulators and ATSC 3.0 middleware. Mediatek, which shipped about 107 million television system-on-chip (SOC) chips in 2020, is participating in trials of its 3.0 technology with major TV OEMs and expects the tests to be completed in Q3 2021, said Chan.

“Right now, I am very happy to tell you that we are absolutely ready with the demodulator second generation cost reduction,” he said. This generation of demod chip is cost efficient, smaller and consumes less power.

“The [SoC] platform is ready, and we see many cities—32 cities—on air now based on your [ATSC’s] website, and 2021 will be a remarkable year across the U.S. From the East Coast to West Coast we see deployments,” said Chan. “We think it is a very exciting time, and we’re ready for launch.”

LG Electronics’ Taylor echoed many of the observations of CTA’s Koenig. “2020 of course was a very challenging year for many reasons,” said Taylor. “But despite the pandemic, it played into the wheelhouse of ATSC 3 in many ways.” People were more focused on home entertainment and television played a central role in entertaining them.

Taylor praised broadcasters for their efforts during the pandemic to accelerate deployment of NextGen TV around the country. “We think the stars are aligning for 2021 being a NextGen TV tipping point in many ways with more stations on-air,” he said.

A recording of the session is available on demand on the ATSC website.

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.