Comcast Explores Spinoff of Cable Networks

Spun-off assets would not include Peacock or NBC, though Comcast’s president said it would consider ‘partnerships in streaming’

PHILADELPHIA—As Comcast reported better-than-expected third-quarter financial results, executives told analysts the company is considering spinning off its cable networks, a move that could produce a significant shift in its corporate strategies and in the U.S. media landscape.

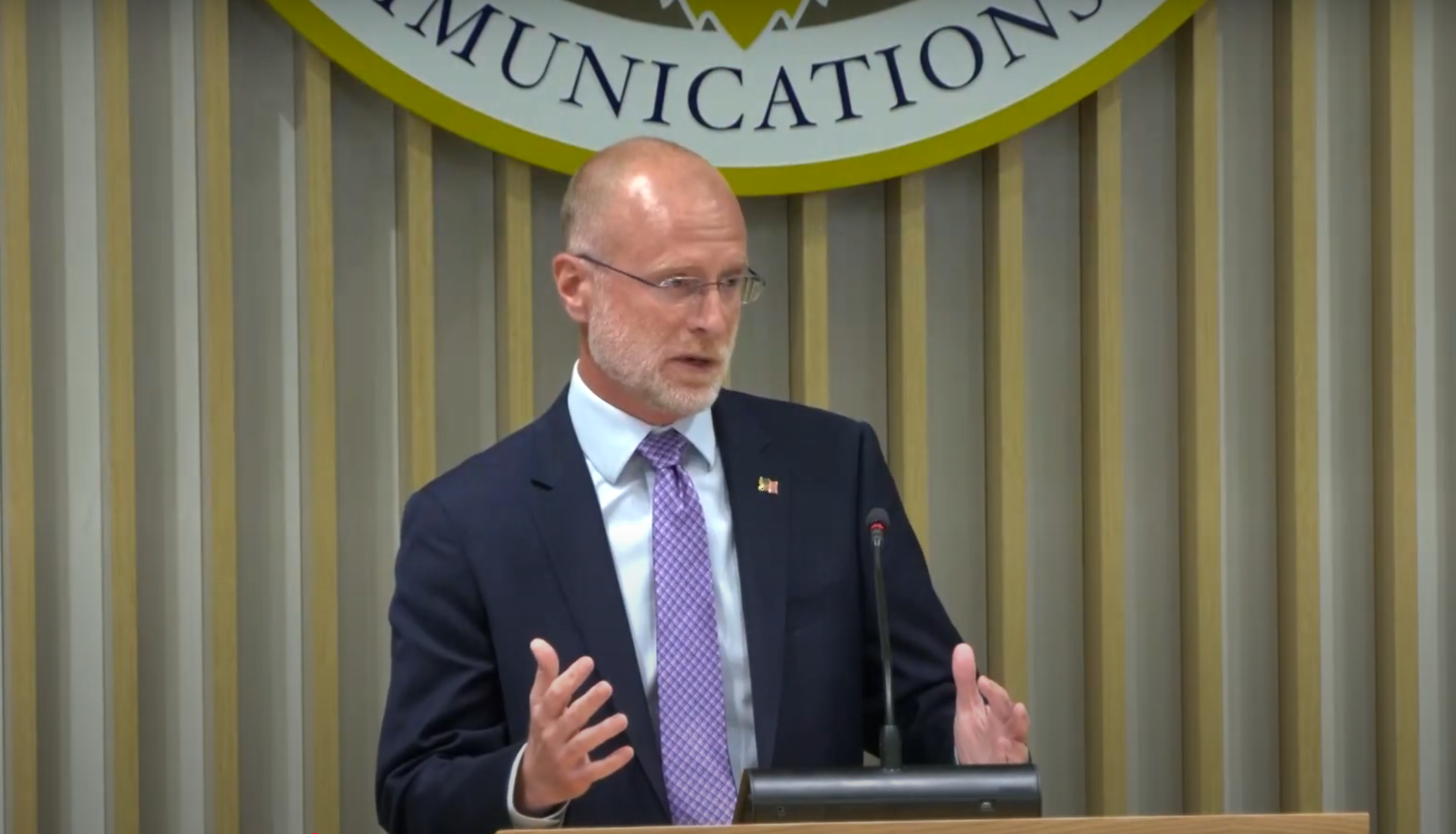

“Like many of our peers in media, we are experiencing the effects of the transition in our video businesses and have been studying the best path forward for these assets,“ Comcast President Mike Cavanagh said of the cable networks, part of its NBCUniversal unit, on the company’s third-quarter earnings call. “To that end, we are now exploring whether creating a new, well-capitalized company owned by our shareholders and comprised of our strong portfolio of cable networks would position them to take advantage of opportunities in the changing media landscape and create value for our shareholders. We are not ready to talk about any specifics yet, but we’ll be back to you if and when we reach firm conclusions.

“I’m not talking about Peacock or broadcast,” Cavanagh added, though he did say Comcast would be willing to “consider partnerships in streaming despite their complexities.”

Some analysts, though, have already thrown cold water on the idea and have highlighted a wide range of problems such a deal would pose.

Cavanagh didn't address those specifics and stressed that it is early in a process that, he conceded, would raise a lot of complex issues. Executives were going public with the idea so Comcast shareholders would have a better understanding of what they were exploring, he said.

“There are a lot of questions to which we don't have answers so we want to do the work, and we want to do the work with transparency around it so that as rumors fly and the like, we expect that,” he said. “But we want our shareholders to understand what we’re willing to look at. And that's in the context of a broader, ‘We look at a lot of things.’ And I do think in a moment of a lot of transition in the industries we're part of, I think we've got a very strong hand given the strength of the businesses.”

In response to the possibility of the spinoff, LightShed Partners analysts Richard Greenfield, Brandon Ross and Mark Kelley were generally negative about the prospects of a cable spinoff or any deal involving Peacock.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“Given the acceleration in cord-cutting and the secular decline of linear TV advertising, particularly basic-cable networks, it’s no surprise that Comcast/NBCU would be interested in spinning off its cable networks,” they wrote. “Unfortunately, spinning off NBCU’s cable networks is challenging at this stage of their life cycle and merging Peacock with a streaming-industry peer is beyond complicated. In turn, we wonder whether this is really much ado about nothing or if it could actually lead to a far broader strategic conversation where Comcast revisits spinning off/merging all of NBCU ex-Theme Parks.

“We suspect this is much ado about nothing and is simply a sign of just how structurally challenged linear cable networks and subscale, U.S.-only streaming platforms are in 2024 and beyond,” the analysts concluded. “When you see a dismal future, with no path to growth, you sound the alarm and explore strategic alternatives.”

Cable Carriage Deals a Concern

One major problem with a spinoff was the value of those networks in ongoing negotiations with multichannel video programming distributors (MVPDs) as a separate company without NBC, which Cavanaugh said would not be included in the spinoff.

“While Comcast Cable could certainly sign a long-term distribution deal with NBCU’s cable networks, why would any other distributor want to renew its carriage agreements or at least renew at levels anywhere near current agreements?” they asked. “It is one thing to package USA, Syfy, Bravo, MSNBC and CNBC cable-network distribution with NBC broadcast, which controls ‘Sunday Night Football,’ college football, Olympics and soon NBA. But without NBC, those cable networks would be in an incredibly precarious position.”

“Remember what happened to Diamond Sports after it lost the protection of the Fox Broadcast Network?” the analysts added, referencing the troubled former Sinclair subsidiary that acquired the Fox Sports regional sports network business spun out during Disney’s acquisition of 21st Century Fox. “Diamond’s $2 billion of EBITDA evaporated within three years and entered bankruptcy because it lost distribution. And remember, there is a lot of NBCU cable network content on Peacock, so for consumers that love that content, there are still ways to access that content, even if not carried by an MVPD/vMVPD.”

Likewise, they noted that some sort of partnership with Peacock is an appealing idea given the streaming platform has already lost $9 billion and is still losing $400 million a quarter. But a “Peacock merger with another streaming service sounds even more complicated and hard to effectuate,” they said.

Issues that would complicate such a deal include control over the partnership; the difficulties of untangling the close ties between Peacock and NBC in terms of programming and sports rights; the regulatory environment; and existing sports-rights deals that could be voided by a merger.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.