Consumer Spending on Streaming Jumped 20% YoY in Q3 2023

Streaming spending rose to $9.3 billion as overall consumer spending on digital home entertainment spending approached $10.7B Billion in Q3 2023 according to DEG

LOS ANGELES—A new report from the Hollywood studios-backed Digital Entertainment Group (DEG) shows that hefty spending on streaming helped boost overall consumer spending on movies and television shows consumed at home and on the go to $10.7 billion in the third quarter of 2023.

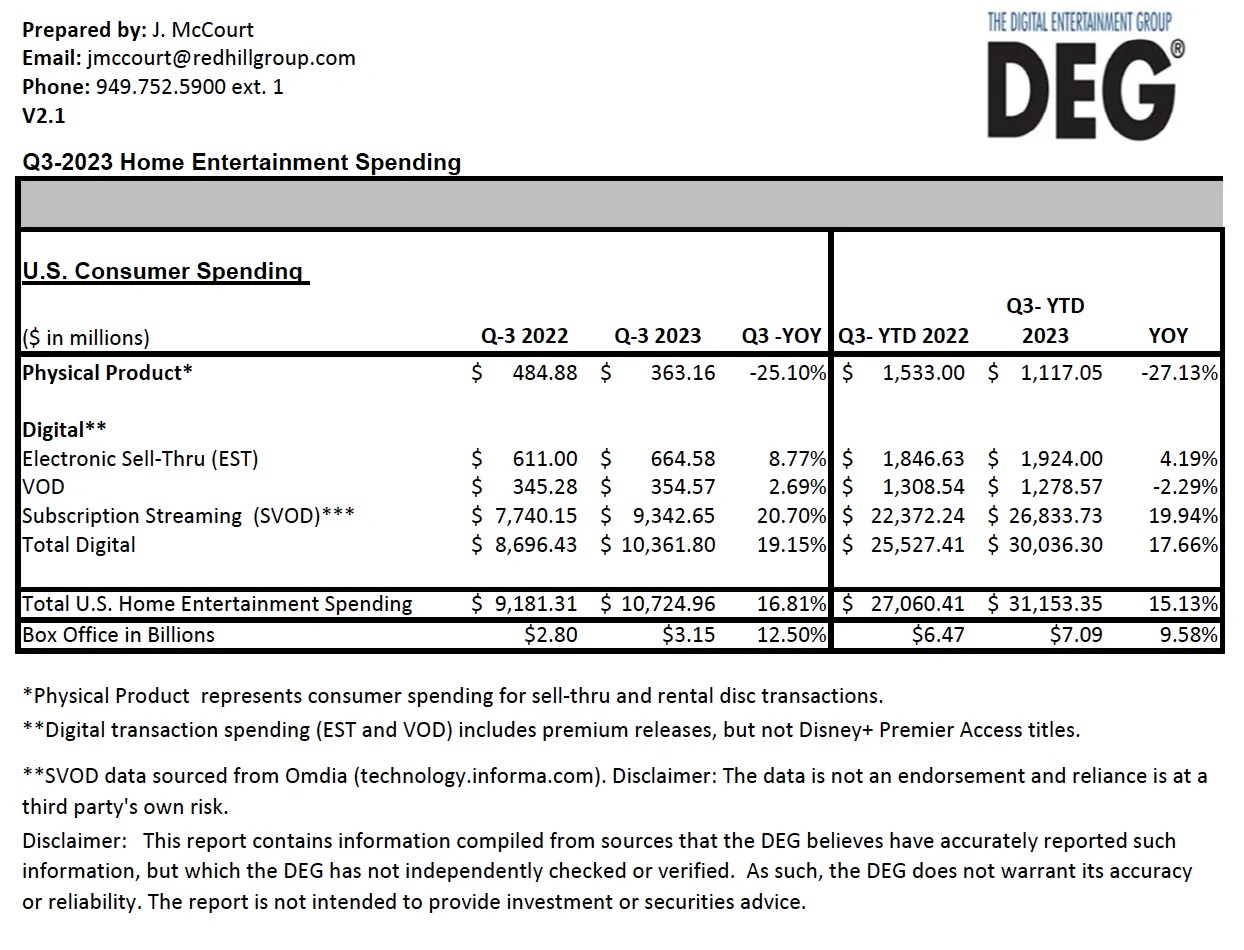

For Q3 2023, spending rose 16.8% from the almost $9.2 billion consumers spent in the same quarter of 2022, driven by the continued growth of SVOD, as well as theatrical franchise titles offered for digital purchase in premium and traditional windows.

DEG reported that Q3 2023 saw a 20.7% increase in subscription streaming, which rose to $9.3 billion, from $7.7 billion in the third quarter of 2022, as targeted and general entertainment services continued to add subscribers with new content, pricing options and ad-supported tiers. Some services will have raised prices more than once in 2023. For the year to date, consumer spending growth also hovers at 20%, the group said.

For the first nine months of 2023, overall spending on movies and television shows consumed at home and on the go topped $31 billion. The year-to-date 17.7% growth across all digitally delivered formats—electronic sell-through (EST), video on demand (VOD) and subscription streaming—was driven by 20% growth in subscription streaming and smaller gains in transactional formats. Physical formats 4 continued to decline, with digital formats accounting for more than 96% of total consumer spending, the group said.

DEG highlighted several other trends for Q3 and the first nine months of 2023:

- Consumer spending on digital purchases (EST) in premium and standard windows continued to grow in the third quarter of 2023, with purchases rising 9% in the period. The effect of theatrical new releases was strong: EST purchases of theatrical titles grew 13% in the quarter. Theatrical new releases are historically a key driver of home entertainment spending. Because of this, announced delays in upcoming theatrical releases due to the Hollywood strikes may have an adverse impact in the next few quarters.

- TV purchases, meanwhile, fell 15%, with the genre already experiencing a negative effect from the Hollywood strikes. With new episodes of scripted series delayed pending the resolution of the actors’ and writers’ strikes, there was little to create excitement around the TV genre.

- Digital rentals (VOD) rose almost 3% in the third quarter, reflective of continued cord-cutting and changing consumer behavior: Internet-delivered rentals were up 11% while cable/satellite rentals fell by more than a third.

- From a transactional slate standpoint, the quarter started strong with early releases and first-half holdovers including The Flash (WBD); Fast X (Universal); Guardians of the Galaxy Vol. 3 (Disney); Super Mario Bros. Movie (Universal); and Transformers: Rise of the Beasts (Paramount). Titles that added energy in September included Barbie (WBD) and TMNT: Mutant Mayhem (Paramount). Other quarterly top-performers across transactional formats included John Wick: Chapter 4 (Lionsgate); Joyride (Lionsgate); The Little Mermaid (Disney); No Hard Feelings (Sony); and Spider-Man: Across the Spider- Verse (Sony).

- 4K UHD Blu-ray was the only segment of the physical disc business to experience growth, with spending up almost 6%. New Release continues to be a key driver of 4K UHD Blu-ray success, with the quarter’s top titles being Spider-Man: Across the Spider-Verse (Sony) and Guardians of the Galaxy Vol. 3 (Disney) both of which saw more than 25% of sales come from the format. Overall, consumer spending on physical product rentals and purchases declined 25% for the third quarter and 27% year-over- year.

- Ad-supported premium AVOD and FAST content reached an estimated advertising revenue of $4.5 billion in the third quarter of 2023, according to estimates from Omdia5, as more major streamers diversified their offerings to include lower cost subscription plans with ads. Omdia estimates show ad revenue grew 20% in the quarter.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.