Cord-Cutters Unlikely to Rejoin Traditional Services During Pandemic, S&P Finds

Cord-cutters' disinterest in cable, satellite, was one aspect S&P looked at on coronavirus media habits

NEW YORK—Cord-cutters aren’t that interested in hopping back on the cable, satellite bandwagon, even as the coronavirus pandemic keeps people at home and consuming more content, according to a new S&P Global Market Intelligence survey.

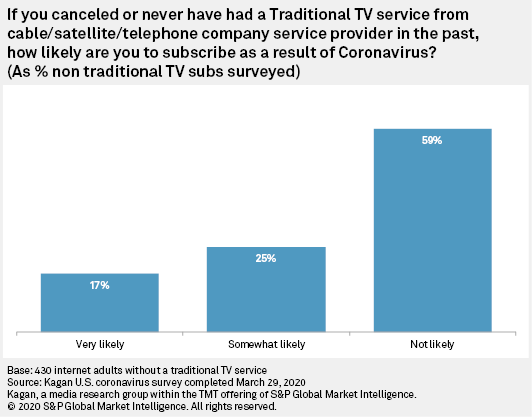

Of the 1,000 participants in the survey, which was conducted from March 27-29, 430 said they did not currently have a traditional multichannel service. Of those, 59% said they were unlikely to start paying again for such a service; 25% were somewhat likely and 17% were very likely.

When it comes to key media services, S&P found that streaming video and cable TV were the ones that respondents deemed most expendable. Between streaming, cable TV, mobile phone and broadband, if something needed to be cut first, 37% said they would drop streaming, while 28% said cable TV. Internet came in at 20% and mobile phones were at 14%.

Live sports, a big driver of TV viewership, is on hold right now as essentially all professional and collegiate leagues have suspended their seasons. But the lack of available sports is not stopping sports fans’ viewing trends. While 61% of respondents are watching more video during the crisis, about half reported that they are still watching live TV sans sports, though about 24% are enjoying rebroadcasts of old games (20% are checking the archives of digital sports services). Only a quarter of fans said they would watch nothing in place of live sports.

Unsurprisingly, streaming services are seeing a boost in usage as well as some in signups. S&P found that nearly two in 10 of respondents expected to add a streaming service through June; one in 10 were planning on dropping one. Traditional Hulu is leading in new additions at 6%, followed by Netflix, Disney+ and Amazon Prime Video.

For those using AVOD sites, 20% were most likely to try network TV websites. Crackle (18%), The Roku Channel (17%), Facebook Watch (17%) and Pluto TV (14%) were the next most popular.

PLUS: OTT Plays Spike During Coronavirus Outbreak

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Additional findings by S&P included the slow adoption rate (3%) of Netflix’s new “Netflix Party” feature, which enables synchronized video playback and virtual group chats. Also, with movie studios releasing new films directly to the home as theaters are shutdown, 29% said they’d be willing to pay $20 for new titles; homes with children were more interested (50%) than adult-only homes.

For more information on S&P’s survey, visit www.spglobal.com.