Cord Cutting Improved by Over 22% in Q1 for Top Operators Thanks to Slower DirecTV Blood Loss

The top five publicly traded pay-TV companies still lost nearly 1.6 million customers in the first three months of 2021

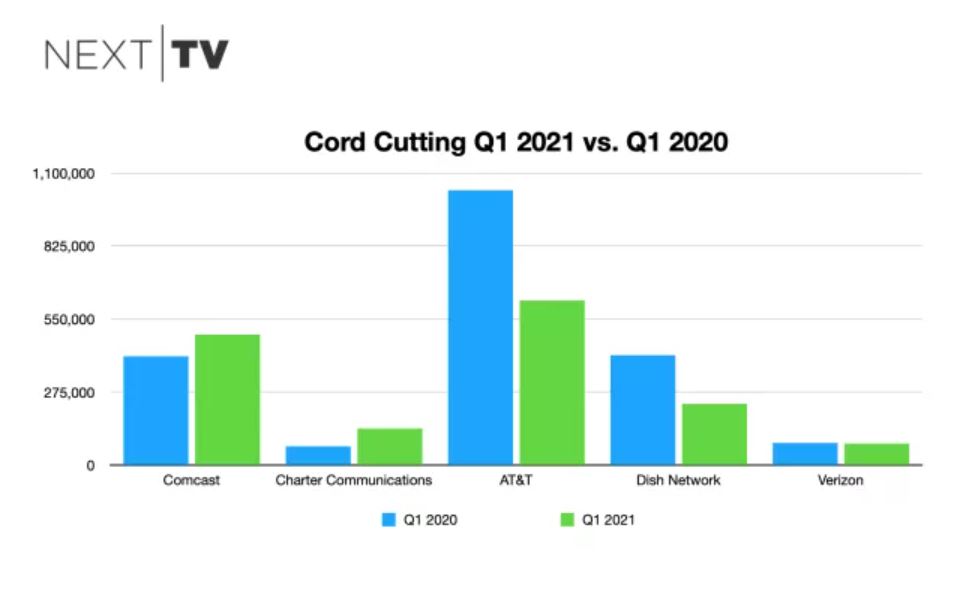

Despite a recent projection that cord cutting will accelerate significantly over the next 24 months, the top five publicly traded pay-TV companies lost 22.3% fewer video customers in Q1 than they did in the first three months of 2020.

Comcast, Charter Communications, AT&T, Dish Network and Verizon combined to lose 1,561,000 video customers in Q1 vs. 2,011,000 in the same period of 2020.

For the most part, video losses for each of these companies were worse, or largely the same, save for one operator, AT&T. That telecom lost 897,000 customers across its DirecTV satellite and U-verse “premium” platforms in the first quarter of last year, and another 138,000 from virtual MVPD AT&T TV Now. Most of the losses came in satellite TV.

In January, February and March of 2021, AT&T lost a combined 620,000 across DirecTV, U-verse and AT&T TV—the latter service, launched in April of last year, having subsumed AT&T TV Now. AT&T is in the process of spinning off a portion of its pay-TV assets to private equity firm TPG.

Among cable operators, Comcast saw its Xfinity TV losses accelerate to 491,000 vs. 409,000 in the first quarter of 2020, while Charter Communications saw losses expand from 70,000 to 138,000, first quarter vs. first quarter.

In satellite, Dish Network saw flat linear customer recession of 132,000 users, but experienced improved subscriber losses for its Sling TV vMVPD, which lost only 100,000 customers vs. 280,000 in Q1 2021.

Among telcos, Verizon’s 82,000 lost Fios TV souls were largely flat with the 84,000 shed in Q1 2020, but the company retracted to overall customer levels (3.7 million) not seen in 10 years.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

This analysis leaves out a range of smaller cable companies, Altice USA, Mediacom and Cable One. Also not included are major virtual MVPD operators Hulu + Live TV and YouTube TV.