CTV: TV’s Latest Gold Rush

Second only to AI in terms of hype, the rush to dominate data aggregation fuels new deals

The year-end frenzy of data, deals and digital divination about connected TV (CTV) has painted an outsized vision of how this internet-based delivery system is overhauling the video ecosystem. Undeniably, CTV—and its hardware and programming components—is already affecting advertising strategies and encouraging re-evaluations of content and equipment opportunities. The lure of customized/targeted video ads has been the Holy Grail for decades, and true believers are now putting their faith in CTV.

But as one of the myriad of new studies points out, nearly two-thirds of viewers think CTV ads are not relevant to them. That analysis amplifies the difficulty of pinpointing relevance in the emerging fragmented CTV world.

‘Fastest-Growing Major Ad Channel’

CTV has definitely been on a roll. Nearly 90% of U.S. homes have at least one internet-connected TV device—either a smart TV or a streaming access plug-in, such as an Amazon Fire Stick or Roku Streaming Stick. More than 200 providers or packagers of streaming content have groped their way into the CTV world, but only a familiar handful continue to dominate it: YouTube (which has been aggressively building its CTV presence), Hulu, Amazon (including its Prime Video and Freevee offerings), Netflix, Max (the relaunched HBO Max) and Disney+. Apple TV+ is also accelerating its role, including leveraging several sports deals.

Like many emerging technologies, “connected TV” (CTV) is still searching for the right word, for itself and for the sphere of services and platforms in its orbit.

• Connected TV: Both a device and a service. CTV can refer to the video receiver/display equipped with internet access (such as smart TVs and plug-ins, e.g. Amazon Fire Stick and Roku Streaming Stick) that enables viewers to stream and see video content. It also describes the services (especially ad-related content) delivered through these devices.

• Smart TV: The digital receiver/display device that delivers streams of CTV content.

• FAST or FASST: Free ad-supported streaming TV, programming that is streamed without a paid subscription. The shows include targeted commercials.

• Over-the-Top (OTT): Video content that is streamed, usually directly to a smart TV receiver, via the Internet but bypassing traditional devices such as a set-top box.

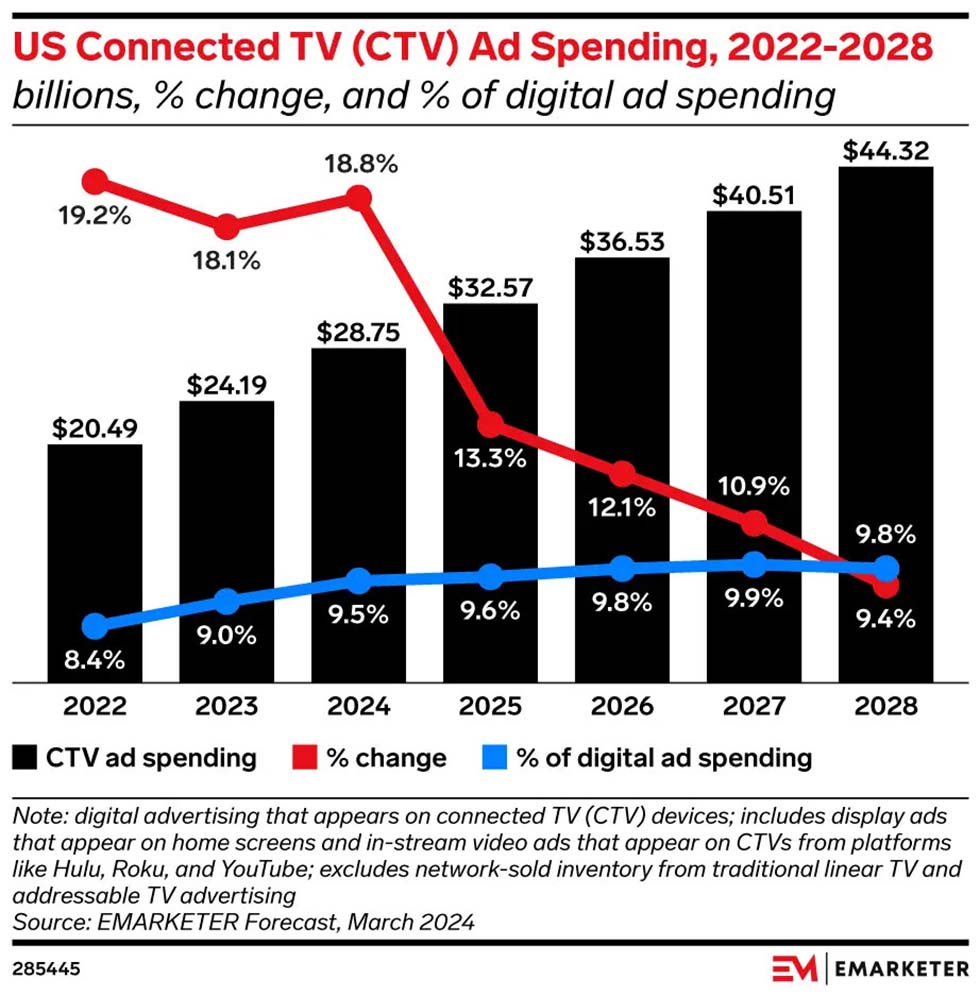

Digital researcher eMarketer calls CTV “the fastest-growing major ad channel,” summing up its 2024 revenue tally at $28.75 billion, nearly 19% higher than the previous year. eMarketer predicts CTV ad spending will climb to $32.6 billion this year, then $36.6 billion in 2026, $40.5 billion in 2027 and $44.32 billion in 2028.

The role of CTV vs. other on-demand and linear platforms is triggering unending hopeful speculation. “More and more advertisers [are] shifting their focus away from linear TV and towards CTV and streaming platforms,” observes Geir Skaaden, chief products and services officer at Xperi.

“The market is poised for meaningful growth on a global scale,” Skaaden tells TV Tech, noting that the “migration away from traditional media players will continue in 2025.” He cites the need to leverage “the advertising potential of smart TVs [as] important [but] it should not come at the expense of the user experience.”

Xperi develops software for consumer-electronics devices and media platforms for broadband video service. In the CTV realm, its primary product is TiVo OS, which Xperi says will be used in about 2 million smart TVs by year-end 2025.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Viewers continue to have more options for CTV equipment. Parks Associates’ latest “Battle of the Platforms” research into CTV ecosystems found that Samsung’s Tizen is the most widely used smart- TV operating system. Sarah Lee, a Parks research analyst, points out that hardware brands can use streaming and CTV content “as springboards to promote their own content channels and smart TV models,” which Samsung, LG and others are doing aggressively.

LG Ad Solutions, the cross-screen advertising offshoot of TV maker LG Electronics, and audience measurement firm Alphonso have also been studying the impact of CTV advertising. In a December report on “The Connected Gamer,” the venture identified the impact of CTV ads on driving video-game purchases. Among the findings:

- 81% of gamers have upgraded their TVs to enhance gameplay.

- 80% say TV ads influence their decisions to buy video games, and 81% are more likely to purchase games they see advertised on TV.

- 85% appreciate seeing video-game recommendations on their TV home screen.

“The largest screen in the home is an incredibly powerful way for brands to connect with gaming audiences,” Tony Marlow, chief marketing officer at LG Ad Solutions, says. “Gamers are among the most deeply engaged audiences on connected televisions, which he called “a platform that uniquely blends premium, big-screen experiences with actionable data.”

When Walmart, the world’s largest retailer, last month completed its $2.3 billion acquisition of Vizio, a leading maker of “value-priced” TV receivers, a key factor seemed to be its plans to use Vizio’s smart TV sets as a vehicle to expand Walmart’s targeted advertising operations. Analysts expect the retailer (on behalf of its merchandise suppliers) to integrate free, ad-supported streaming TV (FAST) content into the CTV features of Vizio sets.

Another December deal hinted at the cross-platform visions of potential CTV operators. Comcast signed a multiyear distribution agreement with Warner Bros. Discovery to carry all of its domestic linear networks, including streaming options for Max and Discovery+, further enlarging the CTV options via Comcast’s Xfinity broadband networks.

Broadcasters’ Role?

The shift toward streaming also raises prospects of the role ATSC 3.0 datacasting will play in IP delivery. Although broadcasters have not yet widely committed to plans to use NextGen TV for wireless internet delivery, some observers envision opportunities that would tie future CTV projects to signals transmitted via 3.0 spectrum.

These visions come as the appeal of over-the-air viewing is waning. Nielsen’s latest analysis showed that nearly two-thirds of the under-35-year-old audience tune to streaming video, while only 7% of that age cohort watches over-the-air broadcast channels. While those figures are more extreme than the nation’s overall viewership preferences (41.6% for streaming, 23.7% for OTA and 25% for cable in Nielsen’s November tally), the data portends the future of viewing in the emerging connected-TV world.

These viewership analyses come as the landscape is changing for hardware, advertising, regulatory and business factors in related industries. For example, The Trade Desk, one of the largest global ad-technology providers, recently disclosed it is building a CTV operating system called “Ventura” (named after its California hometown). CEO Jeff Green believes his company’s demand-side platform (DSP) will find traction because it is independent of content ownership, unlike the CTV platforms at Amazon, Google and Roku.

Wurl, a platform operator that has developed an AI that matches viewers’ emotions to CTV ad content, has issued a report on “Contextual Targeting on CTV” which encourages advertisers to analyze emotions “properly.”

“We have entered an era of AI that will soon enable us to better understand ourselves,” CEO Ron Gutman explained in his analysis of why CTV will become advertisers’ preferred format.

The smart TV infrastructure, including connected and streaming video systems, is creating a surveillance system that can undermine privacy and consumer protections, according to the Center for Digital Democracy, a Washington advocacy group. Connected TV is a “privacy nightmare,” says CDD executive director Jeffrey Chester, who co-authored a report to the Federal Trade Commission and the Federal Communications Commission asking for regulatory intervention. The 48-page analysis “How TV Watches Us” was prepared in early autumn, before the November elections.

Although policymakers from the incoming Trump administration appear unlikely to pursue such curtailment, Chester tells TV Tech: “We’re going to keep the pressure on,” citing “a network of privacy groups in the U.S. and Europe that are working together to develop safeguards” against such digital snooping. Chester said his goal is to make “the public… more aware that their TVs are spying on them.”

“U.S. companies have pushed their connected TV services across the world,” Chester said. “We plan to ramp up the pressure on the Trump FTC to protect the privacy of Americans.”

In its report, CDD cited the “unprecedented tracking techniques” of connected-TV services and smart-TV devices that seek to please advertisers by creating a “Trojan horse” to infiltrate personal privacy. The group’s study found that Hispanic, African-American and Asian-American viewers are “being singled out by marketers as highly lucrative targets” and contends these ethnic groups are the primary advertising targets for FAST channels.

The CDD report also delves deeply into the role of generative artificial intelligence, which it calls the “centerpiece” of the CTV industry’s plans for targeted advertising.

CDD also sent its report to the California attorney general and the California Privacy Protection Agency, asking both regulators to investigate the CTV industry by focusing on antitrust, consumer protection and privacy issues.

The CDD report came on the heels of a separate FTC analysis, “A Look Behind the Screens,” which was highly critical of the privacy practices of social media companies and streaming video services. That staff report concluded that the digital services threaten consumers’ privacy by collecting a “staggering amount of data in order to serve behaviorally targeted ads.”

The FTC report recommended Congress enact new legislation to curb “commercial surveillance” and urged digital platforms to eschew use of “privacy-invasive tracking technologies.”—Gary Arlen

Similarly upbeat is a forecast from Teads, a global, cloud-based omnichannel platform operator that last month announced an exclusive international partnership with VIDAA USA, the smart-TV operating system company powering Hisense Smart TVs globally, to extend advertiser reach with CTV native display inventory on its smart TV OS. In a study released in December, Teads found 42% of media professionals identified CTV and omnichannel formats as the top theme for this year “poised to shape the future of advertising.”

Teads Global Chief Marketing Officer Natalie Bastian cites the concerns of advertising and publishing executives about the fragmented media landscape. She speculates they will seek “innovative ways to reach the consumer” and cites “shoppable CTV formats” and artificial intelligence as tools for “harnessing the full potential of the technology at our disposal.”

Similarly, Kara Manatt, executive vice president of intelligence solutions at Magna Global—the media intelligence and investment firm which identified that 64% of viewers believe CTV ads are misdirected—offers a congruent but alternative perspective.

“The continued growth of CTV and streaming make it a valuable place for brands to reach their audiences,” she says, citing findings from the Magna/Nexxen report on “The Intersection of Audience Data + Creative Optimization.” She contends the study’s performance insights underscore the value of “pairing audience data and optimized creative.”

Much More Programming

Program-rights owners are mining their vaults for streamable shows and developing alliances with CTV packagers for access to platforms. For example, Samsung TV Plus (the CTV offshoot of the electronics maker) last month unveiled a deal with studio Worldwide Pants to offer 4,000 hours of segments from CBS’s long-running “Late Show With David Letterman” as a FAST channel on Samsung smart TVs. The FAST bundle, called “Letterman TV,” is among the latest additions to the Samsung worldwide lineup of more than 3,000 channels.

David Letterman, who hosted the “Late Show” for 22 years, quipped: “I’m very excited about this. Now I can watch myself age without looking in the mirror!”

More significantly, sports are shifting toward streaming platforms, most visibly the dollop of NFL games on Netflix, Prime Video, Peacock and ESPN+. A YouTube tally found viewers accessed 30% more sports content via streaming platforms in 2024 than in the previous year. That digs into a sweet spot for broadcast (and cable’s) programming powerhouse category.

Jon Giegengack, founder and principal at Hub Entertainment Research, calls the current evolution of streaming platforms the “sixth wave of the ‘Battle Royale’ ” among competing providers. The year-end Hub Intel study found that the “average household is using 13 different sources of entertainment,” about half of which are for video (others are No. 1 Spotify and other audio content).

“TV is adapting to its new reality,” he said.

His Hub Entertainment colleague David Tice expects this year “major players in TV tech—especially those dominating TV set operating systems—to buy market share.” Tice predicts tech giants will “squeeze out smaller competitors by offering manufacturers irresistible deals to abandon homegrown solutions. By the end of 2025, the rise of FASTs will drive increased competition for viewers.” Tice also says he expects legacy media firms to exploit their best library titles for exclusive use on their owned-and-operated FASTs.

Now the industry will have to wait to see which of the deals and prognostications come true.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.