DEG: Streaming Revenue up 27.1% to $22.9B in First Half of 2024

AVOD and FAST content produced $5.4B in revenue for Q2, 2024

Despite worries that cash strapped consumers are looking to cut their hefty spending on streaming services, the Digital Entertainment Group reported strong growth in revenue for subscription streaming services in the first half of 2024, with subscription spending on streaming spiking by 27.1% to almost $22.9 billion, up from $18 billion in the first half of 2023.

Overall, the Hollywood studios-backed DEG reported that consumers spent almost $25.4 billion on movies and television shows consumed at home and on the go in the first six months of 2024. For the full first half, spending rose more than 22% from the almost $20.8 billion consumers spent in the first six months of 2023. Q2 year-over-year growth was 21.2%, for a total of almost $12.8 billon in the quarter.

Other key highlights included:

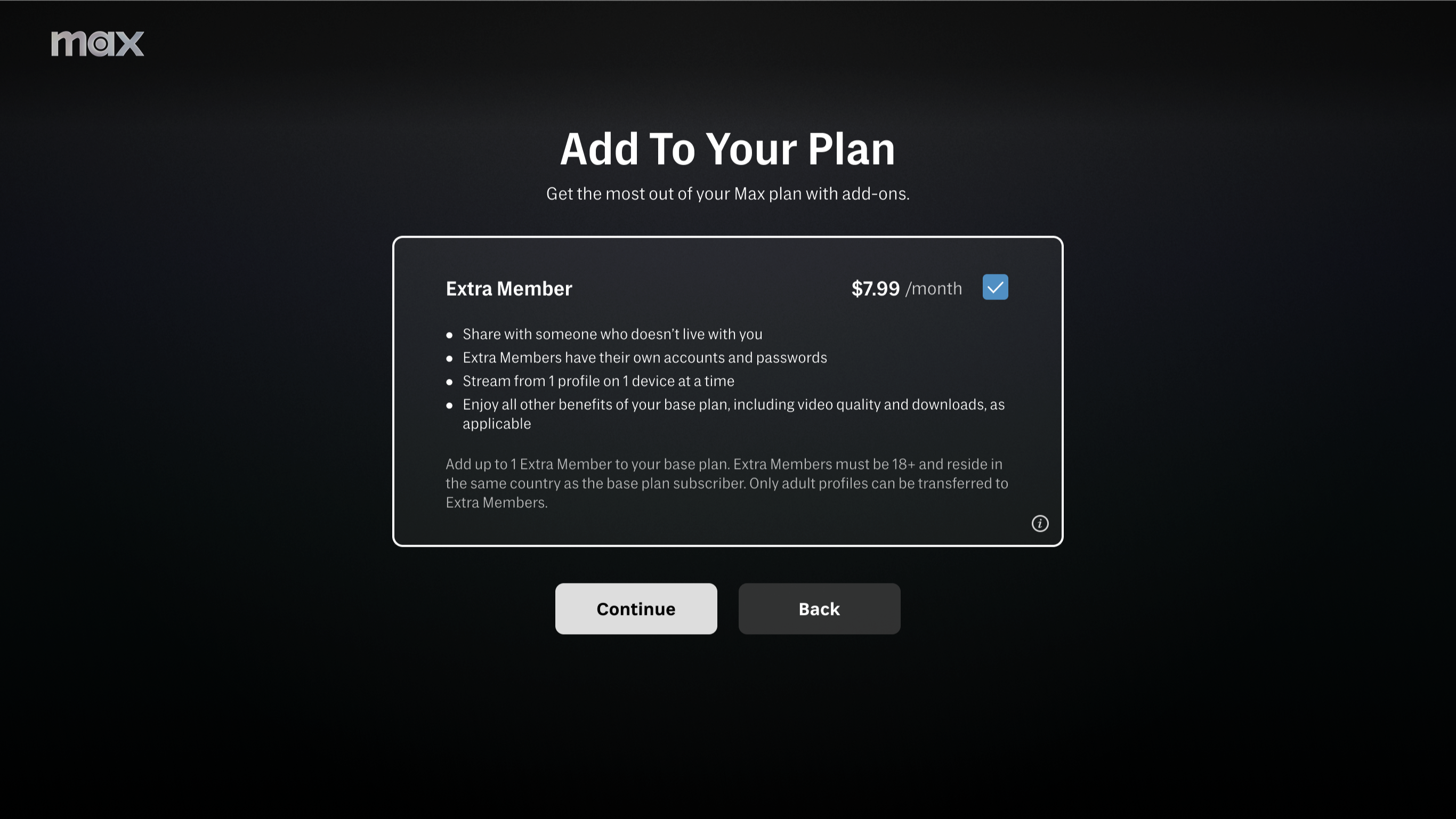

- DEG said that streaming growth was fueled by targeted and general entertainment services continuing to add subscribers with new content including professional sports, pricing options and ad-supported tiers. In the second quarter of 2024, consumer spending on subscription streaming also increased more than 27%, to surpass $11.5 billion.

- Ad-supported premium AVOD and FAST content reached an estimated advertising revenue of $5.4 billion in the second quarter of 2024, according to estimates from Omdia, as more major streamers diversified their offerings to include lower cost subscription plans with ads. Omdia estimates show ad revenue grew more than 51% in the quarter, just a hair faster than the first quarter’s 50% growth rate and in stark contrast to second quarter 2023, when ad revenue totaled almost $3.6 billion and recorded a 5.5% decline from the prior year.

- Box-office spending on titles released to the home in the first half was almost 20% less than a year earlier, negatively impacting consumer spending on transactional formats, which are typically driven by theatrical new release. The 2024 first half suffered from tough comparisons with 2023, when Universal’s $575 million box-office hit The Super Mario Bros. Movie, was released in home entertainment windows. The first quarter benefitted, however, from a number of strong holdover titles from late 2023, including Barbie (WBD); Guardians of the Galaxy Vol. 3 (Disney); John Wick Chapter 4 (Lionsgate); Mission: Impossible – Dead Reckoning Part 1 (Paramount); and Oppenheimer (Universal).

- When including stronger first quarter transactional performance, consumer spending on digital purchases for the full first half was off 11%, and spending on digital rentals was essentially flat, with a decrease of less than 1 percent.

- Being far less dependent on the current theatrical slate, catalog titles performed better than new release in the first half down less than 2%—a sign of digital transactional stability.

- Following Netflix’s 2023 exit from the physical subscription business, DEG reports no longer include spending on physical disc rental, only physical product sales. Disc sales (DVD, Bluray and 4K UHD Blu-ray) continued a steady decline, falling about 28.5% in the second quarter of 2024, and 22.2% for year’s first half. These declines also were driven by new release, with catalog faring better, down only 14% for first half of the year. Consumers continue to show strong demand for collectible disc formats with SteelBooks up 44% and 4K UHD Blu-ray catalog sales growing by 16%.

- Among the first half’s best-performing titles across transactional formats were Anyone But You (Sony); Bob Marley: One Love (Paramount); Civil War (A24); Dune: Part Two (WBD); The Fall Guy (Universal); Ghostbusters: Frozen Empire (Sony); Godzilla x Kong: The New Empire (WBD); The Hunger Games: The Ballad of Songbirds and Snakes (Lionsgate); IF (Paramount); Kung Fu Panda 4 (Universal); The Marvels (Disney); and Wonka (WBD).

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.