Deloitte Peeks Into the Future, Details Four TV/Video Scenarios

NEW YORK—Ten years ago, few might have been able to predict the dominance of Netflix and other streaming services, not to mention that networks and studios would launch their own platforms where they would exclusively show original programming, but here we are. Now, industry forecasters wonder just how far people’s preference for these types of services and other non-traditional offerings will go.

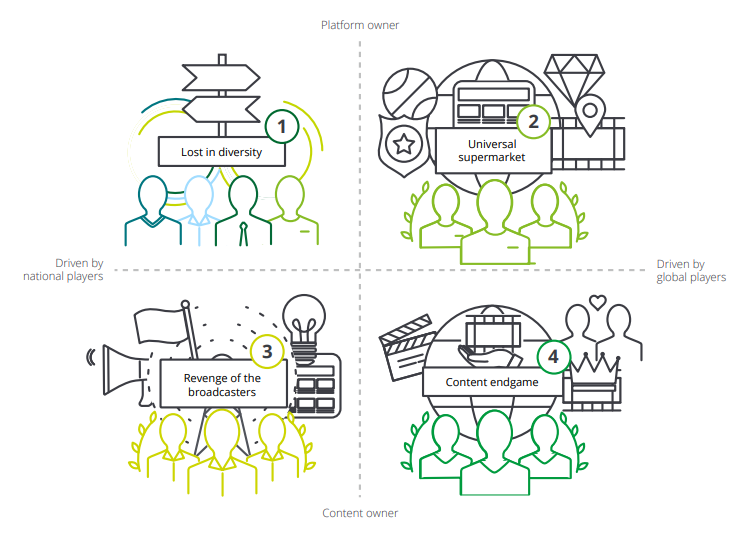

Deloitte recognizes that in this rapidly changing world, trying to make an accurate prediction is difficult. So instead, in a new study, Deloitte lays out four possible scenarios of what the TV and video industry could look like in 2030.

The first scenario is what Deloitte calls “Universal Supermarkets.” This would see a few global digital platform companies assuming the lead roles in aggregation and distribution from national broadcasters. Similar to large supermarkets, digital platform companies would offer global and national content, with differentions coming from exclusive productions and sports rights.

In this scenario, broadcasters would still have a place in the industry as providers of localized content, including news. Other details involved with this scenario include the further development of AI to help with user-specific content selection and digital platforms use direct models of ad trading, which cut off broadcasters from revenue shares.

“Content Endgame” is another scenario that would have content owners emerge as the leaders, withdrawing and withholding content from digital platform companies to distribute on their own channels, establishing direct consumer relationships.

Deloitte describes this scenario as one where “variety of content has decreased, but the quality of global productions has reached new dimensions.” Broadcasters remain as they have shifted their focus entirely to the creation of strong local formats, supplying their productions to the big content owners. Digital platform companies, however, have been pigeonholed as strictly distribution channels focused on technical delivery. In this situation, consumers are paying for their preferred content, not a specific platform.

Then there is “Revenge of the Broadcasters.” Here, national broadcasters have successfully made their digital transformation to secure their place in the TV and video ecosystem, creating digital platforms that support direct customer relationships and deliver on-demand content. Broadcasters would employ new services like targeted advertising and recommendation functions, as well.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Digital platform companies would still exist in this scenario, with national broadcasters focusing on local quality content and digital platforms taking care of global productions and blockbusters. This would still allow for viewers to choose between linear and non-linear content from global or national sources.

The final scenario is called “Lost in Diversity,” where a diverse ecosystem has developed with no dominant method. This would feature a variety of distribution platforms with steady turnover of who is impacting the market and a richness of content. There would be partnerships between global and local players, while also having a distinction between content production and distribution.

“Everyone does everything in this scenario,” Deloitte wrote, with consumers only being loyal to content, not any specific platform. This allows broadcasters to generate revenue in a number of different ways, keeping them largely independent.

Overall, Deloitte’s scenarios paint a picture of digital platform companies being the major disruptors in the industry, while broadcasters and content producers face the most potential change. They argue that broadcasters and content producers can’t rely on their current market positions. Instead, they need to be open in creating alliances, even with direct competitors. Investment in technological skills will also be critical.

The full Deloitte study is available here.