Disney Solidifies Lead in Scripted TV Content

Amazon has recorded the strongest growth among all platforms

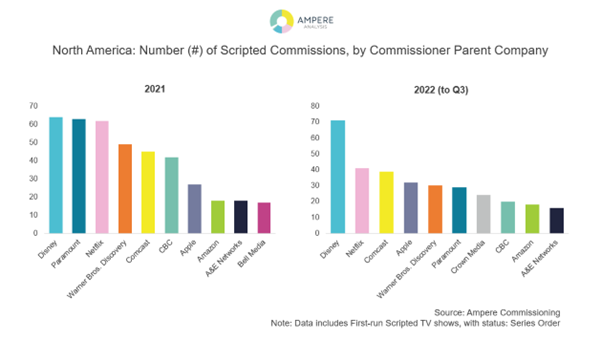

LONDON—Disney is the king of scripted TV content in North America, commissioning 181 titles so far in 2022, vastly surpassing Netflix, according to the latest research from Ampere Analysis.

Last year, Disney barely edged out Netflix, whose scripted output is around 40 so far this year, just slightly ahead of Peacock. So far Disney has ordered more new scripted content by the end of September than it took in the whole of 2021. Netflix has focused more on international with its scripted output falling by 15% in North America across the first three quarters, vs Disney’s growth of 61%.

Warner Bros. Discovery and Paramount have also cut back on its U.S. domestic output, with Warner Bros reducing its scripted outlay from 44 to 28 new series orders in the first three quarters (-30%), and Paramount reduced from 54 series orders to just 29 (-46%).

Mid-size players have shown the greatest development in North America in 2022. One example in this group is Apple, which is steadily evolving into a serious scripted player—this year to date it is the fourth largest commissioner of scripted content in North America with 32 new series ordered, making it one of the global top 10 commissioners of scripted for the first time.

Both Netflix and Disney will far outstrip the competition in terms of scripted output, Ampere said. Disney’s scripted commissions this year are up 28% compared to the end of Q3 last year to 181. Amazon has recorded the strongest growth among all platforms and surpassed the major studios’ commissioning with some 76 titles to date (+33%). As a result, WarnerMedia has dropped out of the top three scripted content commissioners ranking. Its strategy shift post-merger with Discovery means it is likely to be overtaken by Paramount and Comcast.

In Western Europe, traditionally led by public service broadcasters, France TV is currently the largest commissioner of new scripted content with 40 titles so far this year, roughly level with output at this stage last year. Netflix has risen to match this also with 40, four more titles than this time last year.

The biggest reduction in scripted commissioning has come from the BBC, which has fallen to third having been the biggest commissioner in 2021, with a reduction in scripted output of 20 titles compared to this stage in 2021 (-37%). A change of hands is occurring between the major studios active in Europe too. Warner Bros. Discovery has reduced its scripted output in Europe by -29% to date this year (15 titles this year to 21 last), while Paramount has more than quadrupled its commissioning (27 commissions compared to 6 at this stage last year).

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“With public service broadcasters increasingly pulling back due to budget constraints, Subscription Video on Demand (SVoD) platforms and studios are ramping up scripted output, said Fred Black, Research Manager at Ampere Analysis. “At the top of the tree, Netflix is pivoting its Originals strategy even further towards international commissions as it searches for subscriber growth, allowing Disney to catapult its way to the top of the scripted content commissioning via its base in the US, leaning on that volume for global content superiority. If Disney can successfully position its global portfolio of streaming services and cable channels in a way that suits consumers, it can claim Original content supremacy over incumbent market leader Netflix.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.