Global Virtual Reality Shipments Totaled Nearly 10 Million in 2024

Increase represents year-over-year jump of 8.8%, TrendForce reports

Global shipments of virtual reality and mixed reality headsets are expected to reach approximately 9.6 million units in 2024, representing a year-over-year increase of 8.8% according to a new report from TrendForce.

Three key industry trends are shaping the global VR and MR ecosystem, according to the researcher: The dominance of low-cost devices, the shift from entertainment accessories to productivity tools and OLEDs on Silicon (OLEDoS) emerging as the preferred display technology for high-end near-eye devices. These three trends are expected to continue influencing the global VR and MR market over the next several years, TrendForce said.

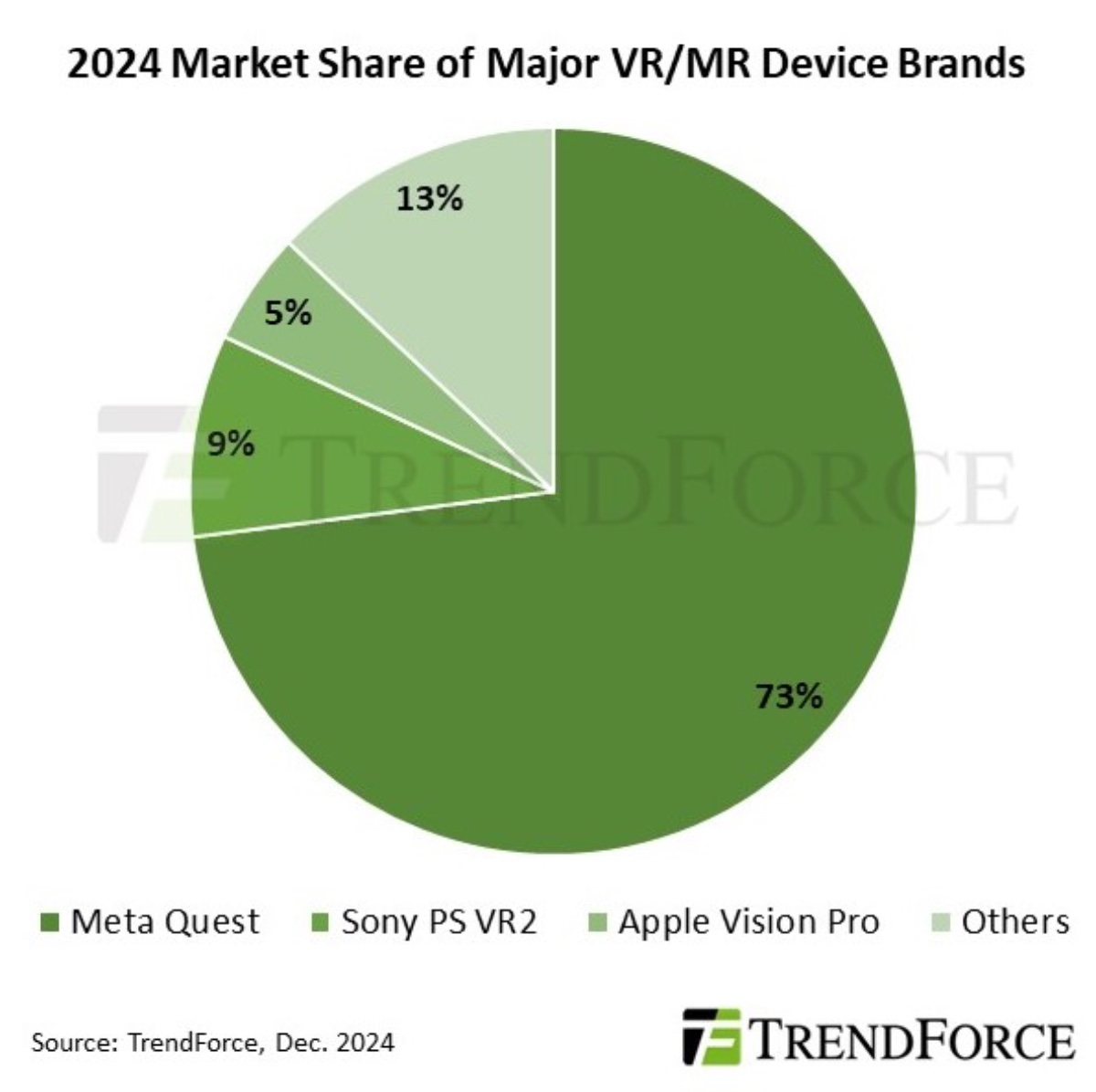

Meta retains its position as the global leader in VR and MR device shipments with a 73% market share in 2024. The primary growth driver is the affordable Quest 3S—priced at just $299—contributing to an 11% year-over-year increase in shipments.

TrendForce said the limited availability of new applications for VR and MR has prompted Meta to adopt a strategy that prioritizes affordable pricing to capture consumer interest. To this end, Meta has opted to release the Quest 3S early while also suspending plans for the high-end Quest Pro 2, signaling a shift in focus toward budget-friendly devices, the researcher said.

Sony’s PS VR2 secured the second-largest market share at 9% for 2024. “Despite Sony’s efforts to integrate the PS VR2 with PC platforms using adapters to broaden the content ecosystem, limited functionality and application support have hindered its performance,” TrendForce said. “Consequently, annual shipments declined by 25% YoY.”

The Apple Vision Pro, which debuted in 2024, quickly captured a 5% share, making it the third-largest player in the VR/MR market. Sales figures fell short of previous Apple product launches, though, largely due to its high price and limited application resources, according to the researcher.

“Vision Pro’s entry, along with Meta’s decision to accelerate the launch of its budget-friendly model and suspend its high-end model, demonstrates that affordable pricing remains the key factor driving consumer adoption,” Trendforce said. “Price sensitivity among consumers has solidified LCD technology as the dominant display technology for VR/MR devices, with a market share exceeding 80%.”

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The launch of the Apple Vision Pro has shifted VR and MR devices beyond their traditional focus on consumer-oriented entertainment toward a broader role as multifunctional productivity tools, TrendForce said.

“Vision Pro is redefining the capabilities and use cases of VR/MR devices—from document editing and virtual meetings to advanced applications in healthcare and education,” it said. “This paradigm shift is expected to encourage other brands to reevaluate the functional attributes of their own VR/MR devices, expanding their role in both consumer and enterprise markets.”

Despite the Vision Pro’s underwhelming sales performance, it has succeeded in establishing a new standard for user expectations of VR/MR. It is also the first device in the industry to feature OLEDoS display technology, setting a new benchmark for product specifications and visual quality in the sector, TrendForce said.

“Apple’s extensive experience in hardware design and its existing expertise in smartphones, tablets, and laptops positions the company as a key driver of the adoption and diversification of VR and MR applications,” it said. “Looking ahead, Apple is expected to launch its next generation of VR/MR devices as early as 2026, with a strategy to introduce two distinct models targeting both high-end and mainstream segments.”