How Broadcasters Thrive In an OTT World

Streaming dominates television but can local stations adapt quickly enough?

OTTAWA—Rather than being an industry killer, OTT (over the top) streaming media is boosting viewership for broadcast television, with the biggest benefits being enjoyed by local TV stations and their ownership groups. The reason? Free advertiser-supported streaming TV (FAST) platforms such as VUit are attracting more viewers to local stations both within their Designated Market Areas (DMA) and outside of them.

“We have plenty of examples of TV stations that are getting 30–40% of their total viewership from outside their DMAs,” said Kevin Dunaway, VUit’s vice president of affiliate relations and content development at VUit, an OTT platform for local TV broadcast stations.

Capturing OTT eyeballs is why the Sinclair Broadcast Group has launched FAST OTT platforms STIRR (120-plus channels of local news, sports, entertainment and movies) and NewsON (access to local Sinclair U.S. news/sports casts worldwide), along with building ATSC 3.0 test transmission sites.

“Our core mission as a company is embodied in the phrase, ‘Connecting people to content everywhere,’” said Scott Ehrlich, Sinclair’s senior vice president of growth networks and content. “These days, everywhere includes digital devices and—increasingly—connected TVs.”

Competing With Giants

The reason TV broadcasters are thriving on OTT is because their stations offer something that Amazon and Netflix don’t, namely online access to local news and sports.

“Live local news is something that TV broadcasters really do well,” said Rick Ducey, managing director of BIA Advisory Services. “Meanwhile, there is a real appetite for local sports among viewers, even if they’re not in the market where this coverage is being broadcast. Collectively, superior coverage of local news and sports is what people associate with broadcast TV, and why they are now seeking this local content on the web.”

The broadcast television industry’s migration to ATSC 3.0 will improve its position in the competitive OTT market as well, according to Richard Friedel, executive vice president of engineering at Fox Television Stations and a member of the ATSC board of directors.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“ATSC 3.0 is the portal to the merger of OTT and OTA, and it’s just going to provide a better consumer experience,” he said.

Leveraging the Power of Local

Available at iOS and Android app stores and most major streaming platforms, the VUit OTT platform works on a simple business case: Local stations provide VUit with feeds, which the company distributes to the web for free. The money made from web ads inserted within those feeds are then split between VUit and its member stations.

“Most VUit stations have a local geo-fenced channel and a national channel,” explained Dunaway. “The local channel is where they can stream local news and sports, plus any programming that they have local rights to. The national channel is usually focussed on local news, sports and any other content that these stations produce and own themselves.”

This “power of local” on the web is nicely illustrated by Heritage Broadcasting in Cadillac, Michigan, a CBS/FOX station that is home to 9&10 News. Being carried on VUit has substantially boosted viewership to the station’s newscast, according to 9&10 News Director Daniel Firnbach, attracting both local viewers who have trouble receiving broadcast signals and outsiders who want to see what’s happening in northern Michigan. VUit’s boost is so significant that this channel now sends news crews to cover OTT-only events during off-hours, so that it can air more ads on VUit.

“Being on VUit really helps us with local ad sales,” said Firnbach. “It also makes it easier to attract sponsors for promotional events, since they get exposure both locally and globally on this platform.”

Sinclair has also taken direct control of FAST OTT content distribution through STIRR and NewsON. “The tagline we’ve been using is, ‘Streaming TV from your local TV station for free,’” said Adam Ware, Sinclair’s vice president and general manager of national networks and platforms.

FOX Television Stations has also taken control through its own FAST OTT channels. “One of them is LiveNOW from FOX, which offers ongoing streaming of breaking live news across the country,” said Jeff Zellmer, senior vice president of Digital Operations for FOX Television Stations. “The other is FOX SOUL, which is a channel dedicated to Black viewers. Our local FOX stations are also streaming on their own web and app platforms.”

Adjusting Ad Strategies to Capitalize on OTT

The availability of local broadcast TV content on OTT meshes nicely with advertisers’ desires to reach viewers of this content—and their willingness to pay for the privilege.

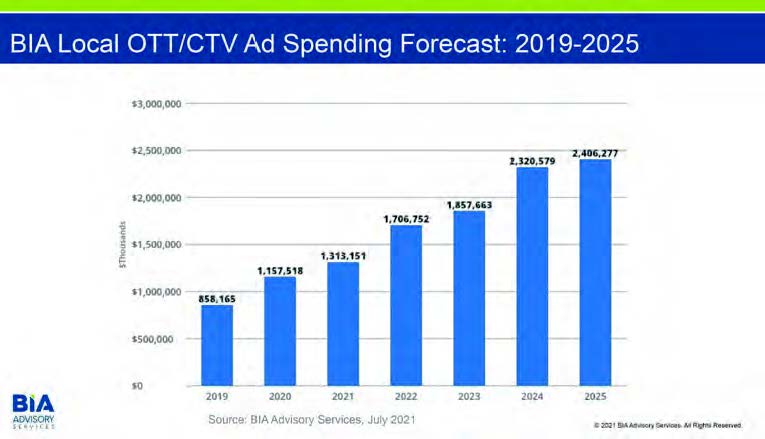

Based on BIA’s own projections, “OTT ads targeting local viewers will be worth $1.3 billion in 2021,” said Ducey, “We see this amount almost doubling by 2025 to about a little over $2.4 billion. This offers a significant opportunity for TV station groups to monetize this demand.”

This increase in local OTT ad buys is part of a fundamental repositioning in overall media purchases, Zellmer said. “At every level—local, regional, national—TV ad budgets are being reallocated, readjusted and reevaluated,” he told TV Technology. “This is because OTT offers addressable, targetable audiences that broadcasters have never had access to before. This new component is really attractive to advertisers.”

To respond to this OTT opportunity, many station groups have set up in-house sales divisions such as Sinclair’s Compulse OTT and the FOX Television Stations’ FLX. Premion performs the same function for majority owner Tegna and minority owner Gray Television, according to Premion President Tom Cox.

“One of the real benefits of working with OTT in conjunction with linear TV is OTT can bridge the gaps caused by cord-cutting and other broadcast TV audience losses,” he said. “OTT allows advertisers to address consumers who can’t be reached by traditional OTA signals.”

Shopping for Horses

The flexibility inherent in OTT allows broadcasters to offer advertisers opportunities that weren’t possible prior to streaming video. A case in point: “Our Texas Sinclair stations in San Antonio and Abilene have a local advertiser in the live horse auction business,” said Ware. “So our stations worked with the client to develop a 24/7 television channel [STIRR Channel 251] called the ‘Horse Shopping Channel.’”

In the same vein, broadcasters can spin up niche FAST channels whenever viewer demand exists for them, then shut these channels down when it drops. This is what Sinclair has done. It has spun up limited-run OTT channels covering 2020’s urban unrest, the 2020 national elections and COVID-19.

The common theme expressed by everyone interviewed for this article is that OTT is good for the broadcast television business. “There was the initial fear among many broadcasters that OTT would cannibalize TV audiences,” Ehrlich said. “But this hasn’t proven to be the case: OTT serves a different audience at a different time and in a different way than broadcasting does.”

The advertising and audience expansions made possible by OTT underline why broadcasters of all sizes need to add this platform to their distribution channels now. “If they haven’t, they’d better real quick,” said 9&10’s Firnbach. “Smart broadcasters understand that the content is their currency—and that they need to expand where it’s being offered any way they can.”

James Careless is an award-winning journalist who has written for TV Technology since the 1990s. He has covered HDTV from the days of the six competing HDTV formats that led to the 1993 Grand Alliance, and onwards through ATSC 3.0 and OTT. He also writes for Radio World, along with other publications in aerospace, defense, public safety, streaming media, plus the amusement park industry for something different.