Hub: Streaming Viewers More Accepting of TV Ads

Annual survey finds two-thirds of viewers find advertising more tolerable than in on-demand programming

PORTSMOUTH, N.H.—With a greater number of lower-cost ad-supported programming sources available, TV viewers’ resistance to ads continues to wane, according to a new report from Hub Research.

Hub’s semiannual “TV Advertising: Fact vs. Fiction” survey indicates most consumers prefer to watch TV ads in exchange for lower subscription costs, particularly those concerned about the economy and potential inflation.

This marks a significant turnabout in viewers’ acceptance of TV ads; in the dawn of the streaming age, low-cost monthly subscriptions for ad-free viewing were all the rage. As streaming services went global, production and distribution costs ramped up, resulting in increased subscription rates, which led to cancellations and lower uptake. Streaming companies, led by Netflix, began offering ad-supported subscription tiers in recent years to attract and retain subscribers, with others soon following suit.

Any doubts about the success of such tiers were quickly settled as Netflix reported recently that 70 million subscribers worldwide signed up for ad-supported subscriptions just two years after launch.

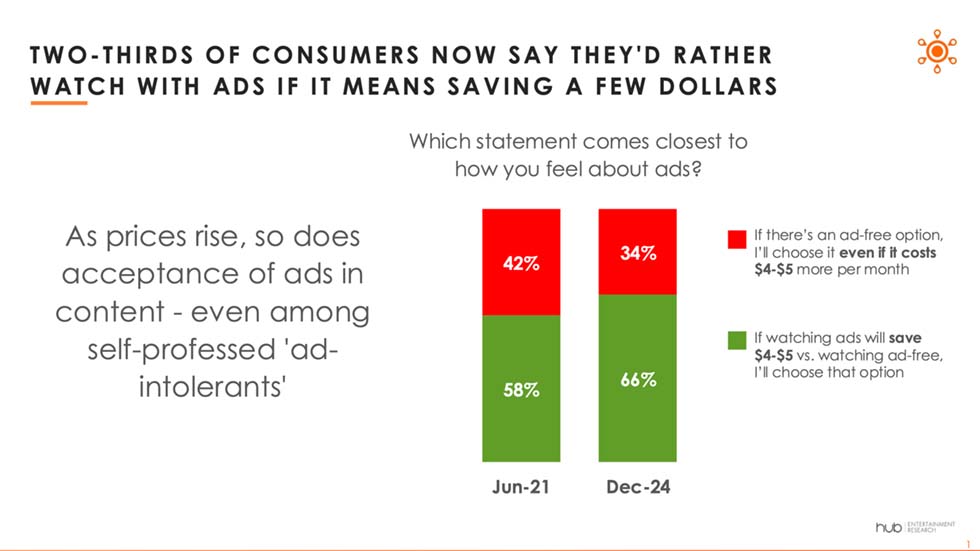

So it’s not surprising Hub reported that a full two-thirds of viewers who responded to its survey now say they would prefer to watch content with ads if it brings down the cost of a TV subscription. Notably, there has been a growing preference for ads over the past three years among people who say they cannot tolerate ads. As viewers add more TV services, and those services increase prices, lower-cost alternatives are persuading consumers who dislike ads to consider ad-supported content, Hub said.

With many free, ad-supported streaming TV platforms (FASTs) and AVODs now offering live-TV options, especially in news and sports, consumers are finding more options for live viewing. Although streaming services are still mainly used for on-demand viewing, one third of viewers’ time is spent with live streaming.

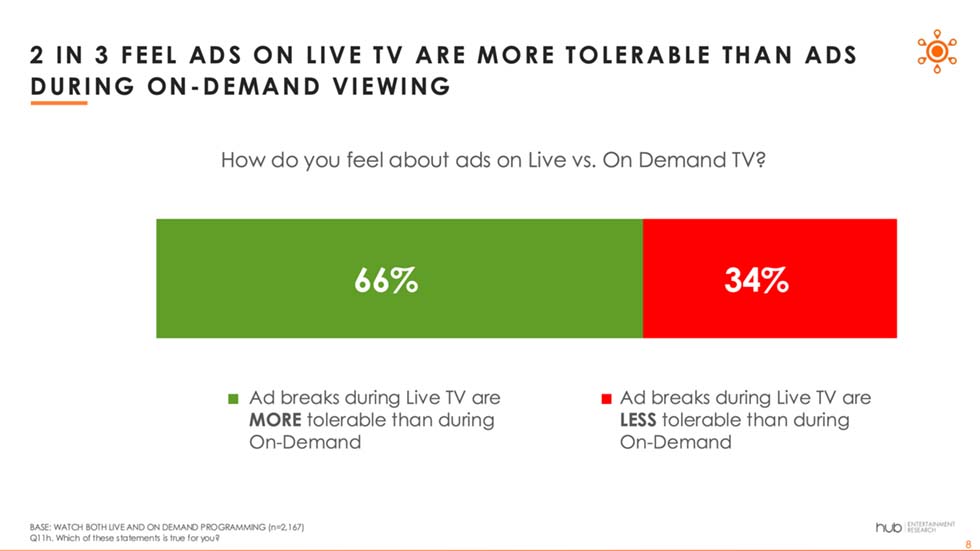

Since a great deal of live TV content is formatted for commercial breaks, two-thirds of viewers find advertising more tolerable than in on-demand programming. The positive sentiment toward live TV ad breaks is even more prevalent among younger viewers.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

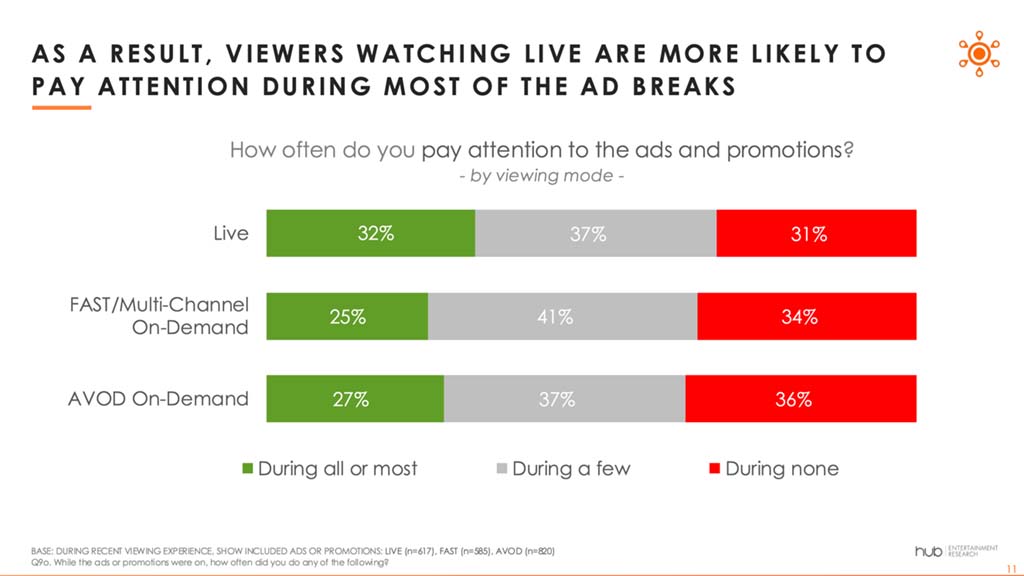

Ad breaks in live TV give many viewers a welcome break in the programming. For live sports in particular, ads are seen as part of the regular rhythm of the action. The positive reaction to ads in live TV subsequently leads to greater attention to the ad breaks, compared to on-demand programming.

According to Hub, when asked a series of questions about characteristics of ads that would garner more of their attention, viewers were most likely to cite rewards for viewing. The next three most-cited drivers of attention were all associated with fewer ads, though: shorter ad breaks, shorter ad length and a single ad per break.

Although many streaming services provide countdown clocks or ad counters, fewer viewers agreed those features earned more of their attention during ad breaks.

Among the lowest-ranked ad break features were those requiring viewer participation: games, interactive ads, or product links. Pause ads, another common practice among streaming services, also scored low on attracting viewers’ attention.

As more TV services have introduced ad-supported offerings, viewers are acclimating to that reality and embracing it, Hub said. The number of consumers who say they are intolerant of TV advertising continues to decline. What is particularly noteworthy is the viewers who say they cannot tolerate ads are the ones who are coming around to accepting ads for lower subscription costs, according to the researcher.

“Over the past three years, it’s clear most viewers prefer watching ads if they can save on TV subscriptions. More recently, we’re seeing that even the most ad-intolerant consumers are deciding the trade-off of watching ads for lower costs is worthwhile,” said Mark Loughney, Hub Research Senior Consultant. “There is plenty of good news here for streaming services and their advertisers. Most consumers think the amount of advertising is reasonable, especially in live viewing. As streamers add more live content, especially sports, advertisers will have greater opportunities to reach more viewers who are paying full attention to their messages.”

These findings are from Hub’s 2024 ”TV Advertising: Fact vs. Fiction” report, based on a survey conducted among 3,000 U.S. consumers age 14-74 who watch at least one hour of TV per week.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.