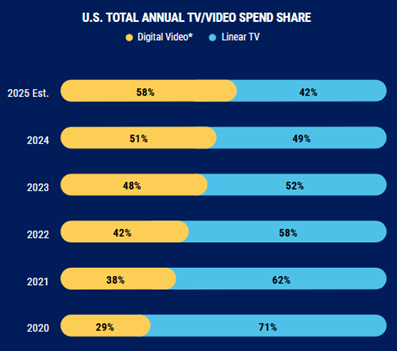

IAB: Digital Video to Capture 58% Share of the TV/Video Ad Spend in 2025

Digital video ad spend rose 18% in 2024 to $64 billion and is projected to grow another 14% in 2025, reaching $72 billion

NEW YORK—A resurgence in live events and sports programming on streaming platforms, coupled with the expansion of self-serve and programmatic ad tools, helped CTV rebound with 16% year-over-year (YoY) growth in 2024, according to new data released by IAB.

The IAB’s “2025 Digital Video Ad Spend & Strategy Report: Part One,” also projects that digital video advertising is set to capture 58% of the TV/video ad spend in 2025 as it grows to $72 billion and that CTV advertising will hit $26.6 billion in 2025.

Linear TV's share will fall to 42%, down from a 48% share in 2024, which was the first year when digital video advertising surpassed linear TV.

“2024 was a pivotal year for digital video advertising. With high-quality content moving to streaming, advancements in advertising technology, and an influx of new inventory accelerated growth for both consumers and advertisers,” said David Cohen, CEO, IAB. “CTV is making it clear it’s a go-to channel for both viewers and advertisers and is expected to continue growing along with social video and online video.”

Now in its twelfth year, the report, developed in partnership with Advertiser Perceptions and Guideline, provides a comprehensive snapshot of the U.S. digital video marketplace across CTV, social video, and online video, surfacing how and where ad dollars are flowing and why.

This year’s findings underscore a clear shift in momentum as digital video is expected to capture 58% of total TV/video ad spend in 2025, double its share from just five years ago. This growth builds on a major turning point in 2024, when it surpassed linear TV for the first time. Digital video ad spend rose 18% in 2024 to $64 billion and is projected to grow another 14% in 2025, reaching $72 billion—two to three times faster than total media overall, the IAB reported.

“The video industry continues its transformative shift towards streaming driven by content, creators, technology, and improved measurement. However, it is important to acknowledge that ongoing economic uncertainty, including tariffs, geopolitical conflicts, and changing consumer confidence, the marketplace in 2025 is more difficult to predict than ever before,” added Cohen.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

All three types of digital video, CTV, social video, and online video, are driving the overall channel’s trajectory, with each posting double-digit growth.

The report found that CTV advertising grew from $20.3 billion in 2023 to $23.6 billion in 2024, a 16% growth rate. The study is projecting that CTV advertising will hit $26.6 billion in 2025.

Social video advertising increased from $19.5 billion in 2023 to $23.7 billion, a 21% pop, and is projected to hit $27.2 billion in 2025, the study found.

Online Video increased by 17% from $14.2 billion in 2023 to $16.6 billion in 2024 and is projected to hit $18.6 billion in 2025.

“CTV and social video are core pillars of a brand’s comprehensive and integrated media strategy,” said Chris Bruderle, vice president of industry insights & content strategy, IAB. “Consumer attention has already moved to these platforms, and advertisers are meeting them there - not just for the scale, but for the ability to precisely target, measure performance across devices, and drive real business outcomes. These channels are now foundational to any effective media strategy.”

The IAB study also found that more categories are ramping up their digital video ad spend to connect with consumers where they watch content the most. In 2025, most major categories are set to increase digital video ad budgets by double-digits with CPG (13%), retail (18%), and pharma (19%) leading the way. These categories are capitalizing on advanced targeting, including AI-driven personalization, real-time insights, and shoppable ad formats to drive deeper engagement and more immediate consumer action.

Another major finding is that CTV is no longer just for brands with big budgets. With the rise of programmatic self-serve tools, small and mid-size businesses are stepping into the spotlight. In 2025, most of the dollars flowing into CTV are coming from reallocations—primarily from linear TV (36%), social media (36%), and other digital channels like online video, paid search, and display. This shift reflects growing confidence in CTV’s ability to deliver targeted, high-impact campaigns, now made even more accessible through programmatic and self-serve tools, the study found.

“The combination of self-service technology, accessible pricing, and the ability to link spend to outcomes has empowered small and mid-size businesses to get a piece of the CTV pie, making it easier and effective to promote, reach, and engage with audiences," Cohen concluded.

The IAB “2025 Digital Video Ad Spend & Strategy Report: Part One” report can be accessed here. Part two of the report, which will be released on July 14th during the IAB Media Center’s Video Leadership Summit, will focus on strategies behind these growth rates.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.