IDC Forecasts 5.6% Growth in IT and Business Services

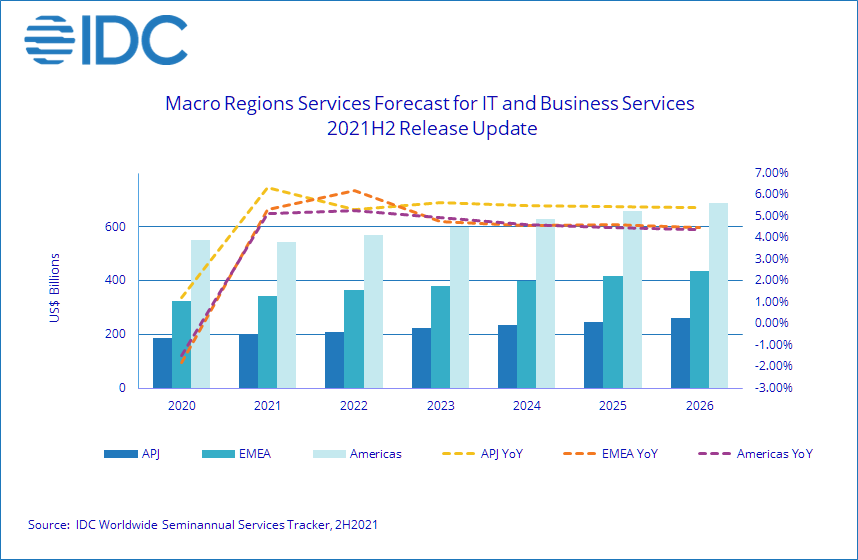

IDC believes that the market will continue to expand throughout the next few years at a rate of 4% to 5%, with cloud technologies being an important driver

NEEDHAM, Mass.—Despite uncertainty about inflation, global supply chain issues, Covid 19 and the war in Ukraine, the International Data Corporation (IDC) has released new forecasts showing that worldwide IT and business services revenue is expected to grow by 5.6% (in constant currency) in 2022.

IDC's Worldwide Semiannual Services Tracker reports that the 2022 market growth represents an increase of 160 basis points (or 1.6%) from IDC's October 2021 forecast.

The improved market view reflects robust 2021 bookings and pipelines by several large services providers, an improved economic outlook (compared to the previous forecast cycle), and inflationary impact on the services market, offset slightly by the negative impact of the Ukraine/Russia conflict, the researchers said.

IDC also is predicting that the market will continue to expand throughout the next few years at a rate of 4-5%, representing an overall increase of 40 to 80 basis points each year, pushing the market's long-term growth rate to 4.6%, up slightly from the previous forecast of 4.3%.

"In this forecast cycle, IDC services analysts have looked at short-term impacts, such as pent-up demand and the Ukraine/Russia conflict, as well as more structural ones, such as adoption of public cloud, the talent crunch, inflation, data security/residency/sovereignty, and more," said Xiao-Fei Zhang, program director, IDC Worldwide Services Tracker program. "Based on our analysis, we adjusted our outlook accordingly at the market level."

"However, at the individual vendor level, services providers will need to brace for more volatility," Zhang continued. "On the heels of a global pandemic, enterprise buyers face another black swan event in 2022, which will accelerate large global trends, such as remaking the global supply chain and value chain and exacerbating the talent crunch by changing demographics. We should expect more of 'the unexpected' in the years to come. During the last two years, the services providers who succeeded were the ones who have proven to be resilient partners helping their clients thrive in change. This has always been the constant force to drive growth in the services market."

Within the IT and business services markets and across all regions, cloud-related services spending has been the main growth accelerator since 2020, the researchers said. IDC forecasts it to continue to grow close to 20% year over year in 2022 and between 15% to 20% over the next three years.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The Americas services market is forecast to grow by 5.3% in 2022, up 150 basis points from the October 2021 forecast (in constant currency.)

The IDC attributes this to a faster economic rebound and the impact of inflation. IDC believes that the trend will continue in the short-term: 2022 and 2023 growth rates were adjusted up by 150 and 100 basis points, or around 4% year-over-year growth for the next five years.

The outlook for the U.S. market has also been also adjusted up by 160 and 80 basis points for 2022 and 2023, respectively, the IDC reported but the long-term U.S. growth prospect remains largely unchanged.

The IDC's mid- to long-term growth prospects for Canada and Latin America improved marginally. Both regions will continue to see recovery well into 2022 and 2023. Latin America's near-term growth outlook is further lifted by the commodity price rally since March.

The 2022 growth forecast for EMEA (Europe, Middle East, and Africa) was raised by more than 220 basis points.

IDC has reduced the Central & Eastern Europe (CEE) forecast significantly due to the conflict in the Ukraine. It expects the CEE services market to grow only by 5.5% and 7.3% in 2022 and 2023, respectively, down from our previous forecast of 9-10% growth. Russian and Ukraine markets will shrink significantly this year.

But, Western Europe's near-term growth forecast has been adjusted up: IDC now forecasts the region to grow by more than 6% in 2022, up by 280 basis points from our last forecast. The improved outlook is largely due to the EU's revised 2022 GDP outlook at the end of the end of 2021 (prior to the Ukraine/Russian crisis). IDC continues to see EU-funded investments driving services spending. Inflation also contributed to nominal growth, although to a smaller degree.

This was partially offset by the Ukraine/Russia conflict. IDC believes that the crisis will dampen Western Europe's mid-term market growth but will be offset by other drivers.

The Middle East & Africa's (MEA) growth prospects for 2022 and 2023 have also been raised by 250 and 100 basis points, respectively.

Asia/Pacific's growth outlook improved by 0.9 percentage points in 2022, largely due to PRC (China) and other developed Asian markets (i.e., Australia, Japan, Singapore, Korea, etc.).

The forecast for China's market growth has been adjusted up to 6.4% and 8% for 2022 and 2023. While China's GDP growth is expected to cool down, IDC believes that digital transformation remains central to the country's long-term "new infrastructure" initiatives, which will further drive services spending in both the public sector and strategic industries such as BFSI, manufacturing, and energy.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.