IDC: Spending on AI to Jump 19.6% in 2022

New IDC forecast estimates that global spending on software, hardware and services for artificial intelligence will top $500 billion in 2023

NEEDHAM, Mass.—The booming demand for artificial intelligence is expected to continue in 2022 and 2023, with a new IDC forecast predicting that worldwide revenues for the artificial intelligence (AI) market, including software, hardware, and services, will grow 19.6% year over year in 2022 to $432.8 billion and break the $500 billion mark in 2023.

“AI has emerged as the next major wave of innovation," explained Ritu Jyoti, group vice president, Worldwide Artificial Intelligence (AI) and Automation Research at IDC. "AI solutions are currently focused on business process problems and range from human augmentation to process improvement to planning and forecasting, empowering superior decisioning and outcomes. Advancements in language, voice and vision technologies, and multi-modal AI solutions are revolutionizing human efficiencies. Overall, AI plus human ingenuity is the differentiator for enterprises to scale and thrive in the era of compressed digital transformation."

The IDC Worldwide Semiannual Artificial Intelligence Tracker is predicting that AI Services will deliver a compound annual growth rate (CAGR) of 22% while the CAGR for AI Hardware will be 20.5%.

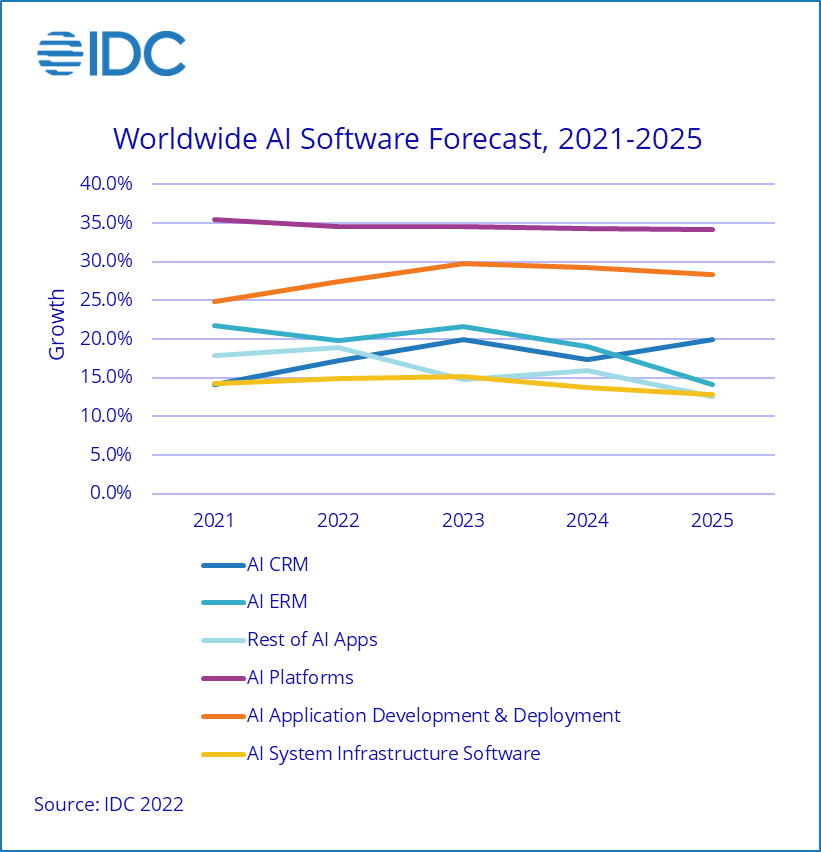

In the AI Software category, AI Applications accounted for 47% of spending in the first half of 2021, followed by AI System Infrastructure Software with around 35% share.

In terms of growth within the Software category, AI Platforms are expected to perform the best with a five-year CAGR of 34.6%. The slowest growing segment will be AI System Infrastructure Software with a five-year CAGR of 14.1%.

Within the AI Applications segment, AI ERM is forecast to grow the fastest over the next several years relative to AI CRM and the rest of AI Applications. Among all the named software markets published in the Tracker, AI Lifecycle Software is forecast to see the fastest growth with a five-year CAGR of 38.9%.

In the AI Services category, AI IT Services enjoyed 20.4% year-over-year growth in the first half of 2021 with worldwide spending reaching $18.4 billion. This growth is forecast to improve to 22% in 2022 and remain there through the end of the forecast period. AI Business Services are not far behind in terms of growth with a five-year CAGR of 21.9%.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

By 2025, IDC expects overall AI Services spending to reach $52.6 billion.

"AI remains a key driver of IT investment, which in turn boosts spending on related services to ensure sustainable adoption at scale," said Jennifer Hamel, research manager, Analytics and Intelligent Automation Services. "Client demand for expertise in developing production-grade AI solutions drives IT services expansion, while the need to establish the right organization, governance, business process, and talent strategies spurs spending on business services."

Relative to Software and Services, the AI Hardware category grew the most in terms of market share in the first half of 2021 with a jump of 0.5% share. It is forecast to reach 5% market share in 2022 with year-over-year growth of 24.9%. AI Storage saw stronger growth relative to AI Server during the first half of 2021. However, this trend will be reversed in 2022 with AI Server expected to see 26.1% growth compared to 19.7% growth for AI Storage. In terms of spending share, AI Server holds the lion's share of the category at over 80%.

"Of all the spending in the various AI market segments, AI Hardware is by far the smallest," said Peter Rutten, research vice president, Performance Intensive Computing at IDC. "What this should tell organizations is that nickel-and-diming purpose-built hardware for AI is absolutely counterproductive, especially given the fast-growing compute demand from increasing AI model sizes and complexities."

The IDC Worldwide Semiannual Artificial Intelligence Tracker provides spending data and vendor share for the global AI solutions market on a semi-annual basis. AI revenues for over 750 companies are included in the Tracker and the data is available for 27 countries and five rest-of regions.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.