Kagan: Nextflix’s Amortized Content Spend Estimated to Hit $13.6B In 2021

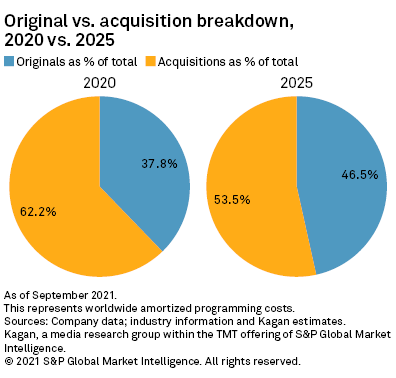

The 2021 Netflix content costs includes $5.21B for originals; the total content spend should rise to nearly $19B in 2025, when about 46.5% will be spent on originals, Kagan is forecasting

NEW YORK—If new forecasts of Netflix’s spending on content prove to be accurate, the streaming service’s total amortized spending may reach $13.60 billion this year and increase to more than $18.92 billion in 2025, according to Kagan, the media research unit of S&P Global Market Intelligence.

Kagan is also predicting that over this period, Netflix will put more money into originals, with spending for originals increasing at a 14.0% annually with acquisition CAGR could be 4.8%.

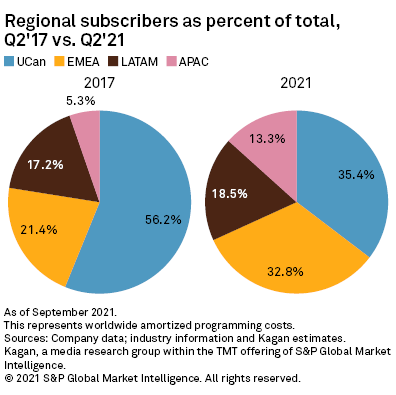

The new report also highlights subscriber data showing that Kagan is seeing some payoff in the localization focus. Second-quarter statistics show that subscribers from the U.S. and Canada made up about 56.2% of total subscribers in 2017 compared to just 35.4% in June 2021.

Kagan highlighted increased competition in the streaming space and the difficulty of producing content during the ongoing pandemic as key factors driving increased content spending.

Kagan noted that the launch of new subscription video-on-demand players, such as The Walt Disney Co.'s Disney+, AT&T Inc.'s HBO Max, Comcast Corp.'s Peacock and ViacomCBS Inc.'s Paramount+, resulted in those players moving content to their own streaming services..

With that dynamic likely to continue, Kagan believes Netflix will be putting increased focus on their originals, with $5.21 billion of the $13.60 billion in total amortized costs going to originals in 2021.

Netflix has been preparing for this trend since entering the originals market in 2012 as it expected studios would eventually hold back programming. By 2014, about 6.8% of spend came from new orders and increased to about 37.8% of the budget in 2020. As the service focuses more on new content, Kagan expects that to grow to 46.5% by 2025.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Kagan defines an original as a production that was ordered by Netflix, including co-productions. This does not include acquisitions that are sometimes marketed by Netflix as originals, Kagan said.

Netflix also had a significant amount of content ready at the beginning of the pandemic, but production delays affected the latter half of 2020 and persisted into early 2021, Kagan noted.

The streamer is also putting more emphasis on unscripted programming as those series nearly doubled in 2020, Kagan said. This series replaced production shutdowns on the scripted side but reality fare has also given strong results, including "Too Hot to Handle" with Netflix ordering two additional seasons and producing the format in other countries, Kagan noted.

On the acquisition side, theater closures left a plethora of films on the table for streamers, with Netflix snagging "The Trial of the Chicago 7" and "Enola Holmes,” Kagan said.

Netflix has also been ramping up spending on local content and subscriber data indicates the localization efforts are paying off. Second-quarter statistics show that subscribers from the U.S. and Canada made up about 56.2% of total subscribers in 2017 compared to just 35.4% in June 2021, Kagan reported.

This analysis comes from the “Economics of TV & Film,” a regular series of articles from Kagan that provides exclusive research and commentary. It was published by S&P Global Market Intelligence.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.