Kagan: Operators Bet on Streaming Video As Pay TV Declines

Global pay TV subs will hit 1.1B in 2021, a slight 0.5% gain but revenue from video services will slump by 3.5% this year, Kagan predicts, accelerating an ongoing shift to streaming

NEW YORK—As fiber adoption accelerates globally and consumers increasingly turn to alternative forms of entertainment online, multichannel operators, particularly telcos, are beginning to reconsider their video strategies, reports Kagan, the media research unit of S&P Global Market Intelligence, in a new blog post on global multichannel TV.

Kagan is predicting that multichannel households will reach a total of 1.10 billion by the end of 2021, a very weak 0.5% year-over-year increase, as subscriber gains in emerging markets barely make up for accelerated cord cutting in North America, Western Europe and advanced markets in Asia-Pacific.

Video services, meanwhile, will generate $191.18 billion in revenues by the end of 2021, a 3.5% drop compared to 2020, thanks to declining annual video service revenues per user in North America.

Kagan also expects this trend to continue, with global video service revenues declining at a negative 2.4% CAGR from 2020 to 2025 due to rapid pay TV household losses in the U.S. and Canada. By 2025, video services revenue should drop to $175.6 billion, down from $198.1 billion in 2020.

However, Kapan is predicting that video service revenues will continue growing in other global regions, with Eastern Europe posting the highest CAGR in that time period at 3.9%.

Those trends, Kagan argues, are convincing “a growing number of operators” to shut down traditional services and migrate customers to own- or third-party virtual multichannel or other streaming services.

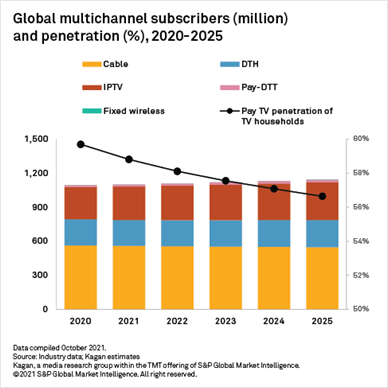

As a result, multichannel penetration of TV households is expected to decline to 58.8% by end-2021 down from a peak of 60.6% in 2018, and continuing to decline to 56.6% by 2025.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Despite the expected multichannel penetration decline worldwide, the global number of pay TV subscribers will continue to grow in the next five to 10 years, Kagan said, with all regions except North America experiencing growth.

Kagan’s researchers are estimating that there will be nearly 1.15 billion homes worldwide with a pay TV subscription by the end of 2025.

Although cable remains the largest pay TV platform on a global scale, accounting for slightly over half of the total multichannel homes in 2021, its market share and the number of subscribers are expected to continue declining in the next five years, with subscriber losses concentrated in North America, Western Europe and Asia.

In 2020, IPTV overtook DTH to become the second-largest multichannel platform worldwide, with an estimated 284.1 million subscribers at the year's end. IPTV is forecast to grow globally as well as in every region except North America, accounting for 28.9% of global pay TV homes by 2025. The DTH segment, meanwhile, will stagnate on the global scale and decline in the Americas and Western Europe, Kagan said.

Mainland China, India and the U.S. have remained the largest multichannel markets by far, which should collectively claim 56.8% of the global subscriber total by the end of 2021. China and India alone claim just over half of the global market, Kagan said.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.