Local TV Ad Spend to Drop 18% Next Year as OTT Advertising Jumps

Video OTT advertising is expected to grow 12.8% according to 2023 forecasts from Borrell Associates

Local television broadcasters take note: now might be the time to launch that local FAST (free-ad supported television) channel under consideration.

Ditto for the ATSC 3.0 fence sitters, especially those who plan to leverage the internet delivery aspect of the standard to stream channels over the top (OTT) to their viewers’ TVs, smartphones and media tablets.

At least, that may be the case if the projections laid out during the “What 2023 Will Bring: Local Ad Spending Forecasts” webinar from Borrell Associates play out as predicted.

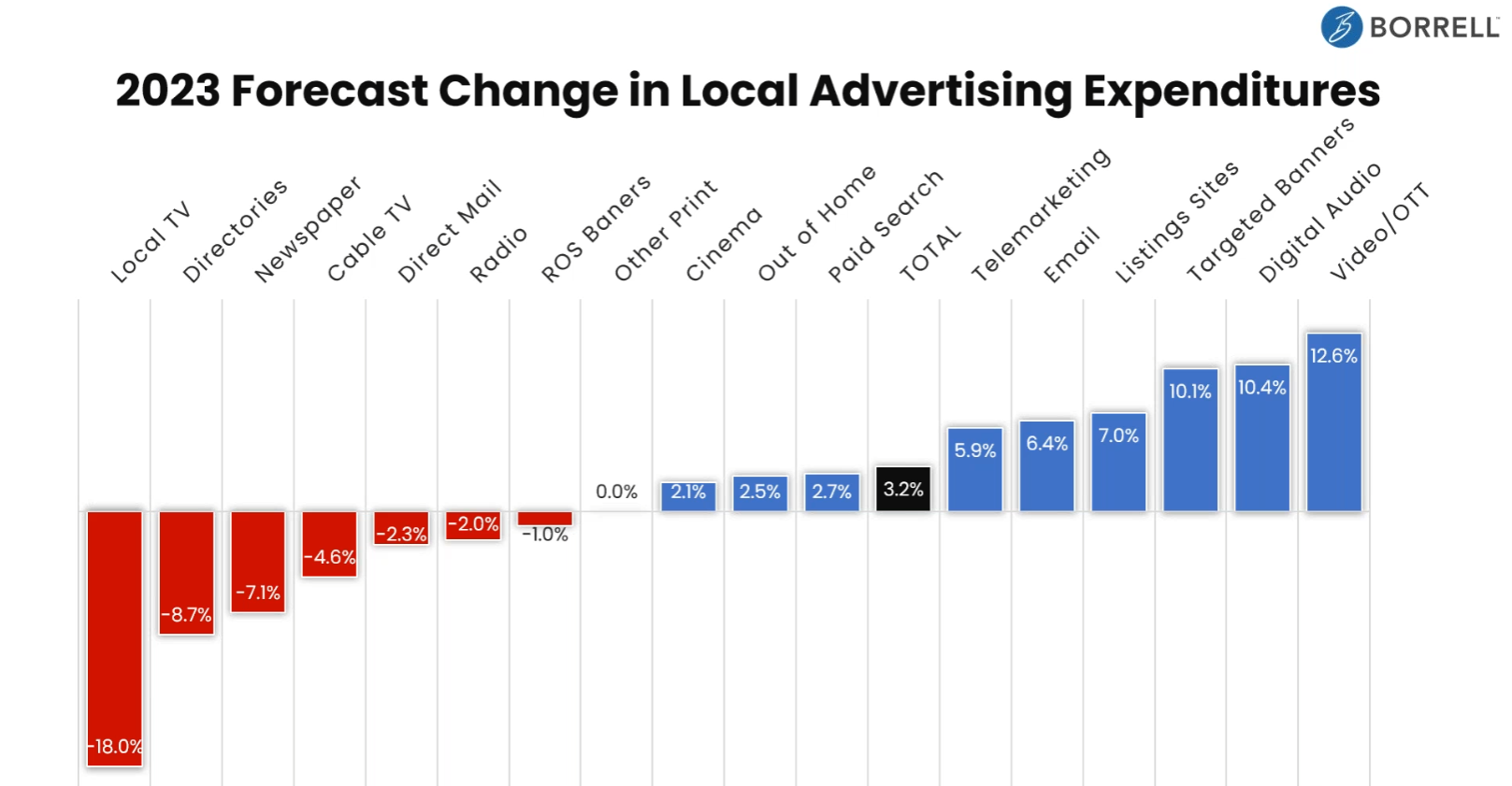

On a percentage basis, local television advertising spending looks to drop the most among 17 identified media verticals—down 18.07% next year. On the other side of the continuum, video/OTT is projected to grow 12.8% in 2023, the forecast showed.

Overall, total local ad spending is expected to climb 3.2%. Digital formats will see an increase of 7.7%, while non-digital formats will drop 5.9%, according to the forecast.

However, both Gordon Borrell, company CEO, and Corey Elliott, executive vice president of Local Market Intelligence at Borrell Associates, who presented during the online event emphasized the local TV ad spend number is the money attributed solely to terrestrial TV ads, not a projection for all ad spending with an individual station, which would include dollars spent on a station’s online properties.

“Now your eye probably immediately goes to the right hand side of this graph,” said Elliot, “because that's where the big pretty bars are. …[T]hose four are all about search, OTT and we call it targeted banners [which include social media ads and any other banner delivered online],” said Elliott.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

While some of the decline reflects 2023 being a non-political year, it’s not all related to the lack of campaign ads. Nor does the entire decline reflect it being a non-Olympics year, he said.

Despite the expected decline, television remains the top non-digital form of media advertising, he added.

“There are also other things to be considered. There’s network spots, national spots, syndicated TV that are not included in that local 18% number…. If you factor those things in, the drop changes to about 12%,” said Elliott.

Borrell’s forecast looked at local ad spending in the aggregate, not at what individual local stations can expect in their individual markets. The pair pointed out that results vary from market to market. For example, while local cable TV ad dollar spending is expected to climb 7.3% in Roubidoux, Mo., it is projected to drop next year by 10.3% in San Jose, Calif., according to the presentation.

There is a bright spot on the horizon, however. The number of viable small businesses has exploded since the pandemic. Quoting statistics from the U.S. Census Bureau tracking new business applications, 6.2 million businesses categorized as “high-propensity,” a term the bureau assigns to those with a good prospect of becoming businesses with a payroll, have been created since 2020.

There has also been growth in the percentage of U.S. business locations with fewer than 10 employees, rising from 90% in 2019 to 94% this year. These small businesses typically do not have the marketing and advertising experience of larger local businesses, are thus more likely to use social and digital out of familiarity with those media and are hungry for guidance, said Borrell.

Ad spending among this group is higher when considered as a share of gross income than businesses with 10 or more employees, and the average annual ad budget of these small businesses is $27,836, said Elliott.

“These businesses, if our theory holds, are below the radar. They’re invisible. They’re not on a report you see in your sales reps’ traditional prospecting…. So if these businesses are in fact new, and they’re beginning to spend, but most of it’s on developing their Facebook page,… developing their own website… they have marketing needs,” said Borrell.

“…[Y]ou have got a broadcast medium at your disposal,” he said. “Advertise yourself. Start a series of seminars in the market about marketing. Find ways to push the message out there that you really know about marketing, [and] you can help people…. Don’t sell them television advertising.

“Tell them you are going to help them with search marketing and Facebook marketing [and] should they be advertising on TikTok—some best practice examples of advertising on TikTok. They’ll show up in droves because they’ve been reading about it. That brings them out of the woodwork.”

More information is available on the company’s website.

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.