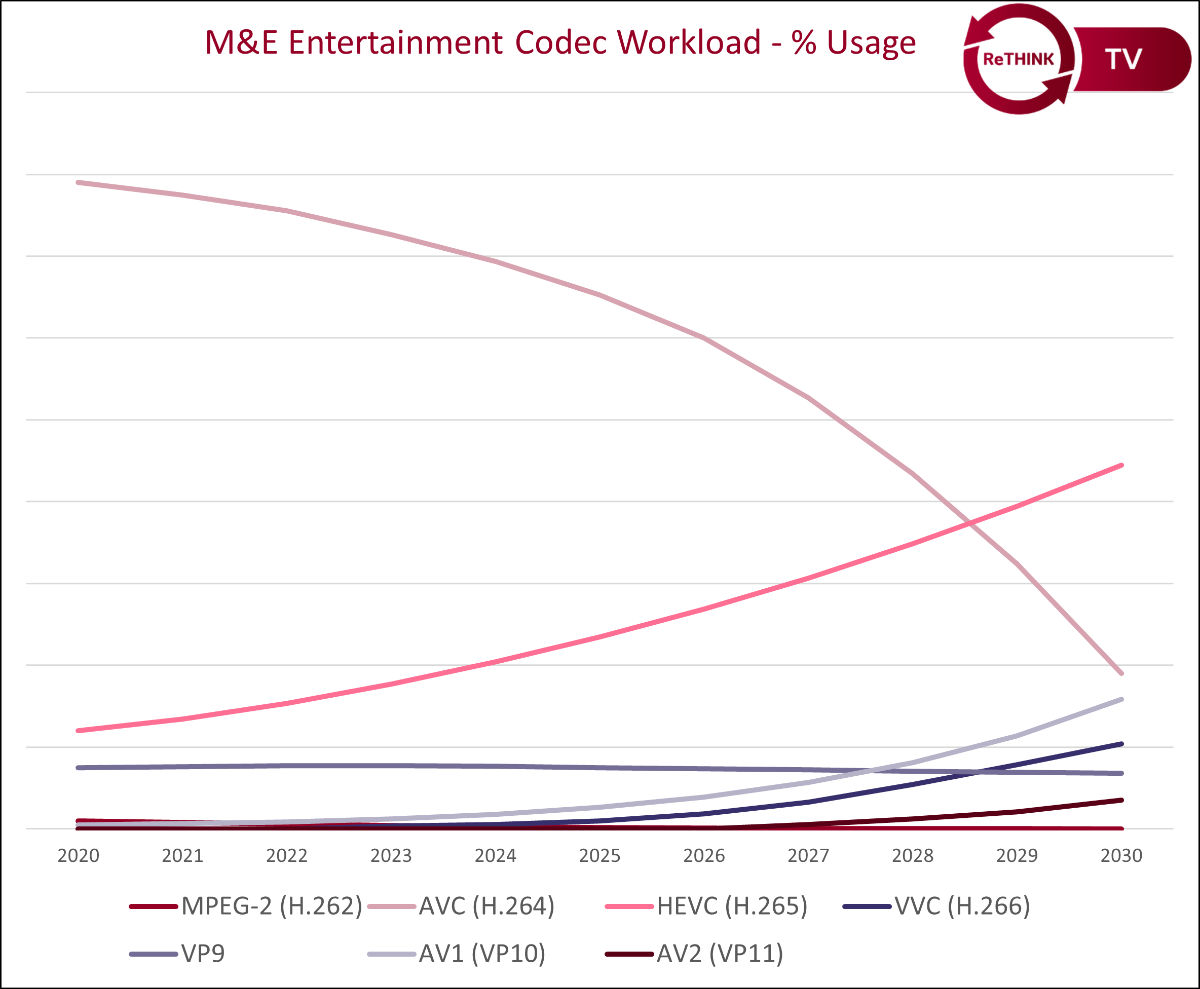

U.K. researcher Rethink TV predicts that the valuation of the rapidly evolving market for advanced video codecs in the media and entertainment market will reach $2.4 billion by 2030, driven by royalties generated by the patent pools that have formed around the video compression tools.

This latest forecast examines the adoption timeline for codecs, focusing on the arrival of VVC, AV1, and eventually AV2. It takes into account recent developments since the researcher last evaluated the market more than two years ago, including what it deems as “the most significant” move when Velos Media exited the VVC patent pool game and shuttered its HEVC pool, leaving just MPEG LA and Access Advance.

Additionally, “the impact of Dolby’s Via acquiring MPEG LA and establishing the Via LA organization, cannot be understated,” the researcher said, adding that with Dolby’s involvement in both organizations, it expected that the two pools will eventually merge, down the line, at least to cut down on administration costs.

“There is a question of whether a single pool option might help snare more licensees, but the practice of direct licenses with IP-holders, outside of the patent pool system, will continue apace,” Rethink TV said.

Regarding TVs that support the VVC codec, Rethink says those sets have arrived slightly ahead of its previous predictions, citing the availability of MediaTek’s Pentonic SoC, but adds that Qualcomm has been slow to add AV1 to its flagship silicon in the mobile sector.

“Potentially the most seismic shift has been Google’s relenting in Chrome, finally allowing HEVC in the browser, and opening the door for a possible explosion in the mobile sector for the codec,” the researcher said.

Rethink TV says the LCEVC enhancement layer has moved slower than it expected, but the codec “seems poised to announce a breakout year of deals.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

(Read: How Multi-layer Coding Standard MPEG-5 LCEVC Can Enable High-quality Metaverse/XR Applications)

“Given its software-only approach, it can move much quicker than the fully-fledged codecs, and its novel business model should demonstrate clear returns on investment for the video services that implement it,” it said.

The researcher also noted the current debate over “fair contribution,” with both fixed and wireless ISPs calling for OTT platforms to pay their “fair share” for the use of traffic on the platform.

“We have a dim view of these positions, largely because these same ISPs are averse to pursuing Multicast ABR on the basis that they ‘can just fire up some dark fiber,’ and maintain their familiar comfy unicast model,” it said. “‘Fair share’ or ‘fair contribution’ smacks of double dipping, and it speaks volumes that these ISPs would prefer to be paid than invest in technologies that might solve their bandwidth problems. To this end, the demand for new codecs seems to have been muted, and to wear our most cynical hat, there will be little pull from the ISPs to speed up the codec roadmap—as this would undermine their fair share argument.”

It concluded that its conclusions are based on the fact that manufacturers keep the rate of adoption and revenues garnered from patent pools close to the vest.

“Assuming that every device sold has paid all the royalties that these pools believe they are entitled to is naïve, and so any modeling done on device sales requires a judgement call about the success rate of codec royalty reclamation,” it concluded.

Click here to download the executive summary of Rethink TV’s Media & Entertainment Codecs Market Forecast 2023-2030.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.