Many Consumers (57%) Willing to Watch Ads to Save on Streaming

Consumers are embracing ad-supported streaming services as a way to save money, a new Hub survey reports

BOSTON, Mass.—As more streaming services launch ad-supported offerings and consumers are increasingly concerned about inflation and the rising streaming bills, the Q4 2022 wave of Hub’s “TV Advertising: Fact vs. Fiction” study reveals strong engagement with ad-supported TV services among TV viewers.

“The industry seems to have finally solved the mystery of how to get consumers to accept ads in TV—and it was as simple as offering a less onerous ad experience and paired with a price break to boot.” said Peter Fondulas, principal at Hub. “Now that Netflix and Disney+ have jumped on the ad-supported bandwagon, the question is whether and when the remaining ad-free only holdouts will join in.”

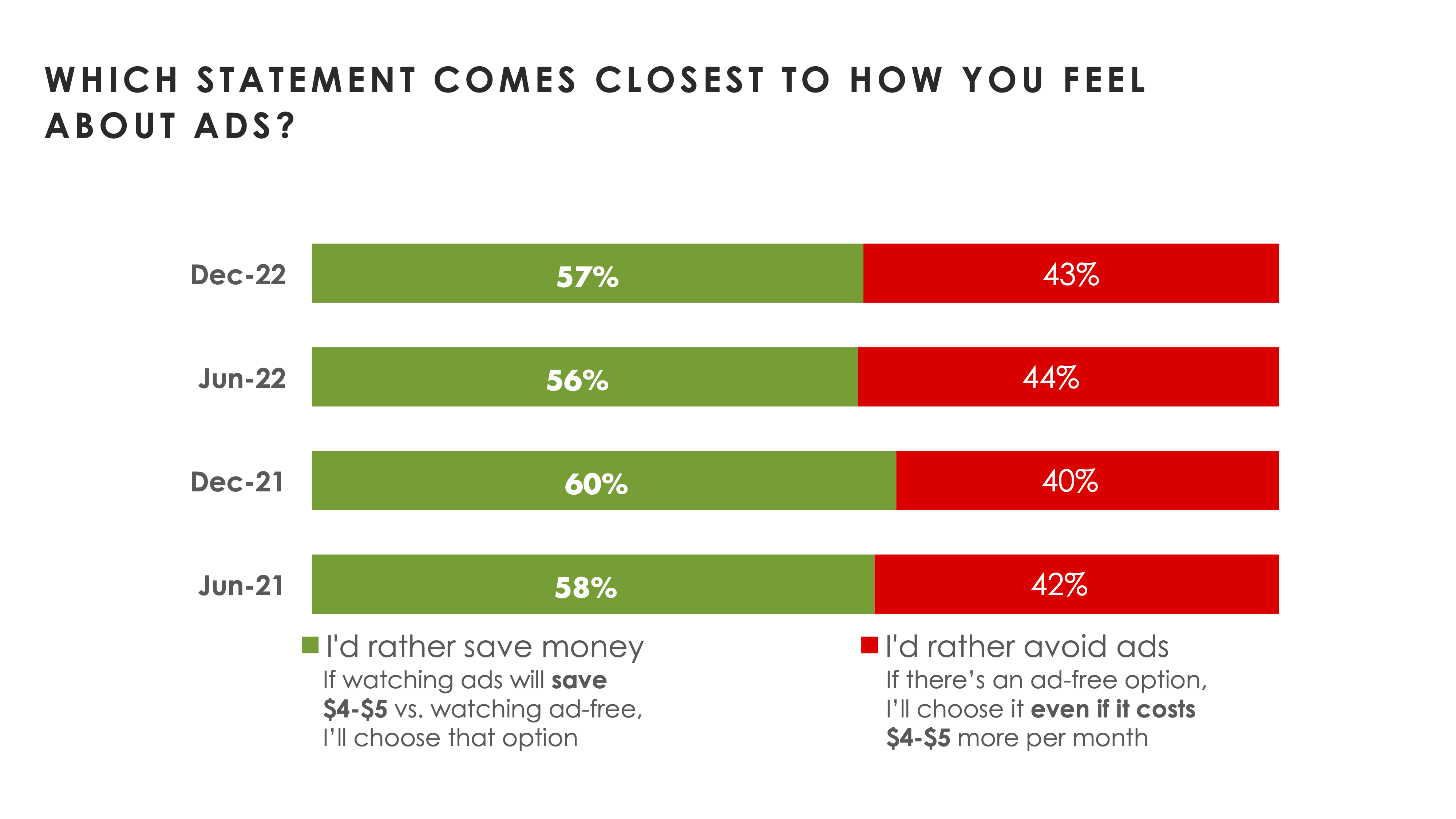

One key finding was that most TV consumers would rather watch ads if it means saving money. Nearly three in five (57%) say they’d rather watch ads and pay $4-$5 less per month for a streaming service. The survey also found that the preference for less expensive, ad-supported tiers over more expensive, ad-free tiers has remained relatively stable over the past year.

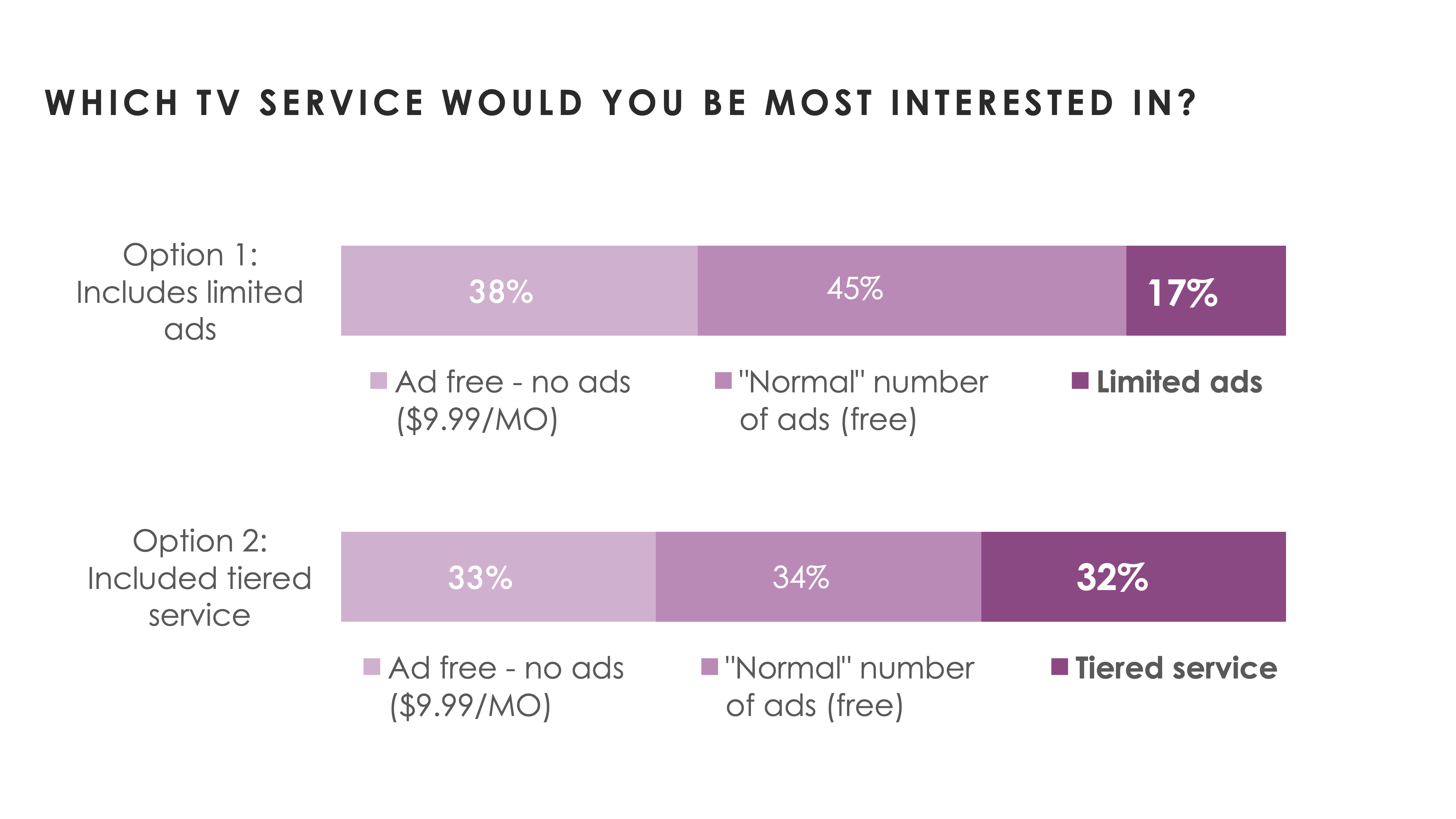

When given the choice, the researchers also found that many consumers would opt for a platform that offered them the option of both ad-free and ad-supported tiers.

When asked to choose between three hypothetical TV services, viewers who are given the option to choose a platform with tiered service – some with ads, some without – do so nearly 2x as often as those shown a platform that only offers “limited ads," Hub reported.

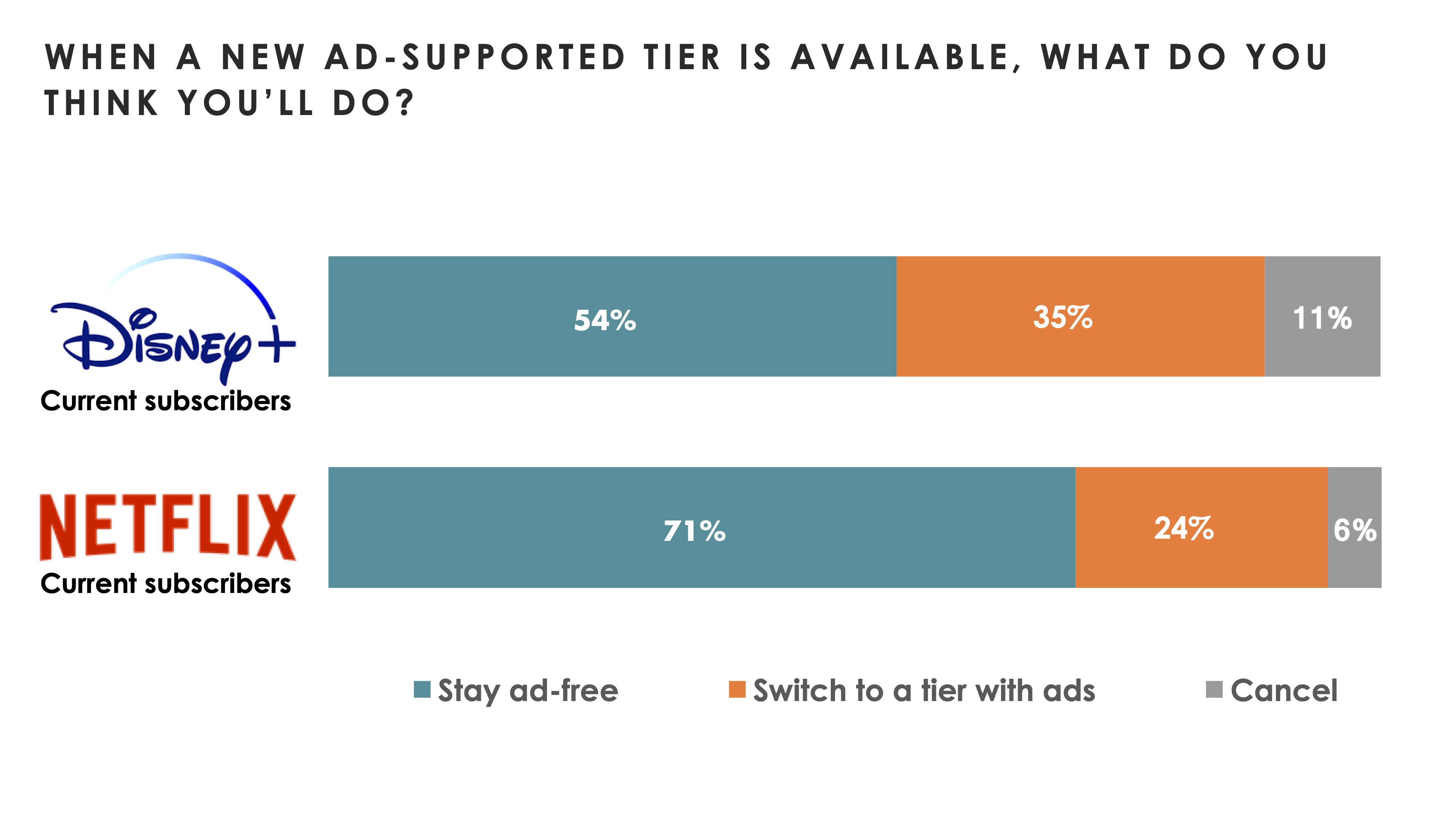

The survey also found that, just as Netflix and Disney+ are releasing their new ad-supported tiers, some subscribers are planning to make the switch, and non-subscribers are considering signing up. Researchers noted that 35% of current Disney+ subscribers and 24% of current Netflix subscribers anticipate switching their subscription tier when the new ad-supported options become available.

The researchers also explored price hikes by streaming services. They noted that in tandem with the release of their ad-supported tier, Disney+ is also raising the price of their ad-free offering: from $7.99 to $10.99 per month. This helps explain why more than 1 in 10 Disney+ subscribers think they’ll drop the service entirely, the researchers said.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The ad-supported tiers are also drumming up interest among viewers who are not currently subscribers. 22% of Disney+ non-subscribers think they’ll sign up for Disney+ once the new ad-supported tier is available. A similar 22% of Netflix non-subscribers anticipate signing up for Netflix service, including 15% who anticipate signing up for the ad-supported tier, the survey found.

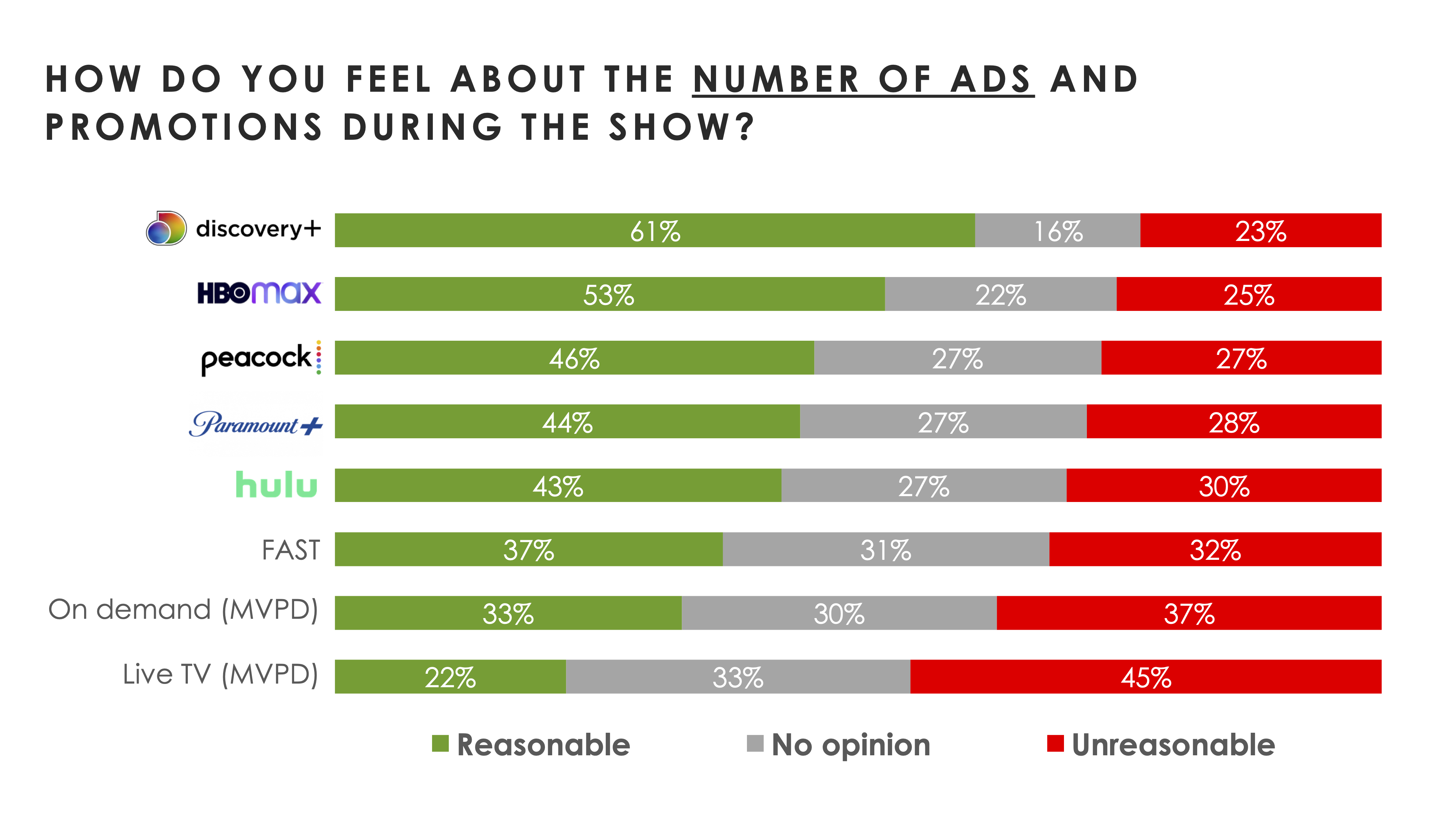

The survey also indicated that AVODs offer the most ‘reasonable’ ad-supported viewing experience and draw the most engagement with advertising, the researchers said. Subscribers to the ad-supported tiers of Discovery+ and HBO Max are the most likely to feel the number of ads they saw during a show they watched recently was “reasonable” – nearly 3x higher than for Live TV on an MVPD.

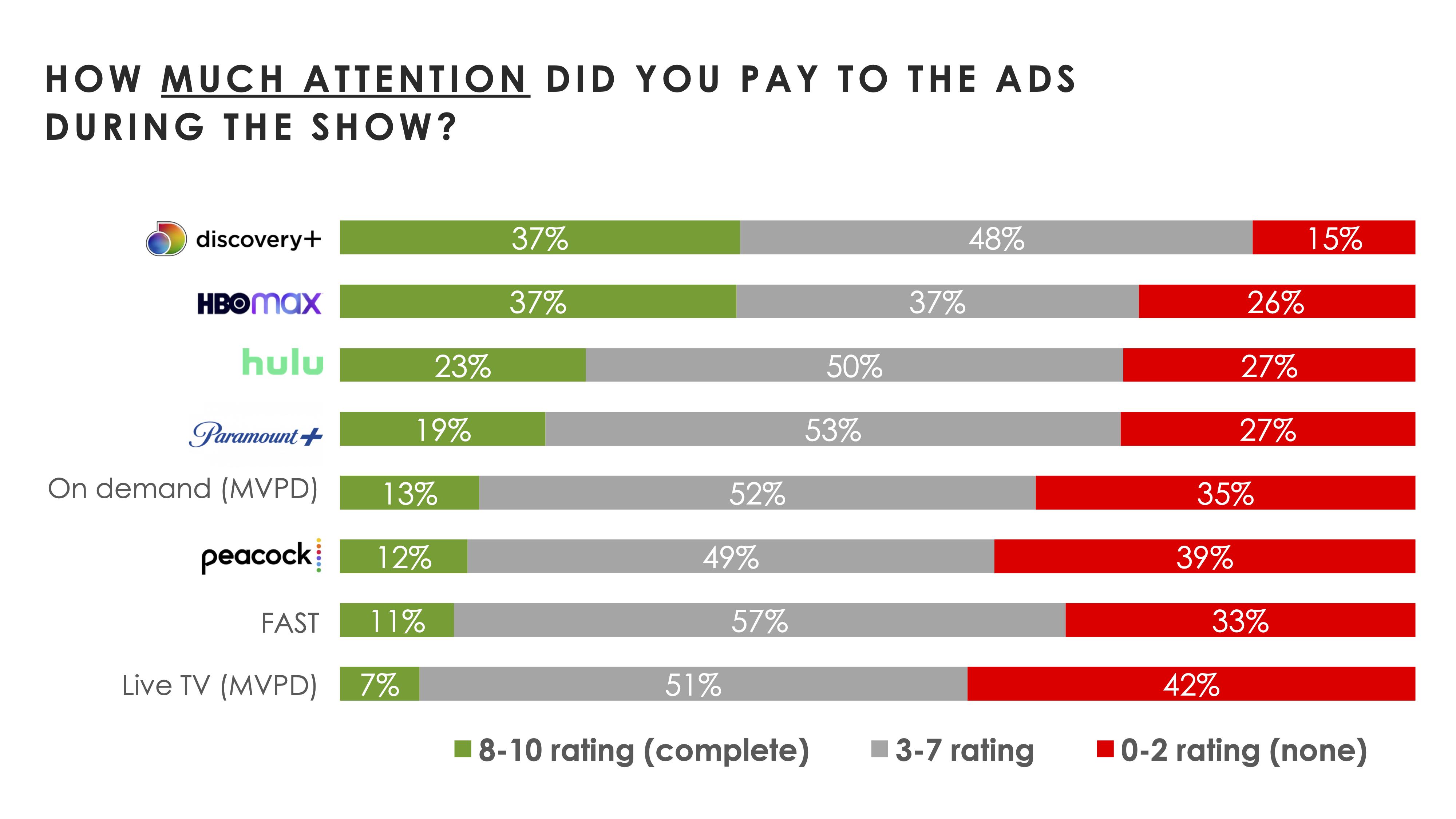

Discovery+ and HBO Max two platforms are also at the top of the list when consumers are asked how much attention they paid to the ads they saw during the show. 37% of Discovery+ and HBO Max viewers say they gave the ads their nearly “complete” attention, the researchers said.

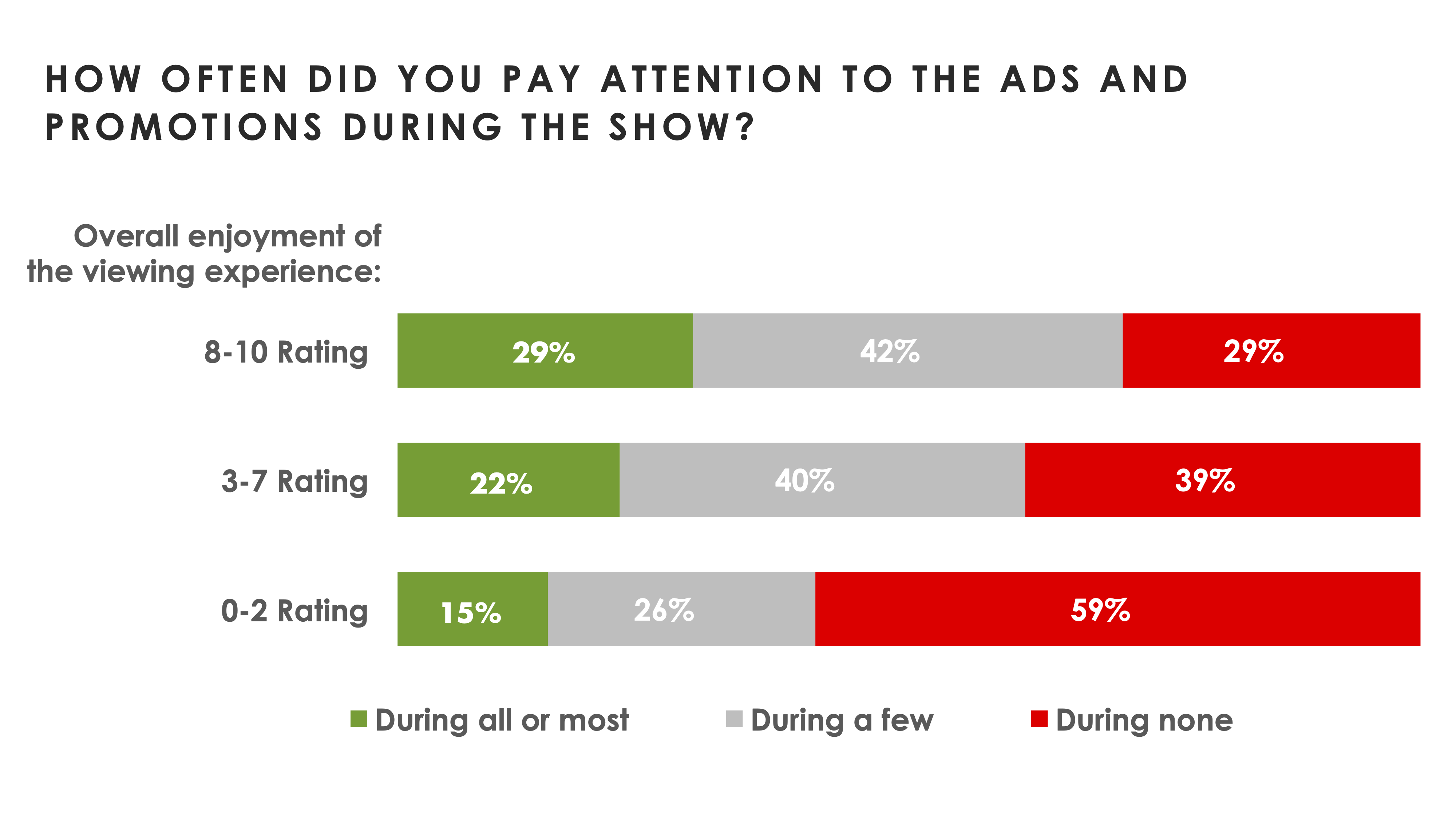

Overall viewing enjoyment is closely linked with ad attention, and ads and ad-breaks that are shorter are more likely to keep viewers engaged, the researchers said.

Viewers who enjoy their overall viewing experience (including the ad load, break length, and other considerations) report paying attention to most of the ads more often than those who enjoyed their overall experience less.

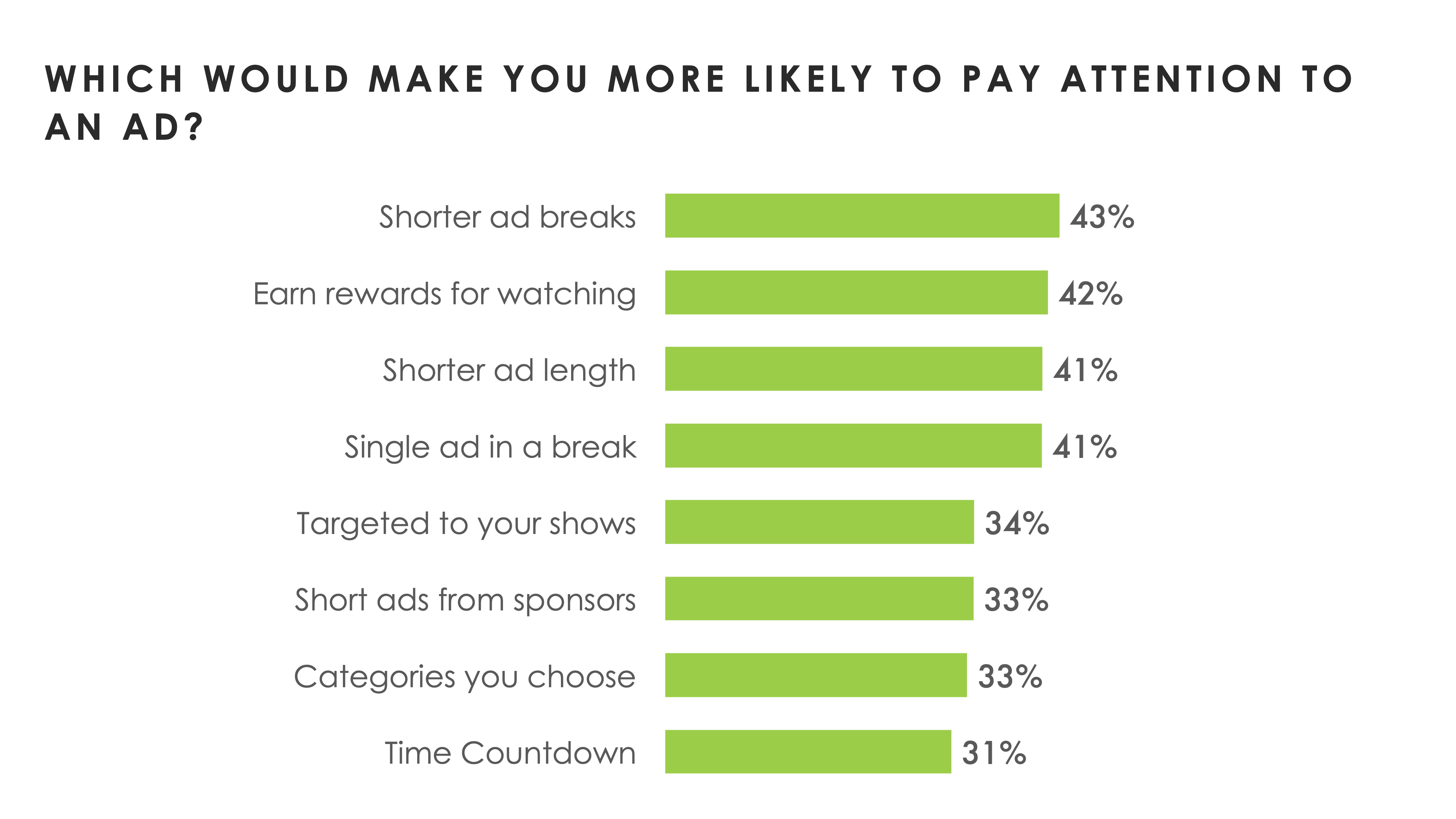

Asked about what would make them more likely to engage with advertising on TV, top answers include shorter ad breaks, shorter individual ads, and single-ad pods, along with with ads that reward viewers for their attention, the researchers report.

Free, Ad-Supported TV streaming services (FASTs) continued to gain users, and made-for-FAST original content is getting noticed.

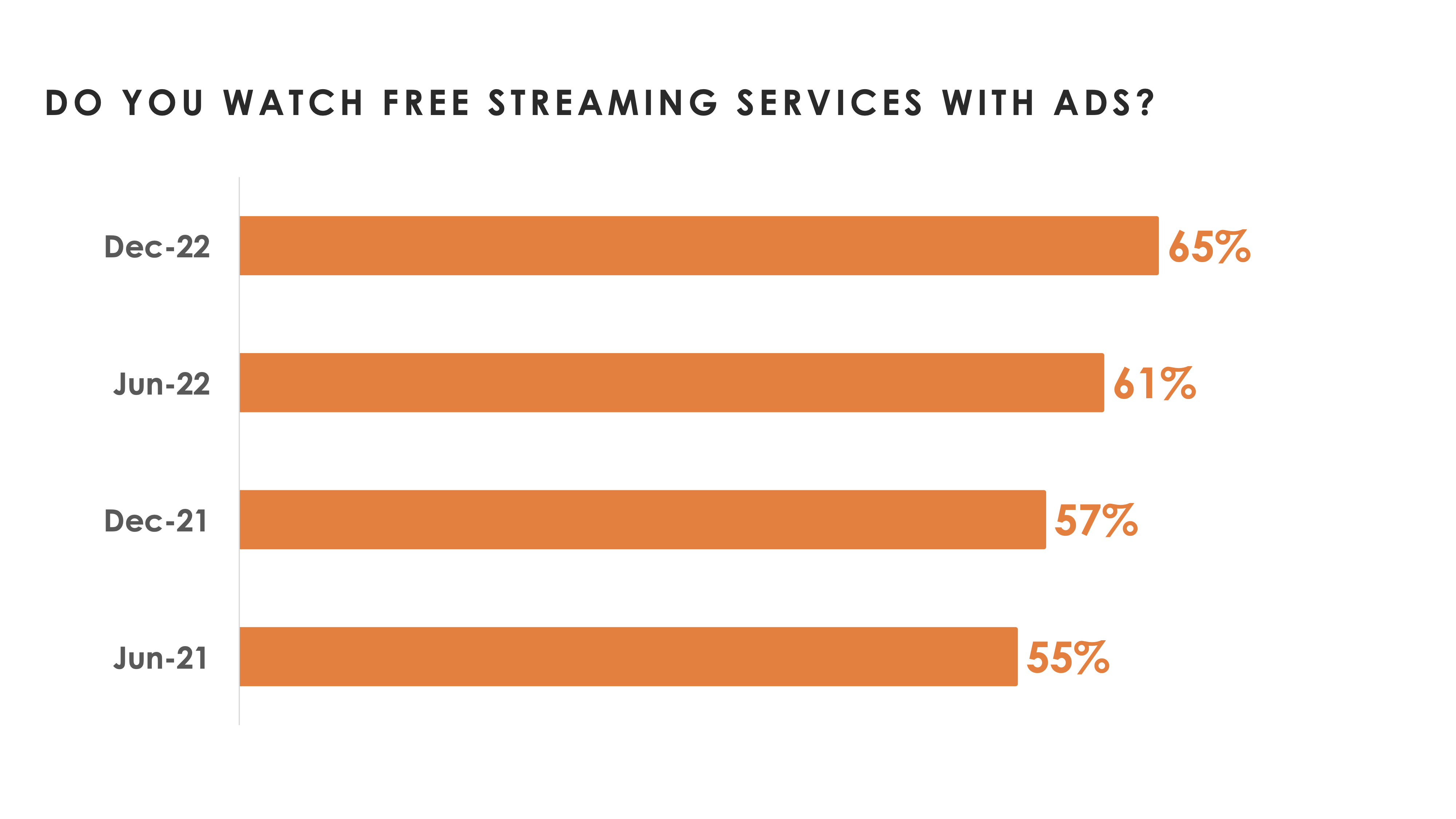

In Q4 2022, 65% of consumers say they use at least one FAST such Pluto TV, the free version of Peacock, the Roku Channel, TubiTV, Freevee, etc. Usage continues to tick up over time, posting a 10-percentage-point gain over Q2 2021, the researchers said.

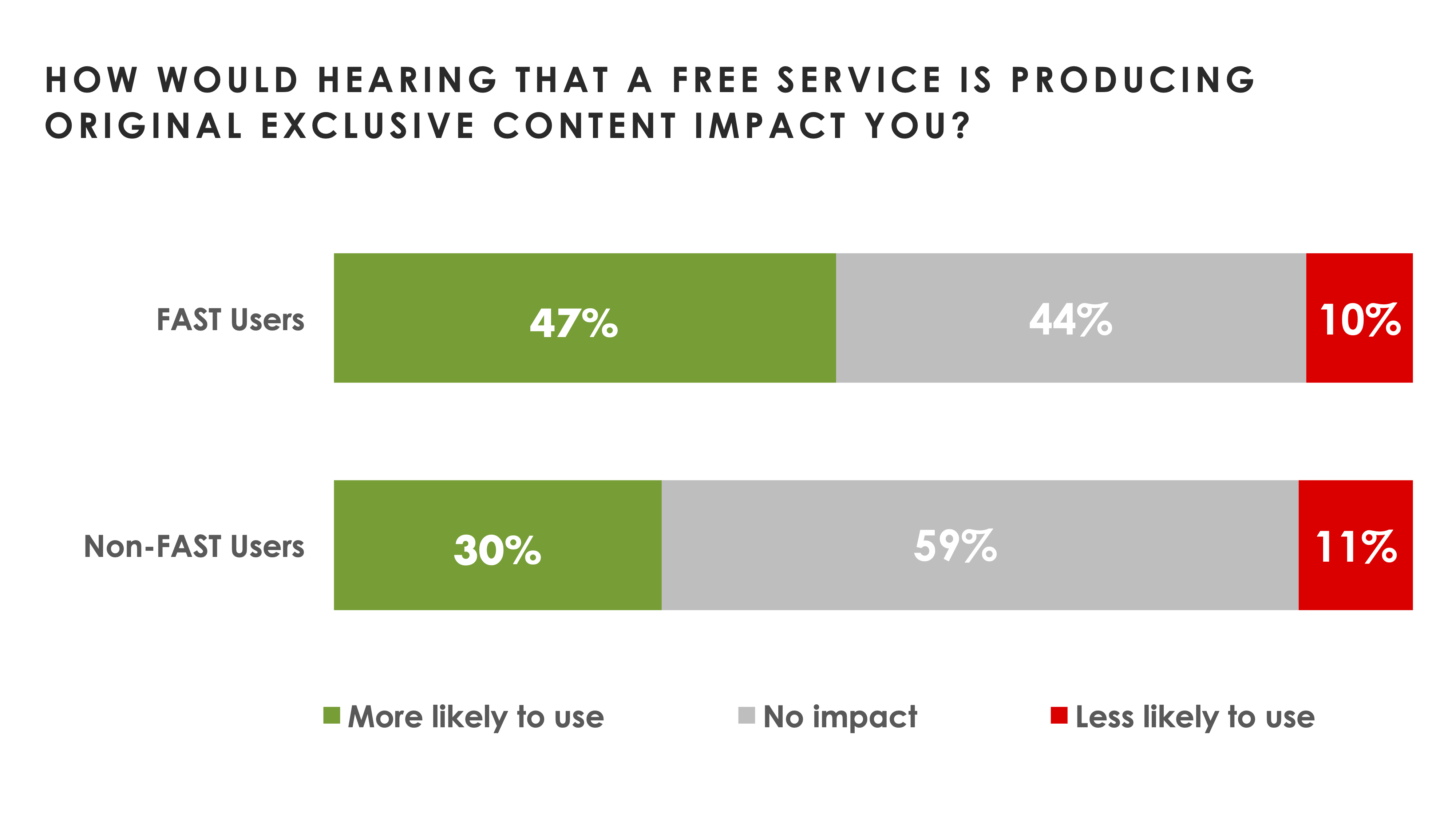

FAST services’ investment in original programming is starting to gain traction, Hub reported. About one third ( 34%) of current FAST users and 19% of non-users say they have heard of original shows or movies that were produced specifically for a free service. The most recalled FAST original titles were Roku Channel’s Weird: The Al Yankovic Story and Freevee’s Leverage: Redemption.

The increased availability of original content on FAST platforms may continue to fuel user growth in this sector. 47% of current FAST users and 30% of non-users say they’d be more likely to use a FAST service if they heard it was producing original, exclusive content.

The data cited here came from Hub’s “TV Advertising: Fact vs. Fiction” study, conducted among 3,001 US consumers age 14-74, who watch at least 1 hour of TV per week. The data was collected in November 2022.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.