Media General Marries Young, Hunts for More Duops

Click on the Image to Enlarge

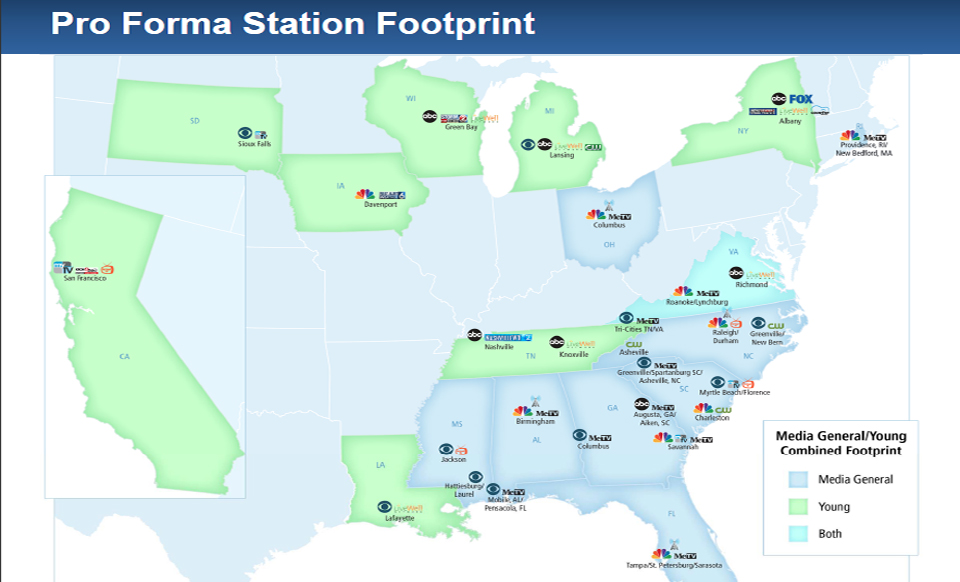

RICHMOND, VA. — Media General gained two duopolies in its merger with Young Broadcasting and will be searching for more.

“We gained duopolies in Albany [N.Y.] and Lansing, Mich.,” said George L. Mahoney, Media General president and CEO. “Media General already has two in Augusta, Ga. One of the first things we’ll be looking at going forward is duopoly opportunities.”

Media General announced its merger with Young this morning. The deal is stock only, with no exchange of cash. Media General will issue 60.2 million shares to Young shareholders, who will hold 67.5 percent of the company.

Executives said the move will generate free cash flow immediately. Wall Street responded favorably. Media General shares (NYSE: MEG) were up more than 27 percent by mid-morning to $9.25.

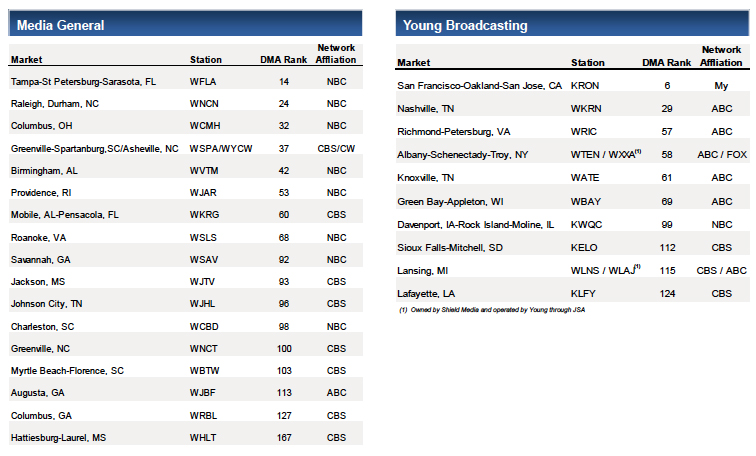

Media General owns 18 network-affiliated stations, and Young owns or operates 12, for a total of 30 stations in 27 markets, reaching 16.5 million, or 14 percent, of U.S. TV households. Pro forma combined 2012 revenues were $605 million, including approximately $115 million of political revenues.

Executives expect the merged company to realize savings of $25 million to $30 million through operational synergies and refinancing existing debt at lower rates. The company expects to refinance around $900 million in debt, resulting in pro forma expense of around $50 million a year.

The refi would include a contribution to the company pension plan, which went unfunded after the recession hit.

“We’re going to make that $50 million contribution to the pension plan, provided the financial markets are there,” the company’s chief financial officer, James Woodward said. “We don’t measure this quarterly, but if we were, at the end of March, our unfunded pension liability would have been $26 million less [than $180 million on Dec. 31, 2012] because of investments and returns. The $50 million will put us into a funded status… and also impact the current, short-term and longer-term required pension plan contributions.”

Woodward said the $50 million would give Media General several years of having to make little or no contribution to the pension plan.

Capital spending for the 30-station group is projected to be between $22 million and $25 million, Mahoney said.

“When Young was struggling, cap spending was something they cut back on,” he said. “When they came out of bankruptcy, they pushed it back up… to help them go to HD and do the upgrades and whatnot they didn’t do while they were in bankruptcy. We didn’t find a tremendous need to make up for capital spending in the past.”

Young emerged from bankruptcy in June of 2010 under the control of the company’s senior lenders ad “New Young Broadcasting.” The lenders purchased the company’s assets for $220 million in Chapter 11 reorganization and wiped $800 million in debt off the books. Young now brings $160 million of debt to the Media General merger. It will be included in the refi.

Media General also secured a commitment to amend a $400 million term loan secured from Berkshire Hathaway last May when Warren Buffett’s investment firm bought Media General’s newspapers. Woodward said the premium on the note was $40 million.

With the sale of its print business, Media General turned its focus on becoming a pure-play TV station company. Broadcast TV accounted for 77 percent of total cash flow in 2011. The company was hit hard by the recession. Struggling to meet debt interest payments, it imposed employee furloughs, halted pension plan contributions and in 2009, suspended dividend payments.

Mahoney didn’t say if there was a definite plan to reinstate dividend payments.

“We don’t want to get too far out in front of ourselves, but free cash generated here is very significant,” he said. “The next step is for us to work on the debt.”

Mahoney will continue to lead the company, joined by Deborah McDermott, CEO of New Young, and Bob Peterson, vice president of station operation for New Young. Headquarters will be in Richmond, Va. The new Media General common stock will be listed on the New York Stock Exchange under the symbol MEG, subject to NYSE approval of the listing of the new shares.

The network affiliation total will include 11 CBS stations, nine NBCs, seven ABCs, one Fox, one CW and one MNT. Markets are illustrated below. Click on the Image to Enlarge

The transaction is expected to close in the late third or early fourth quarter of this year.

RBC Capital Markets, LLC and Fried, Frank, Harris, Shriver & Jacobson LLP advised Media General. Stephens Inc. and Gibson, Dunn & Crutcher LLP advised the independent members of the board of directors of Media General, and Stephens delivered a fairness opinion to the full Media General board. Wells Fargo Securities, LLC and Debevoise & Plimpton LLP advised Young.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.