MediaRadar: Writer’s Strike Cost TV $1.6 Billion

Primetime and late night TV lost an estimated $1B alone

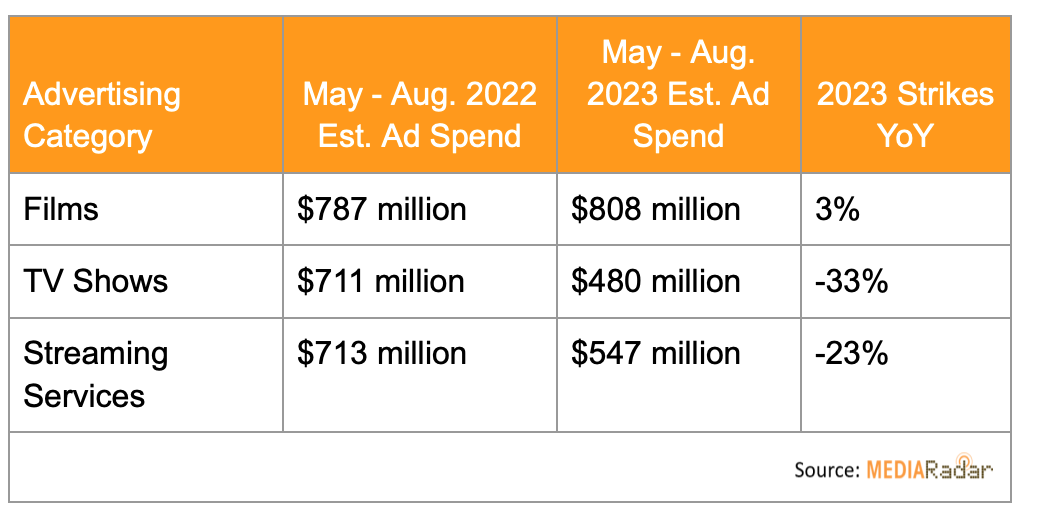

Although the great Hollywood walkout of 2023 is only partially over, the TV industry is estimated to have lost $1.6 billion in ad revenues, a 17% YoY decrease when compared to the same period in 2022, according to a new report from MediaRadar.

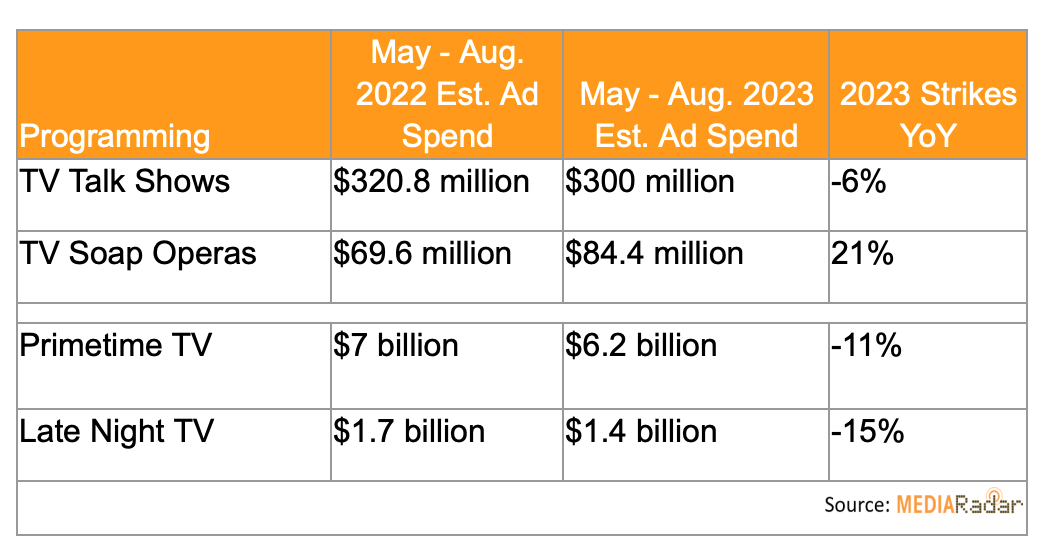

Primetime and late night TV were impacted the most by the strike, with the combined sector losing an estimated $1 billion in revenues. Ad spend for the combined sector decreased 12% YoY to $7.6 billion, with primetime television experiencing a drop of 11% from $7 billion to $6.2 billion, while late night saw a 15% decrease from $1.7 billion to $1.4 billion.

“Late night is one of the most profitable hours of TV, and a lack of talk shows during the writers strike really affected advertisers,” said Todd Krizelman, CEO and co-founder, MediaRadar. “Now that the strike is over and talk shows are returning, we should see advertisers eager to pour money into those slots.”

Daytime TV is a bit more of a mixed bag, however. While ad investment on daytime TV talk shows dipped 6% YoY from May through August to $300 million—down from nearly $321 million spent during the same period in 2022—it’s anticipated advertising will also be down in September.

The few remaining daytime soaps still on the air, however, continued production throughout the writers strike due to a separate SAG-AFTRA agreement that expires in July 2024. During the strike, new daytime drama content aired and advertising was up 21% YoY May through August to over $84 million.

From May through August, overall spend on TV ads reached $14.4 billion from 7.2K brands, a 10% YoY decrease from the $16 billion in ad spend from the same period in 2022. The number of brands also decreased 7% YoY from 7.8K advertising via TV in 2022, according to the researcher.

For its latest report, MediaRadar analyzed a sampling of ad revenue from national TV programming categories. Additionally, it sampled ad spend on national TV broadcasts, national print publications, and newspapers from top DMA’s, as well as online channels for films, TV shows, and subscription services. The data spans from January 2022 through August 2023.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.