NBP Draws Broadcaster Opposition

WASHINGTON

While proposals for a 120 MHz "spectrum grab" of broadcast TV frequencies in the FCC's National Broadband Plan (NBP) generated immediate passion and fury among the broadcasting community, the hundreds of other ideas in the 376-page document face a decade-long gauntlet of political pitfalls and policy-making hurdles.

Even authors of the commission's plan acknowledge that, despite a 2015 target date for repurposing of the broadcast airwaves, it will probably take a decade or longer to reclaim spectrum and initiate the "National Purpose" applications. Those goals, spelled out in the second half of the "Connecting America" NBP Report, range from public safety/homeland security to health, education and economic development.

Aggressive proposals in the plan, including the 2015 target for "band transition/clearing" of the broadcast TV spectrum, are tempered by acknowledgement in a footnote that "timing and quantity [of spectrum realignment] depends on Congressional action… [and] voluntary participation of broadcasters in an auction."

Analysts have already deemed the plan's spectrum timetable, starting with an FCC Order in 2011 and an auction by 2013, as unlikely. Just days before the NBP was delivered, the House Commerce Committee approved a "spectrum inventory" bill (H.R. 3125) that gives the FCC and the National Telecommunications and Information Administration a four-year schedule to evaluate all spectrum usage and efficiencies before any airwave rearrangements can begin.

'100 SQUARED'

The NBP Report, delivered to Capitol Hill on March 17, responds to a Congressional request for a comprehensive examination of wireless and wired broadband technologies and their uses. In the carefully choreographed trickle of information in the month preceding the plan's official publication, FCC Chairman Julius Genachowski and leaders of the 50-person Task Force doled out information about their proposals to think tanks, analysts and industry leaders. With lofty pronouncements about "100 Squared" (100 Mbps Internet connectivity to 100 million U.S. homes) and encouragement of "continuous private sector investment," Genachowski portrayed a new "broadband ecosystem" for 21st-century America.

The expansive vision faces immediate questions about its political viability and longer-term challenges of trans-sector policy-making. About half of the plan's proposals deal with policies under FCC jurisdiction, such as spectrum assignments and many telco issues, such as the fate of the Universal Service Fund in a broadband climate. Beyond the communications issues, the plan's other recommendations would require funding and implementation from Congress and dozens of Federal agencies.

AIRWAVES REALIGNMENT

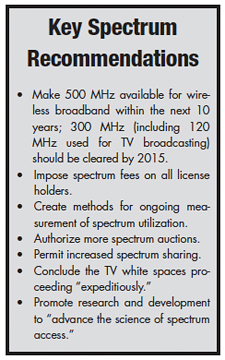

For broadcasters, the NBP's emphatic call for up to 500 megahertz of spectrum for wireless broadband services represents a sizeable assault on historic structures, architecture and procedures. Chapter 5 ("Spectrum") includes a recommendation that the "FCC should initiate a rulemaking proceeding to reallocate 120 megahertz from… broadcast television." It calls for updating rules on TV service areas and distance separations, a revised Table of Allotments "to ensure the most efficient [use] of six-megahertz channel assignments" and creation of a new "licensing framework to permit two or more stations to share a 6 MHz channel."

Through such repacking, voluntary channel sharing and an "overlay license auction," the FCC believes it can corral 500 MHz for wireless broadband by 2020, starting with 300 MHz by 2015.

The NBP floats a variety of approaches, including sharing of 6 MHz channels for standard definition programs, and feeding high-definition shows only to cable or satellite carriers. Must-carry rules for primary channels would remain in place.

To induce TV licensees to relinquish their spectrum, the plan calls for giving broadcasters an undetermined share of the financial proceeds from the eventual spectrum auctions. As part of a carrot/stick approach, broadcasters who do not give up spectrum would face new fees, as would other users of the airwaves. In a broad revenue-generating move, the FCC and NTIA would collect spectrum usage fees from private and government users of wireless bandwidth, presumably after extensive policy-making procedures are put in place.

This idea drew immediate criticism from industry groups, including the Association for Maximum Service Television. "The National Broadband Plan could force television broadcasters to change channels and reduce service areas, perhaps stranding millions of viewers," MSTV said. "And 'non-volunteers' might be punished with onerous spectrum fees and other indirectly coercive measures."

Justification for the broadcast spectrum overhaul comes in the form of financial valuation, as do many elements in the FCC Task Force's self-proclaimed "data-driven" approach. The report cites the metric of "dollars per megahertz per person reached" (called "$/MHz/pop"), which it calls "the convention used to estimate the market value of spectrum." It notes that the FCC's 2008 auction of the 700 MHz broadcast band generated $1.28/MHz/pop compared to the broadcast value of those channels at $0.11 to $0.15/MHz/pop—an 8- to 11-fold differential.

"This gap in economic value between spectrum used for wireless broadband and… over-the-air broadcast television reflects in part the long-term market trends in both industries," the report contends. While acknowledging that, "it is important to allow television broadcasting to continue to fulfill [public service] obligations to local communities," the report focuses on the value of "utilizing less spectrum, thus freeing up additional airwaves for mobile broadband."

As a clue to what the FCC Task Force has in mind, its summary of "expanding opportunities for innovative spectrum access models" includes several recommendations. One urges that the FCC "should move expeditiously to conclude the TV white spaces proceeding"; another says that within the next 10 years, the FCC should open "a new continuous, nationwide band for unlicensed use."

BEYOND BROADCASTING: A GATEWAY

The NBP also assaults the cable TV industry's set-top box supplier "duopoly"—Motorola and Cisco Systems—which it says "captured a 95 percent share of unit shipments over the first three quarters of 2009... up from 87 percent in 2006." By contrast, the top two cable set-top box manufacturers in Europe, the Middle East and Asia, where open standards are used, accounted for a relatively steady market share of just under 40 percent over the past four years, according to the report.

The Task Force recommends that the FCC adopt a "standards-based gateway" to replace traditional STBs by the end of 2012. "Set-top boxes are an im-portant part of the broadband ecosystem," the report says in Chapter 3 on the "Current State of the Broadband Ecosystem." "The lack of innovation in set-top boxes limits what consumers can do and their choices to consume video, and the emergence of new uses and applications. It may also be inhibiting business models that could serve as a powerful driver of adoption and utilization of broadband, such as, models that integrate traditional television and the Internet."

LOUD PREDICTABLE RESPONSES

With weeks to prepare their responses as the report's proposals trickled out, communications companies and their lobbyists were ready with reactions—if not full-blown tactical campaigns—as soon as "Connecting America" appeared.

NAB encouraged members of Congress to examine closely the plan's details. NAB Executive Vice President Dennis Wharton voiced "strong support" for the "congressional efforts to conduct an inventory of all available spectrum.

"No reallocation plan should move forward without a complete accounting of how the airwaves are allocated, licensed and used," Wharton said. "We were pleased by initial indications from FCC members that any spectrum reallocation would be voluntary, and were therefore prepared to move forward in a construc-tive fashion on that basis."

He expressed concern that the "voluntary" options in the spectrum realignment "may in fact not be as voluntary as originally promised."

The Open Mobile Video Coalition, which is promoting Mobile DTV, emphasized the billions of dollars broadcasters spent for the DTV transition plus even more money that consumers spent for converters. "Broadcasters and U.S. consumers [should] have a chance to see these new digital capabilities develop," said Colleen Brown, CEO of Fisher Communications and head of OMVC's public policy committee.

Comcast timed an announcement of its own high-speed initiative to appear within days of the FCC Plan. The nation's largest cable operator said that it will offer 100 Mbps service to "most if not all" of its subscribers by the end of next year, although it did not indicate price.

THE LONG ROAD AHEAD

Despite the immediate polite commentary about the 10-month effort to gather data and write the plan, vested interests and impartial observers are gearing up for a years-long process to implement—or impede—sections of the NBP.

"While there is broad support for a broadband plan, there is no clear consensus on the major elements of getting from here to there," says Larry Darby, a Washington economist/consultant whose career has encompassed the FCC (where he was chief of the Common Carrier Bureau), NTIA, Wall Street, Capitol Hill, academia and telecom corporate management. He points out that the FCC is already considering "in various forms and vintages" seven or eight issues that are mentioned in the NBP.

"The weight of technological and market change is on the side of the commission here; reallocation and reassignment are inevitable," Darby said. Although Darby doesn't expect lobbying groups to stray from their traditional stances, he acknowledges that the "the way some of the issues are framed will provide opportunities for compromise and resolution."

Darby is enthusiastic about the plan's visions in the "National Purpose" chapter of the Report. "Consumers… are well served by government taking an active role in various 'enabling' and 'nudging' activities designed to broaden and deepen use of this very valuable asset called the 'Broadband Internet,'" he said.

Gregg Skall, a member in the Washington office of Womble Carlyle Sandridge & Rice law firm and a former NTIA Chief Counsel, also expects that "a significant portion of legacy over-the-air broadcast television spectrum will be allocated to mobile, wireless applications."

"There are a wide variety of options open to broadcasters," Skall said, "from taking the money and running, to being aggressive players in a converged digital, mobile content distribution market. To play in the converged world, broadcasters are challenged to acquire the resources, or partners, needed to develop business plans and create value commensurate with the drivers of those who would be auction bidders." Skall adds that the plan "actually offers a variety of potential alternative business plans, revenue models, technologies, and participants that could accomplish its spectrum goals."

Another Washington lawyer with expertise in the broadcast spectrum issue expects a volatile debate about the airwaves assignments. "There is very little that is voluntary about the broadcaster spectrum provisions except for the plan's use of the term," says Scott Patrick, partner in the communications practice at the Dow Lohnes law firm in Washington. "It does not appear that the plan takes seriously the warnings from Hill leadership regarding forcible reallocation of TV spectrum. Our guess is that the FCC will have to ratchet this down."

Patrick cites the after-effects of the DTV transition, which "freed more than 100 MHz of broadcast spectrum" while forcing consumers "to buy new equipment and, in a number of cases, lose stations that they previously had received.

"The transition cost local broadcasters billions of dollars," Patrick adds. "As a result, hundreds of television stations have sought bankruptcy protection, and many more cut large numbers of good-paying jobs in their newsrooms. It is hard to imagine how the 'public interest' will be served by forcing broadcasters to now surrender another 120 MHz for the wireless and Internet giants."

Patrick expects that Capitol Hill "will drive the timing" of the spectrum realignment, questioning the plan's threat for the FCC to accelerate the auction timetable if Congress doesn't act promptly.

"I'm not sure how that message will be received on the Hill," Patrick said, adding that he expects broadcasters to emphasize the likely further "loss of free TV service for a sizable number of voters whom already are not in a good mood."

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.