Netflix, Amazon and Hulu Eye Older Linear TV Viewers With Programming Choices

Streaming services are making a concentrated effort to draw in consumers 35 and older

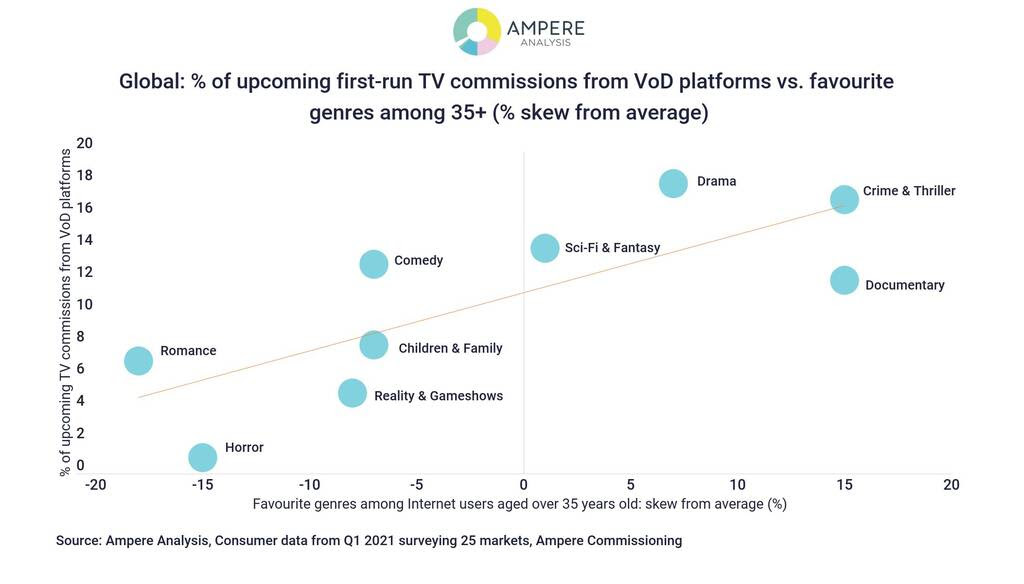

LONDON—As the streaming wars rage on, Netflix, Amazon Prime Video and Hulu have enacted new strategies designed to entice older consumers (35+) by producing programming in genres that are of more interest to them—most notably, drama, documentary and crime & thrillers.

According to a new study from Ampere Analysis, younger SVOD subscribers are reaching a saturation point. However, 55% of consumers who don’t engage with VOD in a typical day are aged 45-64. Rather, many are keeping with their linear TV habits. A reported 50% of medium linear TV viewers (watching two to four hours per day) are over 45 years old, while 57% in the same age group are classified as high linear viewers (more than four hours a day).

This is inspiring the larger push in producing programs that are of more interest to those older consumers.

Documentaries, drama and crime & thrillers are among the most popular for consumers over the age of 35. And now, these genres are in the top five of commissioned projects by VOD players. For example, in March, Netflix ordered more documentary titles than any other genre, with more than half of those described as true crime.

Keeping up this investment into factual and crime & thriller content is one of the keys to persuade older viewers to make the switch to streaming, per Ampere. They should also work to expand their sports-related content (something Amazon Prime Video is already pushing with the NFL) and, on a global scale, more local language programming is needed in markets like France, Germany and Japan.

“The fastest growth in uptake of Video on Demand viewing is now in the 35-44-year-old age bracket,” said Minal Modha, principal analyst, consumer research lead at Ampere. “Nearly twice as many in this age group are now high VOD viewers compared to two years ago. The laser-like focus on matching commissioning strategies with the favorite genres of the older demographics in question is evident, but to more fully compete with linear TV players, local language content is going to be key, as will some sports content, be it live or ancillary.”

For more information, visit www.ampereanalysis.com.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.