New Research Suggests the Streaming Party Isn’t Over

While industry analysts question the future of streaming TV services, a Hub survey finds that penetration of streaming services is significantly up and that most consumers say they plan to add more services

BOSTON, Mass.—While the brouhaha over Netflix’s subscriber losses has caused some analysts to suggest the streaming party is over, consumers don’t seem to have gotten the memo, the newly released Hub’s “Best Bundle” research study suggests.

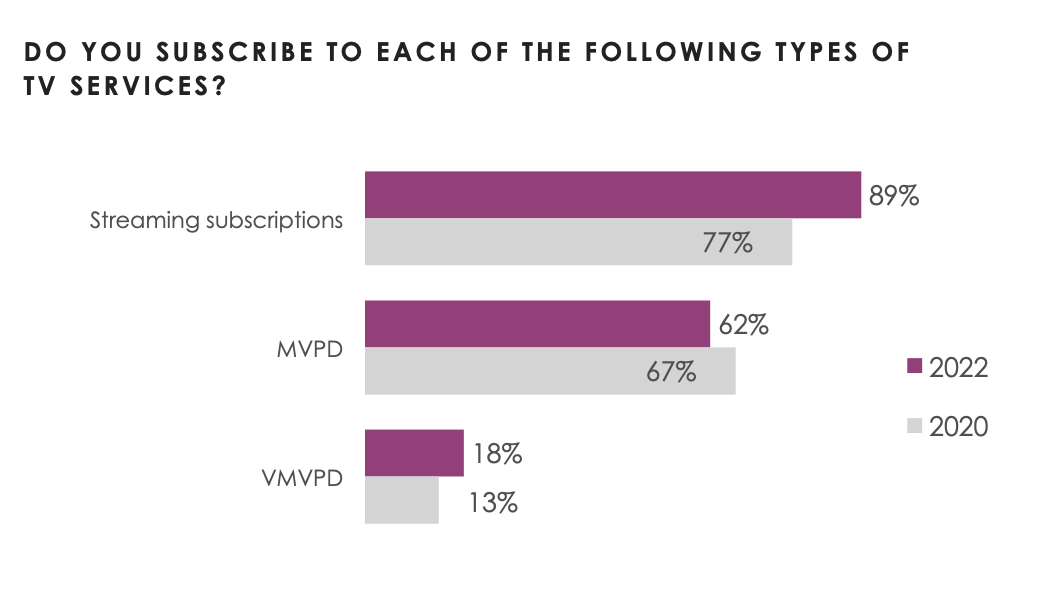

It found ongoing growth in the uptake of streaming services with 89% of U.S. consumers subscribing to one in 2022–up an impressive 12 percentage points in one year–and the average number of TV sources hitting 7.4 in 2021, up from 5.7 in 2021.

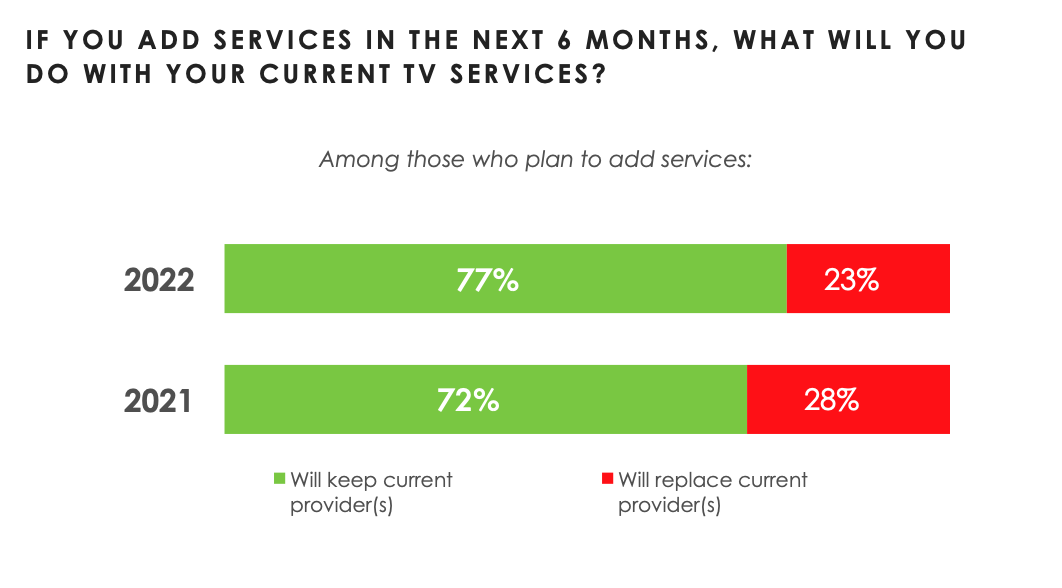

Overall, more than three quarters of those surveyed say they plan to add more streaming services. Among those who plan to add services, 77% say they’ll keep all of their current services when they do and that they’ll be simply adding to the size of their TV bundles.

“Netflix’s subscriber loss in Q1 of 2022, and its anticipated losses in the following quarters, represent a tiny proportion of its global subscriber base,” said Peter Fondulas, principal at Hub and co-author of the study. “And in fact, at some point, a service as widely penetrated as Netflix has only so much room left to grow. In our view, it would be a grave mistake to take the Netflix experience as a sign that streaming TV services are on the verge of decline, as some analysts have suggested. The lure of buzzworthy exclusive content, and the sheer convenience of on-demand viewing, are two powerful forces that should keep these services growing at least for the near term.”

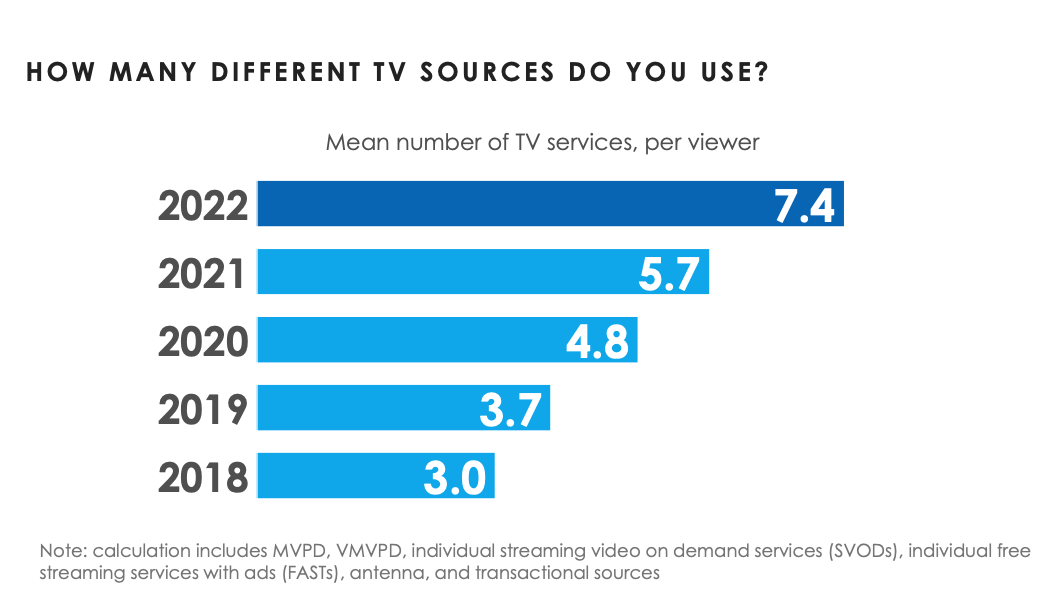

One of the key findings of the study is that the average number of sources consumers use to access TV content has hit an all-time high in 2022.

Counting traditional pay TV service, live TV streaming services, individual streaming subscriptions, free streaming services, transactional services, and antenna, the average consumer now uses 7.4 sources for TV content. That number has been climbing steadily since 2018 and saw its biggest increase yet between 2021 and 2022.

While the use of traditional pay TV service (cable, satellite, telco) is down 5 percentage points year over year, live TV streaming services like YouTube TV, Hulu + Live, and Sling are up a comparable 5 points, the Hub reported.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

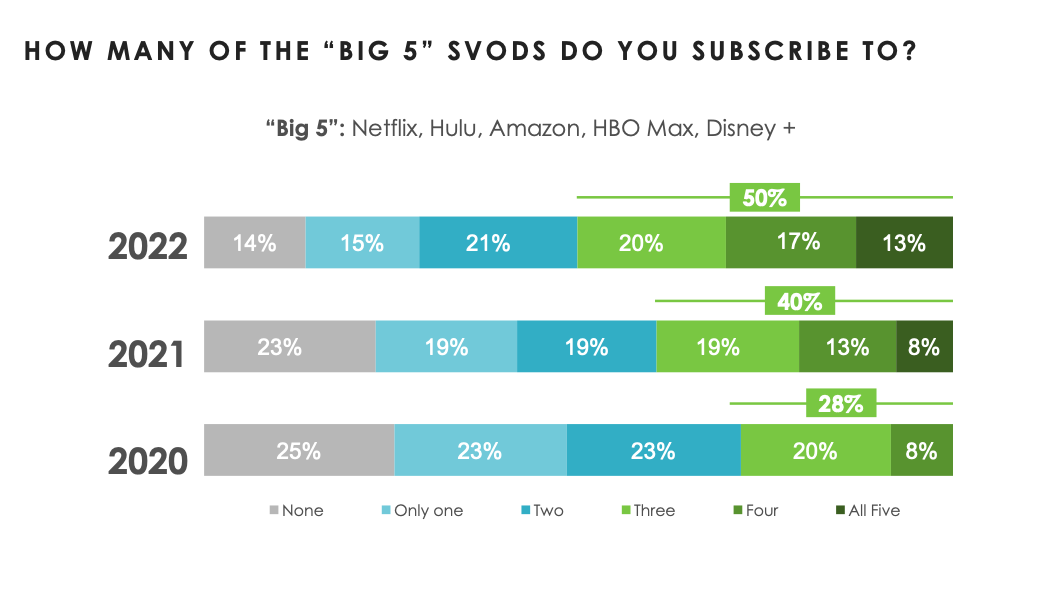

Consumers are not only subscribing to more streaming services, but increasingly, they’re combining multiple services into their TV service bundles, the study found. Half of TV consumers now subscribe to three or more of the “Big 5” streaming TV services: Netflix, Amazon Prime Video, Hulu, HBO Max, and Disney+. That’s up 10 points since 2021, and it’s nearly double what it was just two years ago.

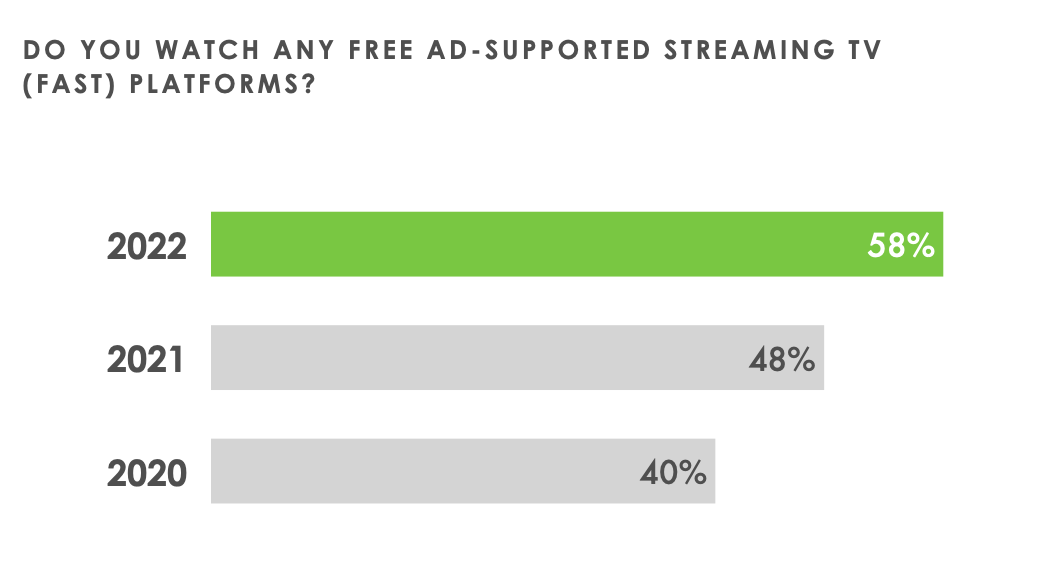

In addition the Hub study found that more and more consumers are using free, ad-supported streaming platforms (FASTs) like Pluto TV, Tubi, Freevee, and the Roku Channel.

Use of these free services is approaching 60%, after having grown by close to 10 points each year since 2020.

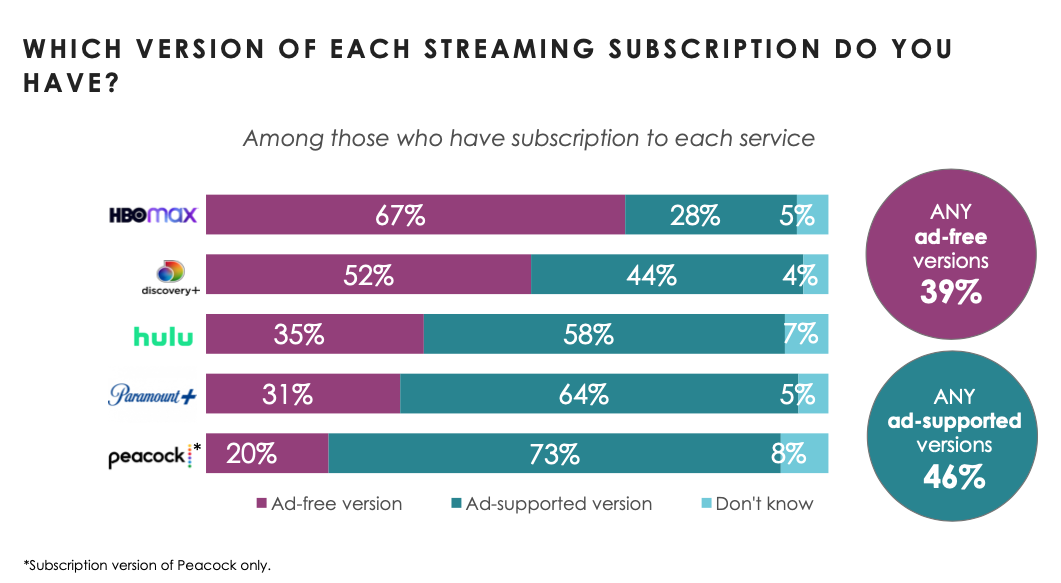

The distribution of ad-free vs. ad-supported subscribers differs dramatically for each of the five major streaming platforms that offer both options, with HBO Max the most heavily ad-free and the subscription version of Peacock the most ad-supported, the Hub researchers noted.

More than three-fourths say they plan to add even more new services in the next six months, the study found. And the proportion intending to add services is up 5 points since last year.

Notably, among those who intend to add services, three-fourths say they’ll keep all of their current services when they do: simply adding to the size of their TV bundles.

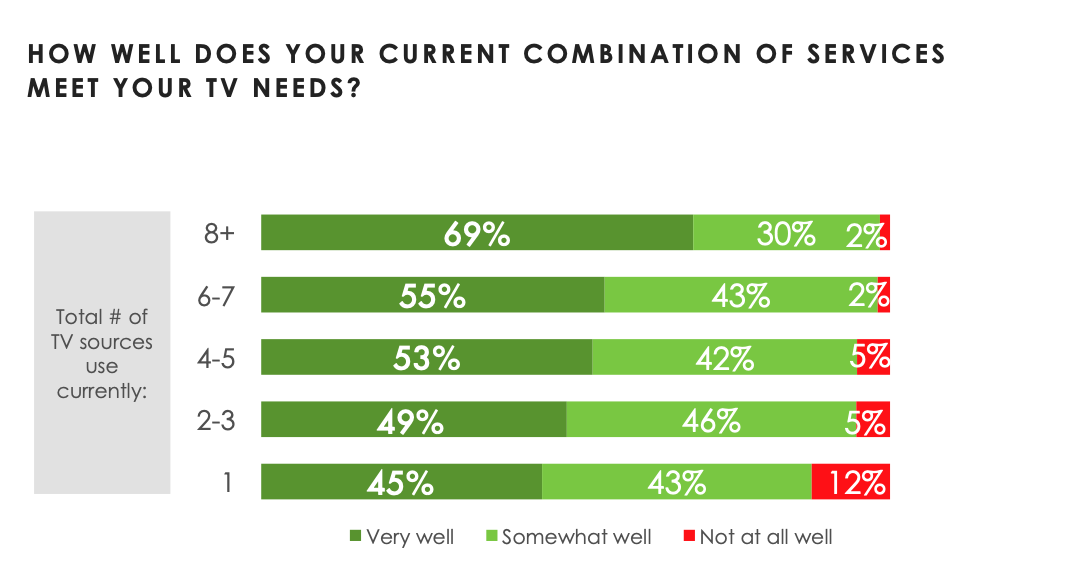

The study also found an interesting correlation between the number of services used by a consumer and their satisfaction with the services. With virtually every streaming service now touting its exclusive content, consumers need to have at least 4 TV services before a majority feel strongly satisfied with their TV bundle, the researchers reported.

Among those with 4 to 7 services, a slight majority feel all of their needs are met “very well”.

It’s not until one reaches 8 or more services that a strong proportion (69%) feel the same about their TV service lineup.

The data cited here come from Hub’s “Best Bundle” study, conducted among 1,600 U.S. consumers with broadband, aged 16-74, who watch at least 1 hour of TV per week. The data was collected in April 2022.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.