New Survey: Viewers Say Streaming Is “First Stop” for Watching TV

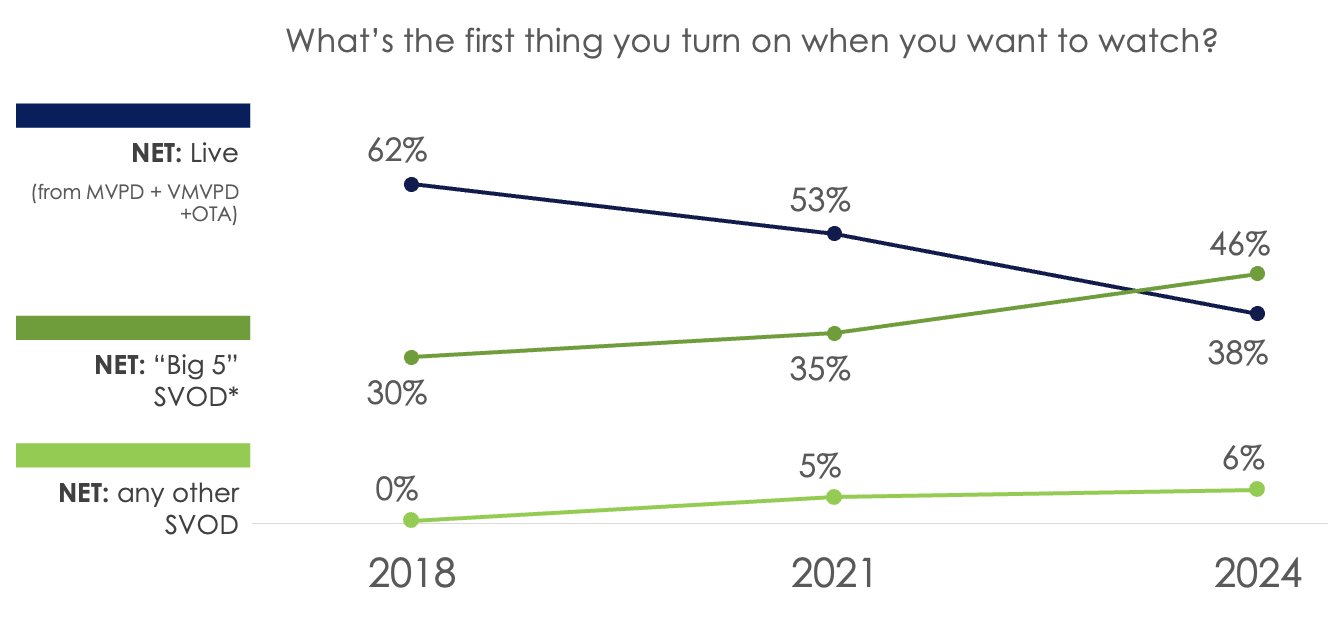

For the first time in five years of surveys, nearly half (46%) of all viewers say a top five streaming app is the first place they go when they start watching TV versus 38% who start by tuning into live cable or broadcast TV

PORTSMOUTH, N.H.—A new survey indicates that cable networks and broadcasters are losing the battle for being top of mind with viewers as the default destination for viewing TV, with nearly half of all viewers (46%) saying that their first stop when they start watching TV is with an app from one of the top five SVOD streaming services.

Hub Entertainment Research's latest "Decoding the Default" study found that for the first time in five years of tracking, the combined "Big 5" SVODs (Netflix, Prime Video Disney+, Hulu, and Max) are more likely to be the "first stop" for 46% of viewers versus 38% starting with live TV via cable, vMVPD or antenna.

This is a monumental shift in viewing habits that has worrying implications for traditional TV. In 2018 only 30% started viewing with one of the top five SVOD services versus 62% for live TV. In a landscape of endless viewing choices, the services that viewers turn to first are the ones that consumers engage with most and are least likely to cancel, the researchers said.

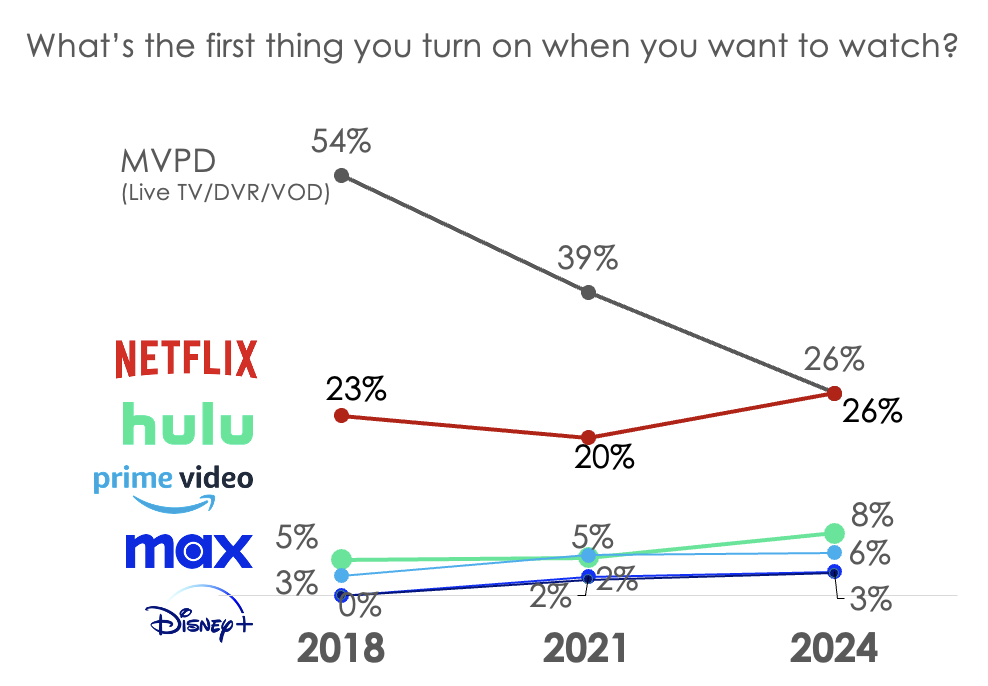

The survey also found that Netflix is the top SVOD default, on par with cable TV as a "first stop" to watch. Around one quarter of viewers (26%) say that Netflix is the first place they turn to when they want to watch something, on par with the 26% of viewers who say traditional cable (excluding vMVPD and antenna) is their default source.

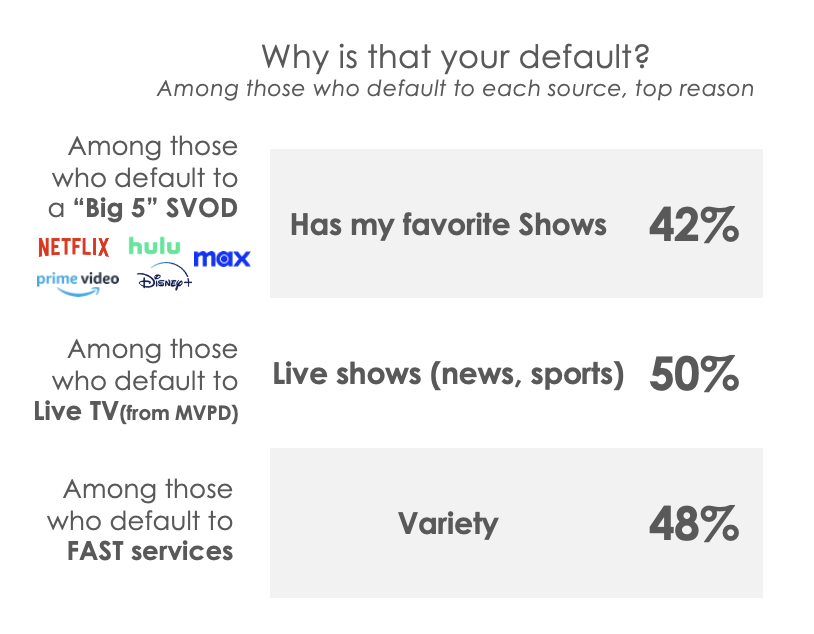

The research also found that different kinds of content play a key role in anchoring viewers to SVODs, live TV and FAST services.

About 42% of viewers who default to a major SVOD say that "favorite shows" connect them to that service. In contrast, live programming (sports, news) continues to make traditional cable a default source, while those who default to a free ad-supported (FAST) service say that "variety" is the big draw.

While sports rights are migrating to streamers, the current hold-up of Venu sports and other challenges in finding sports content online will continue to challenge viewers juggling both traditional cable and online options.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

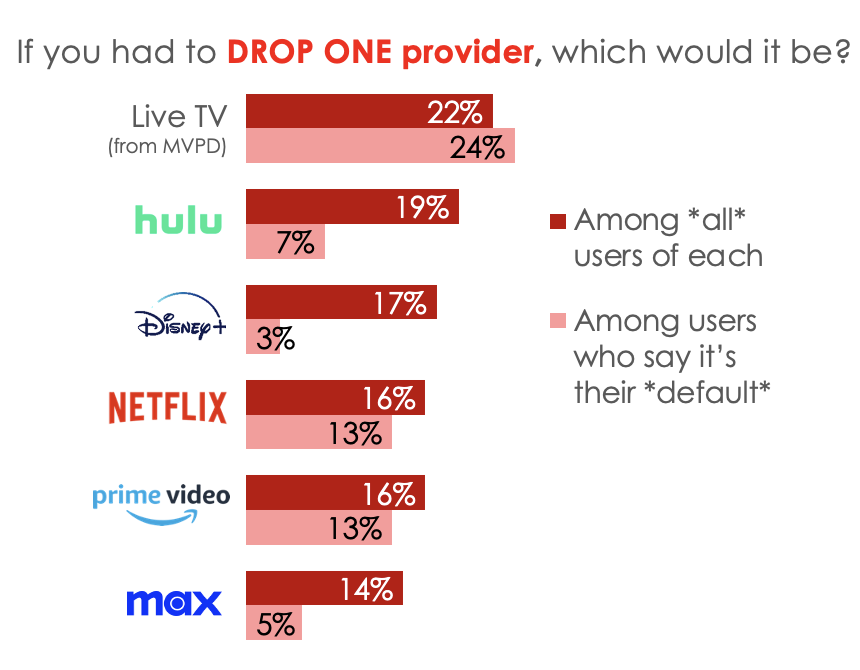

In another worrying finding for pay TV, broadcasters and linear TV the researchers reported that loyalty to SVODs is notably stronger compared to traditional MVPD sources. Default usage helps stickiness, but only so much: when viewers are asked to choose a service to drop, live TV from MVPD does not hold up as well as streaming services. Even among devoted cable viewers who say it is their "first choice" for viewing, they are less loyal to that service (24% say they will drop), compared to SVOD "default" users (3%-13%).

"The first stop people turn to watch will always be the one that has the highest loyalty, and favorite shows can deepen those loyalties across streamers," said Jason Platt Zolov, Senior Consultant for Hub. “While football and the election may help keep cable TV viewers watching this fall, we can expect a quicker abandonment of cable as live sports becomes more easily available online."

These findings are from Hub’s 2024 “Decoding the Default” report, based on a survey conducted among 1,600 US consumers with broadband, age 16-74, who watch at least 1 hour of TV per week. Interviews were conducted in August 2024 and explored consumers’ default options for viewing sources and how those have changed over time. A free excerpt of the findings is available on Hub’s website. This report is part of the “Hub Reports” syndicated report series.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.