Nielsen: TV Viewing Surged in November

Total TV usage was up 7.8% vs. October as a result of increases in sports and streaming audiences

NEW YORK—Nielsen is reporting that the time spent watching television jumped in November, making it second-highest month of overall TV consumption in 2022, thanks to large audiences for sports and streaming. January, 2022 remains the month with the most TV viewing.

Nielsen’s The Gauge reported five days in November with over 100 billion minutes of TV viewing, including Thanksgiving Day (November 24) when audiences spent nearly 106 billion minutes in front of television screens.

Thanksgiving ranked as the No. 2 most-watched day of TV so far in 2022, second to Sunday, January 16 which racked up over 107 billion minutes that were largely driven by three NFL Wild Card games, according to The Gauge, which provides a monthly snapshot of TV and streaming usage in the U.S.

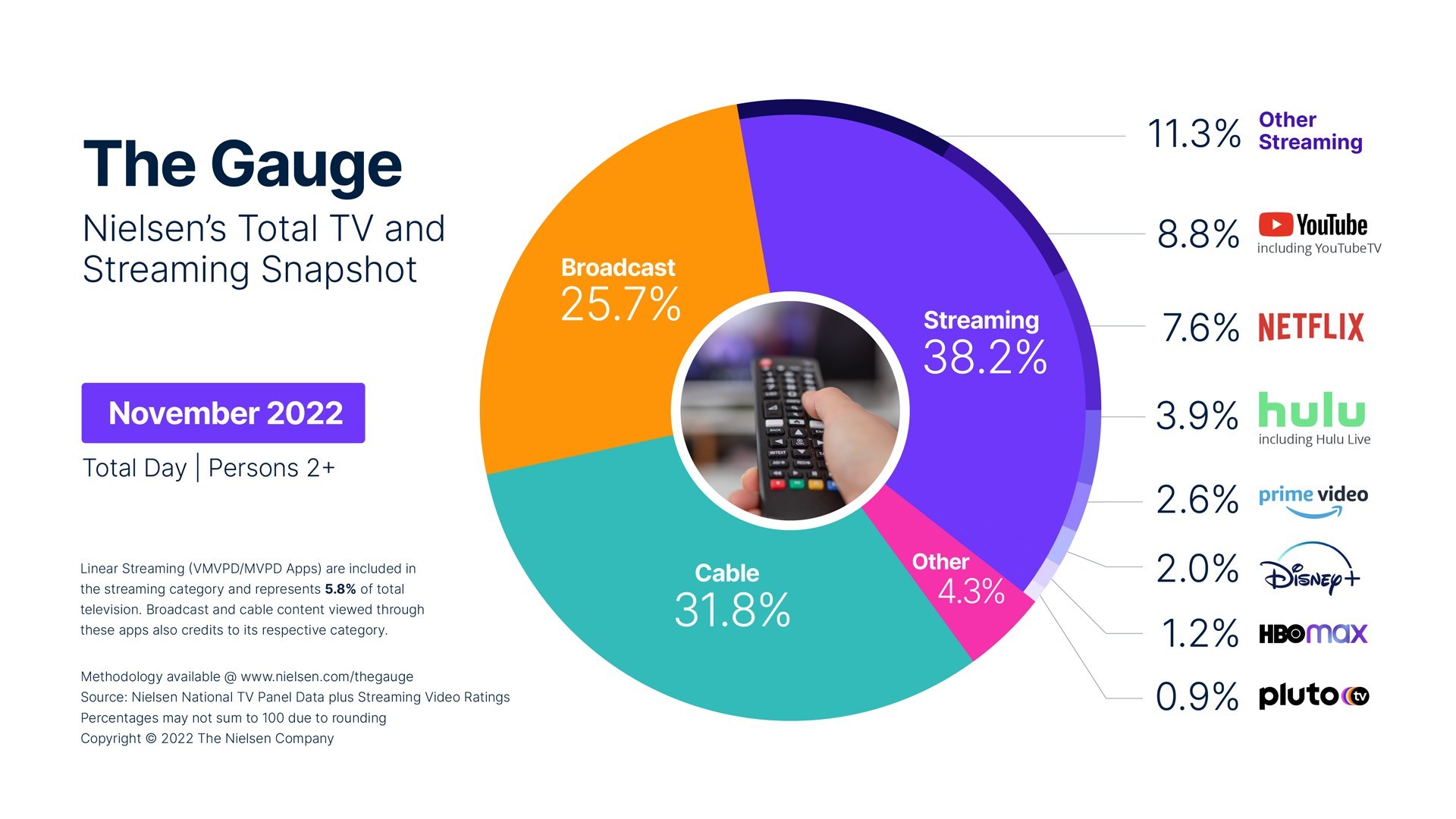

Overall TV usage climbed 7.8% from October, and viewing volume was up for all categories across The Gauge on a monthly basis.

Broadcast usage rose 6.7% from October, but due to the large increase in total television usage, its share of TV dropped slightly (-0.3 points) to 25.7%, Nielsen reported. Primarily driven by NFL programming, World Cup coverage, and four World Series games, broadcast sports viewing jumped 10.2% and accounted for the largest share (32%) of the category's viewing total. Broadcast news viewing was also up 14.6% compared with October, and viewing to the drama genre declined by over 12%.

Total broadcast viewing in November was fairly similar compared with the same month one year ago (-0.7%), and from a share perspective, broadcast lost 1.6 share points. Additionally, broadcast sports viewing was down 5.6% on the year, while broadcast news viewing was up 19%, Nielsen said.

Streaming saw the largest monthly increase in November with a 10.2% bump in usage, which brought the category to 38.2% of total TV viewing and set another record share for the digital format. Compared with November 2021, streaming usage grew by 41.2% and the category gained 9.7 share points.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

From a streaming platform perspective, Netflix, HBO Max and YouTube all achieved double-digit viewing increases in November, up 13.1%, 12.2% and 11.8%, respectively versus October. Netflix also saw the most significant monthly increase in share (+0.4) to finish November with 7.6% of TV.

Viewing of linear television on MVPD (multichannel video programming distributor) and vMVPD (virtual multichannel video programming distributor) apps represented 5.8% of total television usage and 15.2% of streaming usage in November (compared with 5.7% and 15.4%, respectively, in October). YouTube TV accounted for 15.4% of YouTube viewing (1.4 share points), and Hulu Live made up 12.0% of Hulu viewing (0.5 share points). Broadcast and cable content viewed through linear streaming apps also credits the respective category.

Cable gained the smallest amount of monthly growth among viewing categories in The Gauge (+4.2%) and ended November with 31.8% of total TV usage, representing a monthly loss of 1.1 share points. The increase in cable viewing was driven by the feature film genre, which climbed 32.7% to make up 18.7% of cable's total, and cable news (+1.4% on volume), which remained the top genre for the category with 18.9%.

On a year-over-year basis, time spent watching cable content declined 9.3% and the category lost 5.1 share points. A yearly comparison also shows that cable sports and cable news viewing were up 19.6% and 17.6%, respectively, versus November 2021.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.