Nielsen: U.S. Audiences Streamed Record 21M Years of Video in 2023

`Ted Lasso’ was the most popular streaming original; library content dominated the list of most streamed shows and `Suits' was the most streamed show

A new study from Nielsen shows that viewing of streaming content continued to grow in 2023, with U.S. audiences streaming 21 million years of video, up 21% from 2022, and that library content dominated the list of most streamed shows.

In contrast to the ongoing growth of streaming audiences, Nielsen reported that the time spent viewing content on TV was largely flat, making streaming the biggest driver of TV usage.

Another important trend, Nielsen noted, was the growing importance of library content. This reflected both the strikes in Hollywood that reduced original content production and a move by major media companies to boost revenues by selling more of their content, Nielsen. This is a sharp shift in strategy from a few years ago when companies were using their own libraries to bulk up their streaming offerings.

The year also saw a notable rise in the number of services, with Nielsen’s Gracenote reporting that audiences had 90 different streaming services to choose from at the end of last year, up from 51 at the start of 2020.

During the strikes of 2023, Nielsen’s researchers found that deep libraries owned by streaming services—just under 1 million unique titles worth—proved vital in 2023, as services carefully rationed the stockpiled originals they had in their arsenals. The environment also inspired new perspectives about content licensing, as titles that were once exclusive to individual platforms began appearing on multiple services—a significant pivot from previous years. “Band of Brothers” and “The Pacific”, for example, benefited as a result of this approach, appearing on Nielsen’s U.S. top 10 list the week of Sept. 18, 2023, given their availability on both Max and Netflix, Nielsen reported.

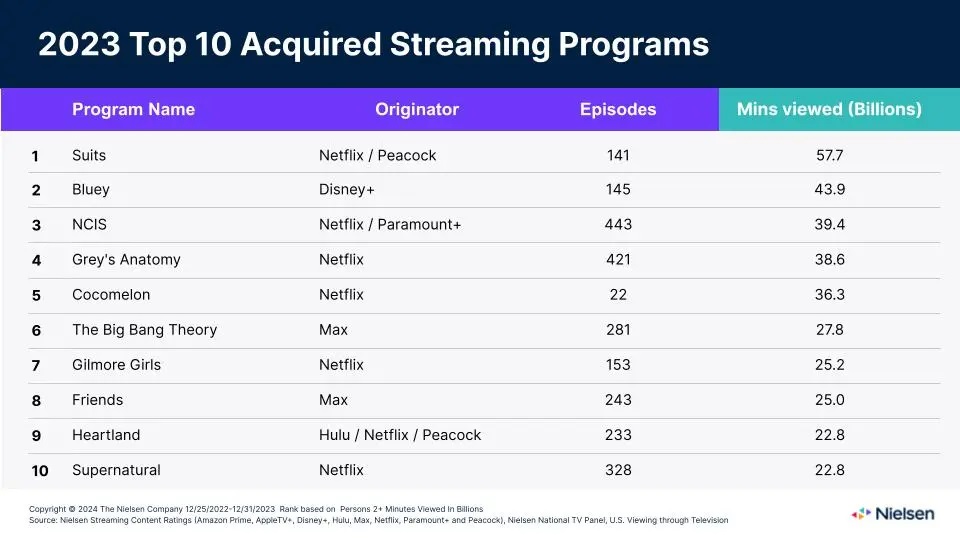

A notable example of these steaming viewership trends in 2023 towards library content, was “Suits”, which spent a 12-week run in the No. 1 spot on Nielsen’s U.S. top 10 list as a result of its availability on Netflix and Peacock, Nielsen said.

In total, the program, which originally aired on USA Network from 2011 to 2019, racked up 57.7 billion viewing minutes in 2023—enough to take the crown away from another audience favorite, "The Office", which generated 57.1 billion viewing minutes in 2020 amid pandemic-induced lockdowns. "NCIS" is the other stand-out example of a show with an entirely new life outside of linear TV, landing in the third spot on the acquired list for the year. With its availability on both Netflix and Paramount+, NCIS gained 1.3 million viewing minutes from last year to end 2023 with 39.4 billion minutes.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

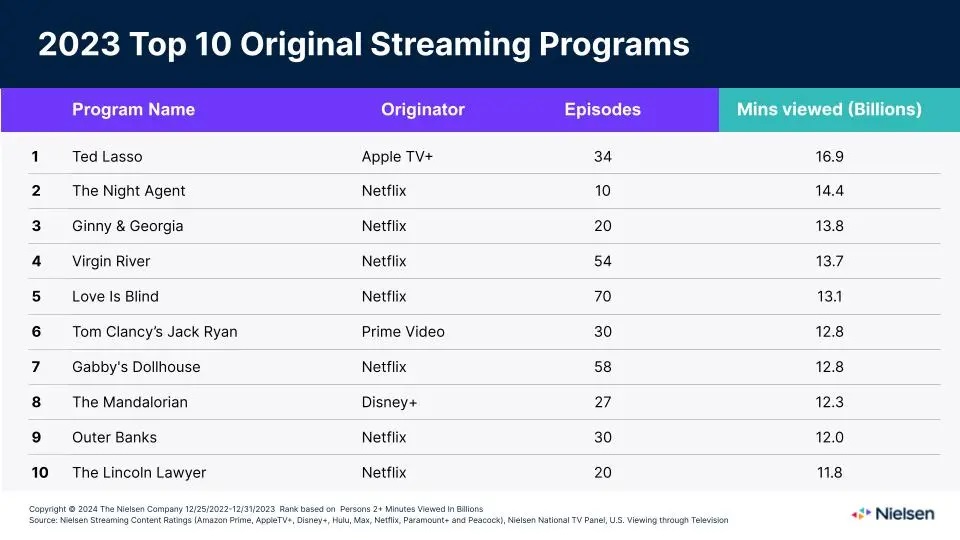

Despite the presence of the writer and actor strikes last year, a handful of originals did come to market, and the U.S. top 10 titles garnered more than 133 billion minutes viewed. The biggest surprise in the list, however, was "Ted Lasso", the signature series of Apple TV+ that took the crown as most-watched original program despite the fact that the platform has a smaller relative footprint than the other platforms.

In the movie category, "Moana", released on Disney+ in late 2019, continues to engage audiences, topping all other movies in 2023 with an all-time high of 11.6 billion viewing minutes after landing in the top four spots over the past four years. Since Nielsen began measuring streaming, audiences have watched nearly 80 billion minutes of Moana, which translates to watching the full movie 775 million times.

Originally released in 2021, "Encanto" showed ongoing appeal with audiences with just under 10 billion viewing minutes after topping the movie list in 2022 with 27.4 billion viewing minutes.

Looking to the year ahead, Nielsen's researchers argued that even with the end of the Hollywood strikes, audiences will continue to see less new content than we saw in 2022—the likely high water mark for scripted programming.

Given the massive library of existing video titles—more than 1.1 million across linear and streaming—combined with evolving distribution strategies, audiences will never find themselves with nothing to watch. That said, however, streaming will remain a dominant option in the U.S., especially as high-profile sporting events, like the recent NFL playoff game between Kansas City Chiefs vs. Miami Dolphins (which attracted 22.8 million live and same day viewers), become exclusive to streaming services.

Amid the ongoing excitement about streaming, however, it’s important to note that streaming is no longer limited to on-demand programming, Nielsen said.

The rise of virtual multichannel video programming distributors (vMVPDs), free advertising-supported streaming television (FAST) channels and apps that offer access to live programming highlights the continued blurring between linear and streaming TV. For example, more than 80% of houses that access TV content from an internet connection watched some form of linear programming in 2023.

"The takeaway here is that the TV screen remains the biggest device for media engagement, but it’s now a conduit for all content rather than a screen for channel-specific programming," the researchers wrote.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.