Ops Brace for Second Wave of Cord-Cutting

Analyst Craig Moffett predicts Q2 pay-TV video losses are just the tip of the iceberg

NEW YORK—After what was a devastating second quarter for pay-TV—video customer losses reached a new record, fueled by the pandemic and the overall shift to streaming services—influential media analyst Craig Moffett believes that the worst is yet to come.

Pay-TV shed about 1.8 million subscribers in Q2, fueled by continued heavy losses at DirecTV and Dish Network, as well as pandemic-fueled declines at Comcast and telco TV providers. Comcast more than doubled its video losses in Q2 to 478,000 (from about 224,000 in the prior year), while DirecTV continued to bleed customers, losing 871,000 subscribers in the period.

Charter Communications was the only bright spot on the video front in the period, adding about 102,000 video customers. But Moffett, principal and senior analyst at MoffettNathanson, doesn’t expect that trend to continue. In a note to clients, he said that the industry weathered yet another record subscriber decline and it shows no signs of letting up.

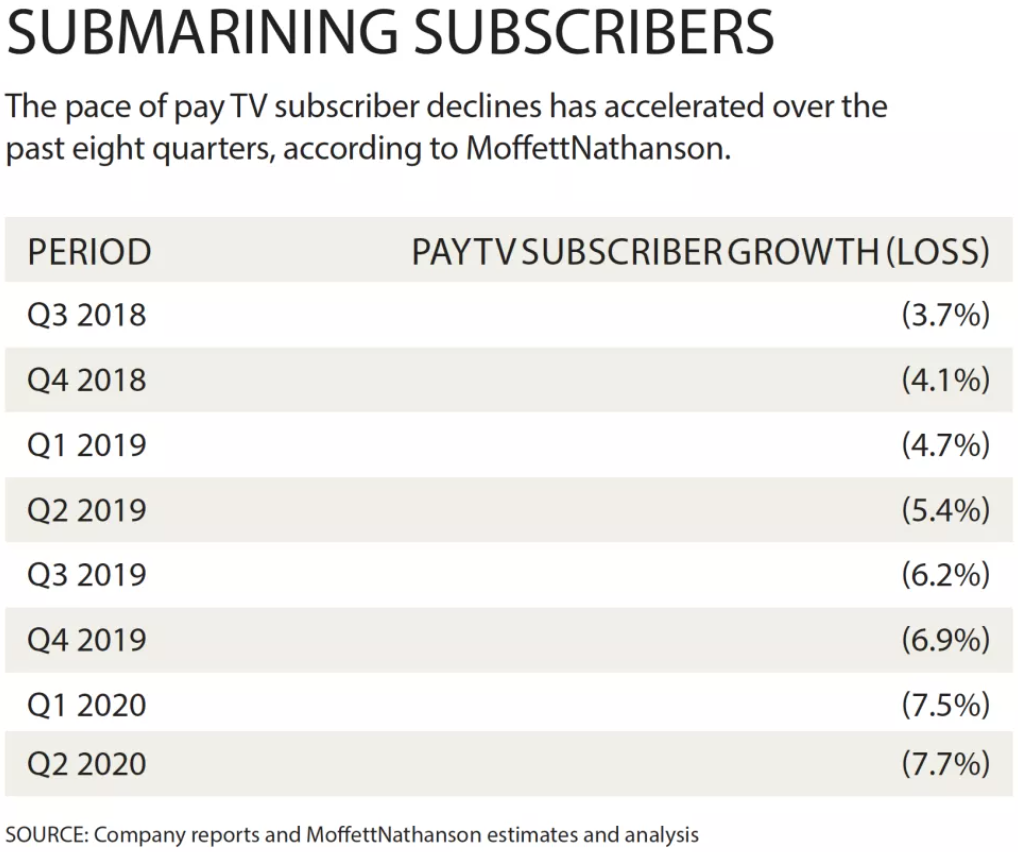

According to Moffett’s estimates, pay-TV subscribers fell 7.7% in Q2 (8.3% if pandemic-related nonpay customers are excluded), the worst ever for the sector. And it comes after eight consecutive quarters of worst-ever losses.

That forebodes a scary trend for the business.

“At this rate of decline (somewhere between 7.7% and 8.3% per year), the traditional pay-TV business would disappear entirely in another 12 years,” Moffett wrote, adding that just two years ago the rate of decline was 3.3%, while last year fell at a 5.4% clip.

Cable operators have shifted their focus toward broadband, which enjoyed record growth in Q2. Charter added 850,000 high-speed internet customers in the period, 50% above the prior quarter, while Comcast and Altice USA also had record growth in that segment. Broadband growth is expected to continue. And, at the same time, more customers are opting for broadband-only service, using that connection to access Netflix, Amazon Prime Video, Hulu, Disney Plus and Peacock and driving a stake through the heart of the video business.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Adding to the confusion, Moffett said, is the uncertainty around the Keep America Connected pledge, under which most cable operators agreed not to disconnect broadband customers during the pandemic for lack of payment. While no operators are being accused of skewing numbers, it is difficult to determine how many of those customers will convert to paying subscribers once the pandemic subsides.

Then there’s the question of new household formation, which according to U.S. Census Bureau statistics, reached 2.28 million additions in Q2. That, too, could be skewed by the pandemic, Moffett said, boosted in part by a moratorium on rental evictions, people occupying their seasonal second homes, or just a product of the “impossible environment for data collection.”

Other analysts expect video subscriber erosion to continue. In a research note, Evercore ISI media analyst Vijay Jayant predicted Comcast would lose around 400,000 video customers in Q3, while broadband subscribers would rise by 525,000.

At the Goldman Sachs Communacopia conference last month, Comcast chairman and CEO Brian Roberts said the company was on pace to break records in broadband additions, adding that it was already “well over 500,000” broadband additions in mid-September.

In a research note, Sanford Bernstein media analyst Peter Supino said the focus on broadband will help drive margins higher. “Comcast’s excellent internet sub results reinforce our ‘losing to win’ theme: that the confluence of robust internet and relentless video subscriber losses means structurally improving margins and ROIC,” Supino wrote of Comcast’s Q2 performance.

Altice USA, which surprised the industry with its $7.8 billion unsolicited bid (with Rogers Communications) for Canadian telecom company Cogeco on Sept. 2, also is expected to see continued video erosion. At press time, there had been little movement on that bid since Cogeco’s controlling shareholder flat-out rejected it in September, but the pace of video declines highlights the need to expand the footprint. Altice USA, which has the highest broadband penetration rate in the industry in its metropolitan New York area, lost about 35,000 video subscribers in Q2, but added a record 70,000 broadband customers, more than three times consensus expectations of 21,000 additions.

Supino expects video losses to level out at Altice over the next few years. In a research note, he estimated video losses would hover between 30,000 and 40,000 through Q1 2024. He estimated broadband growth would be around 20,000 to 40,000 per quarter during the same time frame.

DTC: THE LAST NAIL

While broadband rolls rise, the shift to streaming video continues at an accelerated pace. And Moffett believes the transformation of the content business to a direct-to-consumer (DTC) model will drive the final nail in traditional pay-TV’s coffin. In his note, Moffett predicted that content redirection, the practice of taking A-list shows from traditional networks and offering them DTC, is the second wave that will ultimately make pay-TV as we currently know it moot.

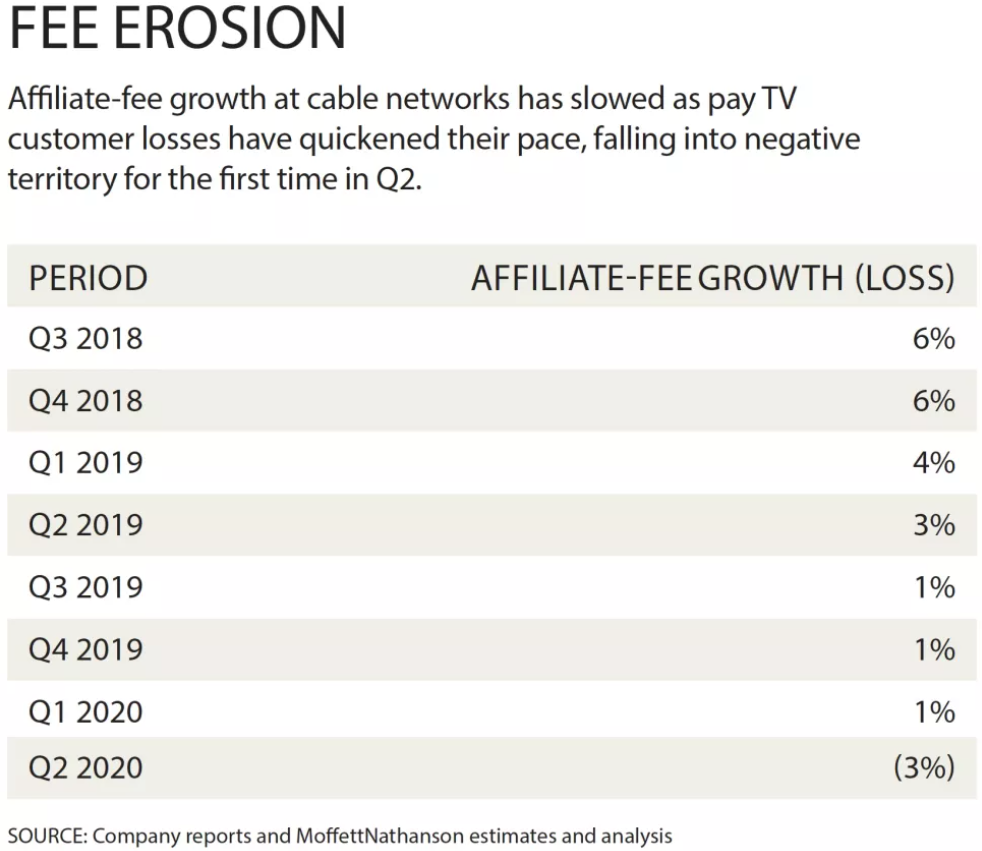

The analyst warned that as networks are redirecting content while their channels are still under contract with traditional distributors—with escalators that help partially offset subscriber declines—that train could stop running come renewal time. Moffett estimated that overall affiliate fees dropped 3% in Q2 for the first time ever. Over the next four years, he predicted that 0% affiliate-fee growth would be the new normal for cable networks.

“The pay TV ecosystem is well and truly unraveling,” Moffett wrote.