OTT Keeps Viewing Options Open for Consumers

With more services launching and corporate strategies diverging, don’t expect a streaming shakeout soon

It is arguably the best time in history to be a content consumer. Gone are the days of relying on the Big Three (ABC, CBS and NBC) for news and entertainment. Today, between linear broadcasters and the flood of OTT services — a new one being introduced what seems like every day — consumers have more viewing options than ever before.

New streaming services continue to be launched. HBO Max, Roku Originals and IMDb TV joined the Big Three — Netflix, Amazon Prime Video and Hulu — as well as Disney+, Apple TV+, Peacock, Paramount+ and Discovery+ among the major entertainment choices.

Altogether in the United States there are over 100 OTT services and more than 1,000 worldwide, according to Dan Rayburn, principal analyst, Frost & Sullivan, who said that the growing OTT market is giving consumers more options to find their entertainment.

“Whether it’s cars or streamers, consumers love choice when it comes to services as a general rule,” said Rayburn.

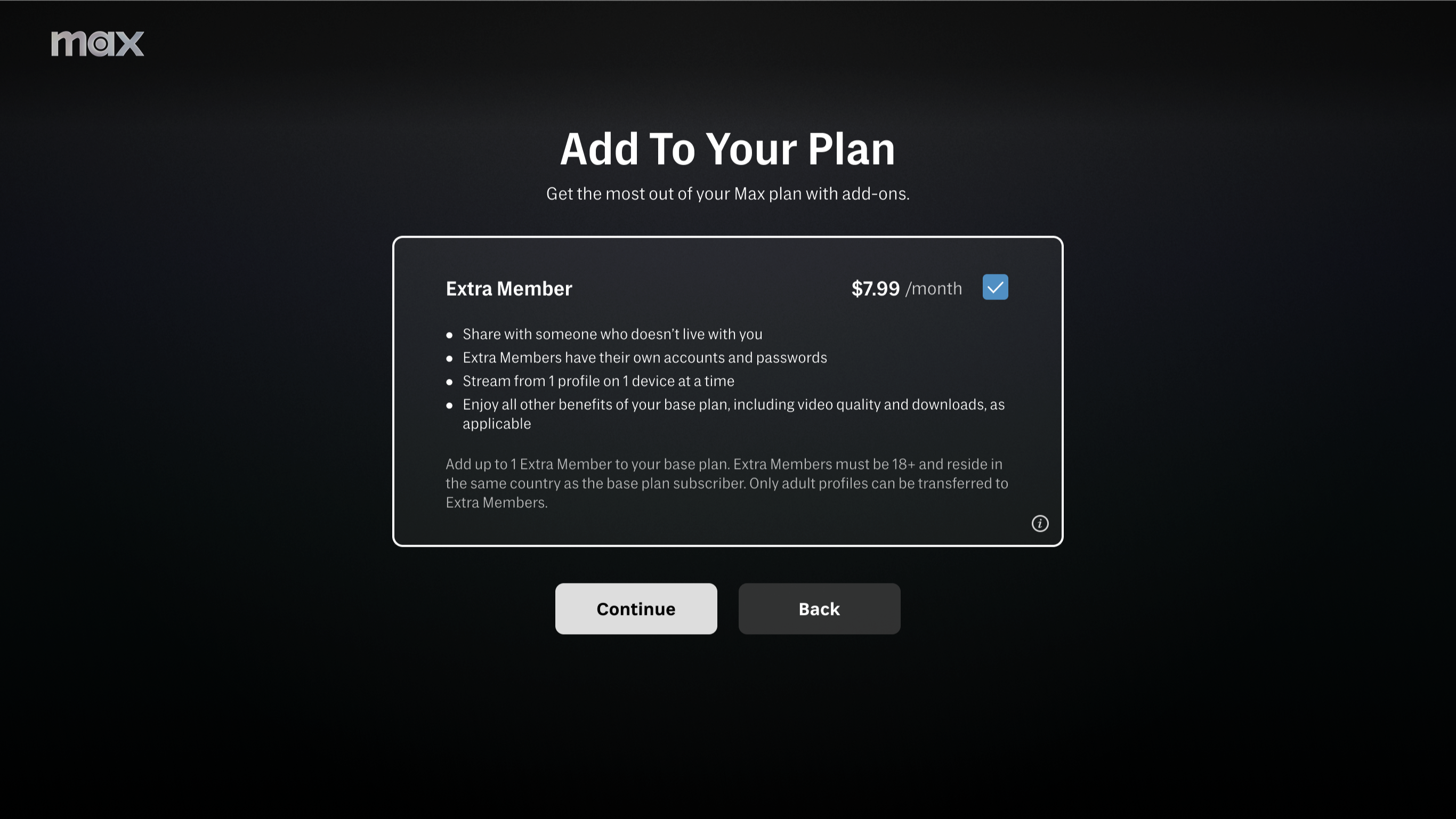

But with choice comes confusion, and understandably so. The multitude of OTT services in the market, with prices shifting on a regular basis, has left consumers confused and wary of adding on more monthly fees.

“These services are going to get more expensive, so consumers are going to have to decide how much money they have to spend and which services are most important to them,” said Rayburn. “And that’s not going to change going down the road because you’re not going to have services combining.”

Consolidation is not likely to happen among the biggest worldwide OTT services, according to Rayburn, because conglomerates with different business models and ecosystems own them.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Liam Gaughan, a researcher at Parks Associates, agrees. “Larger players are less likely to merge due to their role as brand ambassadors for their respective entertainment companies,” he explained. “But consolidation will continue to be common among smaller and niche services.”

Some might say documentaries are a niche market, but with the boom in content services, according to Gaughan, that programming is essential to OTT service libraries.

“Nonfiction programming ranks high among viewers’ preferred content,” Gaughan said. “Of U.S. broadband households, 37 percent watch documentary content on the online video services they access. Nonfiction exclusive services such as CuriosityStream and Discovery+ have rapidly grown.”

While nonfiction content might be the sweet spot for several OTT services, Rayburn said that when it comes to what programming works for a streaming service is debatable.

“If you look at content, [each service] has their own formula based on who their audience is,” Rayburn said. “They have a formula and data, which they don’t share. What’s interesting, though, is to see how many times a formula doesn’t work. How many shows on Netflix and Amazon and Hulu get cancelled after a year? It’s a hard formula to figure out and a very expensive business.”

There’s no denying that the digital version of the Magnolia Network, the highly anticipated multimedia venture between Discovery and Chip and Joanna Gaines, helped Discovery+ when it launched in July with more than 150 hours of unscripted programming.

Originally the plan was to launch Magnolia on the linear grid first, taking over Discovery’s DIY Network. The challenges of the pandemic altered that plan, pushing the linear takeover to January 2022 and making Magnolia a streaming exclusive for now.

Magnolia Network President Allison Page said that while the Gaineses already had plenty of viewership among all demographics, being on Discovery+ has introduced the duo to nonlinear audiences and has also “brought some of that linear audience over into streaming because they’re passionate about [the Gainses] and they are passionate about this brand. So, even though they don’t want to pay $5 more a month, they came to Discover+.”

Content, as they say, is king and all the kings in this streaming war, or race, want to win. Only time will tell what OTT services survive.

© NAB 2021