Paramount+ Provides 'Best Value in Streaming' in U.S., According to Ampere

Disney+ comes in a close second

LONDON—Ampere Analysis has rated Paramount+ as the top streaming service in the U.S., in terms of value, based on the company’s “Popularity and Critical Rating” formula.

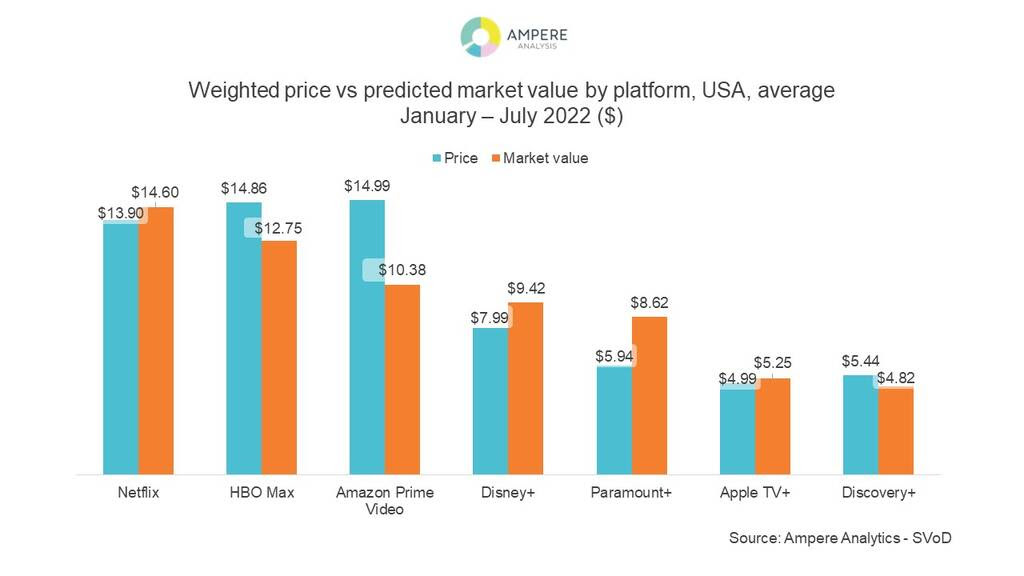

Priced at $6.00 but with a content value of over $8.50 a month, Ampere says Paramount+ provides the best streaming value in the U.S. Disney+ is a close second with a content offer able to justify its recent $3.00-a-month price increase for the ad-free tier, according to the latest Popularity and Critical Rating data from Ampere Analysis.

Paramount+’s overall content offer is boosted by the breadth of its diverse content catalogue and the popularity of several hit Reality TV franchises, the researcher said. In addition, it is supported by Paramount Global’s long-running Crime drama series plus a strong mix of licensed movies and TV shows from other suppliers. Ampere’s analysis suggests Paramount+ has plenty of headroom for price rises while still remaining competitive with its US streaming peers based on its content offer.

The findings are contained in Ampere’s latest report, The value of content to major streaming services in the US, which uses Ampere’s Popularity and Critical Rating metrics to assess the relative market value of content to the price a streaming service is able to charge viewers for access.

The analysis assesses the contribution made to the market value of different content suppliers, both in-house and third-party. Paramount Global productions contribute the most to the value of Paramount+ at 40% of the market value. Licensed classics including The Brady Bunch and Star Trek: The Original Series pack a punch, generating 28% of the market value, despite contributing just 9% of the titles available on the platform.

In-house Crime & Thriller titles are the most valuable per title to Paramount+ with classics like The Godfather, NCIS, and CSI. But Paramount Global-produced Children & Family titles add considerable value to a different, younger audience segment with titles like Avatar: The Last Airbender and iCarly.

Disney is the only other major U.S. streamer analyzed that had such a stark price-to-market value disparity, Ampere said. Although pursuing a very different content strategy, Disney is buoyed by its big-name franchise content and Intellectual Property with Marvel Cinematic Universe titles contributing the most value relative to volume within the content offer. Other Disney-owned content, primarily children’s live action and animation are the single largest contributor to value, driven by the volume of Disney’s archive. But even Disney+ still derives 30% of the value of its content offer from third-party licensed content, the researcher said.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“As a later entrant to the US streaming market, Paramount+ is maximising great value as a marketing tool relative to some of its more established peers, said Ben French, Analyst at Ampere Analysis. “Simultaneously, it is also leveraging the substantial catalogue and key Reality and Entertainment franchises of Paramount Global. Our unique analysis shows the huge importance of franchise content and film and TV based on character IP. It also highlights the on-going importance of licensed content from third-party suppliers, not just to Paramount+ and Disney+ but to all the streaming services analyzed.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.