PwC: U.S. Entertainment and Media Spending Grows for the First Time Since 2007

NEW YORK: The latest PwC financial forecast for the entertainment and media sector calls for clear skies and sunshine. PricewaterhouseCoopers’s five-year outlook calls for the E&M sector to grow at a 4.6 percent a year on average in the United States, from $443 billion last year to $555 billion in 2015. Growth in the global sector is pegged to grow 5.7 percent on average, from $1.4 trillion to $1.9 trillion by 2015.

This year’s forecast is brighter than last year’s 2010-14 outlook,when the U.S. growth rate was expected to top out at 2.6 percent, and the global rate, 5 percent.

According to the PwC 2011-15 outlook, the E&M industry is being driven primarily by multiplatform demand and collaboration.

“The biggest challenge for E&M companies is to turn five key attributes that matter to consumers: Convenience, experience, quality, participation and privilege--into sustainable, profitable and engaged relationships by offering advantages that outweigh the attractiveness of free or pirated content,” said PwC’s Ken Sharkey.

While digital currently accounts for just over a quarter of total industry revenues, it is expected to account for 58.7 percent of all growth in spending globally during the next five years. Digital spending in the United States is expected to account for 28.5 percent of all E&M spending in 2015, up from 20.6 percent in 2010.

Advertising, the most cyclically sensitive of the three E&M spending streams (advertising, consumer and end-user spending), recorded the largest year-on-year swing, rebounding in the United States at 5.4 percent in 2010 from a 14.4 percent slump in 2009.

Overall, U.S. advertising is expected to increase at a 4.2 percent on average from $170 billion in 2010 to $208 billion in 2015.

This compares to last year’s outlook, when PwC said 2014 U.S. ad spending would remain 9 percent below 2007 levels by 2014. The 2010-14 growth rate was then forecast at 2.6 percent.

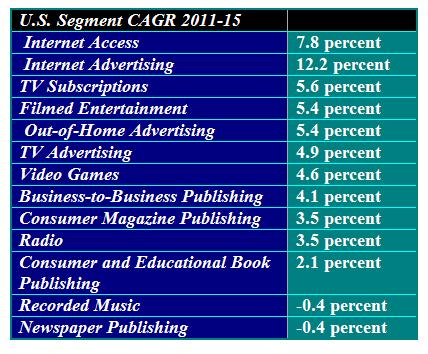

Television advertising, the largest segment, is expected to grow at 4.9 percent compound annual growth rate. Internet access and advertising will exceed the overall average, while recorded music and newspapers will experience a decline.

By way of indirect comparison:

~ In-Stat predicts ad-supported content discovery will generate $2.4 billion by 2015.

~ BIA/Kelsey forecasts:

Local search ad revenues will reach $8.2 billion by 2015.

Social media ad spending will reach $8.3 billion by 2015.

Local TV revenues rose 23.2 percent to $19.4 billion in 2010.

~ Deborah D. McAdams

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.