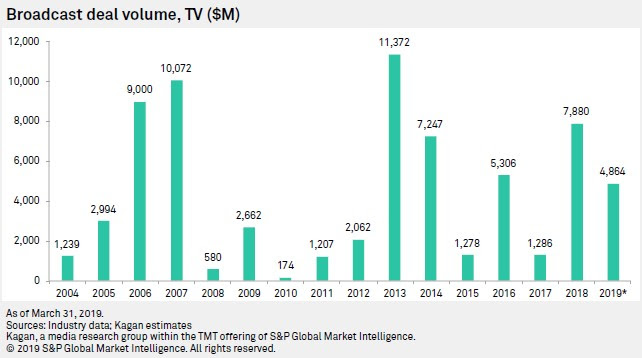

Q1 2019 Sees $5B in Broadcast M&A Deals, Says Kagan

MONTEREY, Calif.—Apollo Global Management’s Cox Media Group and Northwest Broadcasting deals and Nexstar Media Group’s divestiture of 19 stations to win FCC approval of its Tribune Media acquisition helped to propel merger and acquisition activity in the U.S. broadcast market to $5.1 billion, according to Kagan, a media research group with S&P Global Market Intelligence.

The quarterly deal volume, the highest since the second quarter of 2007, was propelled by Apollo’s $3.1 billion purchase of a majority stake in Cox Media, which included 14 full-power and nine low-power TV stations, four radio stations and a newspaper, as well as its $384 million purchase of a majority stake in Northwest Broadcasting, the researcher said.

The other major M&A activity centered on Nexstar divestitures. The company sold a total of 19 stations in 15 markets for $1.32 billion to E.W. Scripps and TEGNA, a move needed to win regulatory approval for its December 2018 deal to merge with Tribune Media.

Gray Television boosted the quarterly deal total by $45 million with its acquisition of two CBS affiliates, WWNY serving Watertown and upstate New York and KEYC-TV serving southwestern Minnesota, Kagan said.

Radio deal volume for the quarter hit nearly $237 million, half of which involved Cumulus Media.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.