Q3 Quiet on Big Broadcast Station Deals, Totals $190 Million

MONTEREY, CALIF.—Despite taking place during the heart of baseball season, the third quarter of 2017 didn’t feature any home-run station acquisitions or mergers, as the $189.6 million in volume was the lowest quarterly volume for the year, per S&P Global’s Kagan media research group. Of course after the first two quarters of the year saw two billion-dollar deals, it would have been hard to match.

A total of $66.6 million of the total deal volume came from the TV market. The top TV deal for Q3 took place in July, when OTA Broadcasting sold its two Palm Springs, Calif., stations to Entravision Communications Corporation for $21 million. Kagan estimates a 7.5x forward seller’s multiple, while Entravision reported a buyer’s multiple of less than 6.5x.

Other deals included EVINE Live selling its WWDP station in Boston to WRNN-TV Associates Limited Partnership for $10 million, as well as a $3.5 million channel-sharing agreement with WMFP. London Broadcasting sold KTXD in Dallas to Cunningham Broadcast Corporation, a marketing agreement partner of Sinclair Broadcast Group, for $9.5 million. Southern California License sold KAZA in Los Angeles to Weigel Broadcasting for $9 million; KAZA had previously sold its spectrum during the Spectrum Incentive auction and entered a channel-sharing agreement with Venture Technologies Group’s KHTV-CD. All other TV deals in Q3 registered $6 million or less.

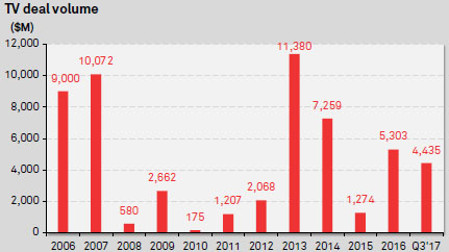

The Kagan graph on TV deal volume through Q3 shows 2017 is already well beyond the results of 2015, and has a chance to surpass that of 2016.

Radio contributed a majority of the deal volume, accounting for $123 million. Nearly 50 percent of that came from the Educational Media Foundation acquisition of three FM stations Entercom Communications had to spin off after its merger with CBS Radio; Educational Media Foundation paid $57.5 million for the stations.

The second largest being a sale of four AM and 14 FM stations and two FM radio translators from Alpha Media to Dick Broadcasting Company for $19.5 million; all the stations are located in markets in Georgia and the Carolinas. There were 10 other radio transactions between $1 million and $7 million; all other radio deals in Q3 were less than $1 million.

According to a graph from Kagan, deal volume for radio through three quarters is already higher than the last five years total.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.