Report: Consumers Doubling Up on TV Services by Bundling

Click on the Image to Enlarge

LONDON—There are a lot of ways for viewers to watch TV nowadays, whether it be services like Netflix, devices like Roku, or a good old-fashioned cable box. Rather than simply choosing a preferred service, a new report from Ampere Analysis reveals that many consumers are combining services for the most possible coverage.

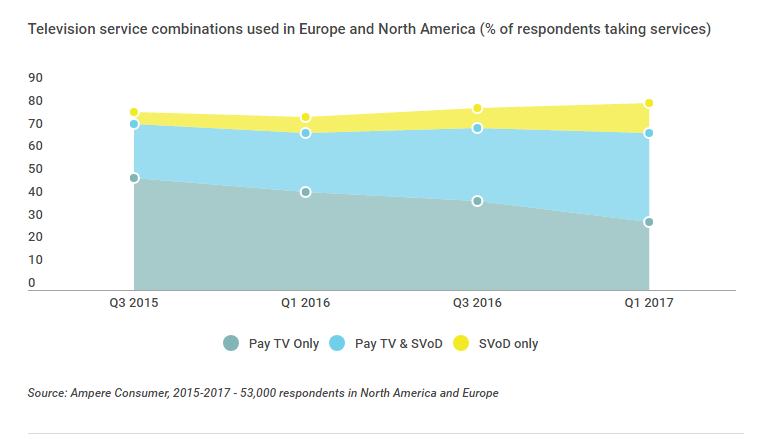

This bundling of Pay TV, VoD and SVoD services is taking place so consumers can “build their own perfect TV offer,” Ampere described. The survey gathered information from 53,000 internet users in North America and Europe over the last 18 months and discovered more and more of them are customizing their own bundles. At the end of Q1 2017, 40 percent of respondents had built a custom TV bundle, an increase from mid-2015 when that number was 24 percent.

Despite the influx of these new services, cord-cutting has not taken off as much as some have feared with the respondents for the survey. While there has been an increase since 2015 of consumers with just on-demand services (5 percent in 2015, 13 percent in 2017), as well as a decrease in the number of homes that just have a Pay TV service (49 percent to 30 percent), Pay TV remains present in about the same number of homes in some capacity. Approximately 70 percent of homes have just Pay TV or some combination of Pay TV and SVoD services.

“The often-predicted mass cord-cutting from Pay TV, driven by growth of SVoD, has yet to arrive,” said Richard Broughton, research director at Ampere Analysis. “But let’s not get complacent. There are warning signs. Our research has found that consumers who are doubling-up on their TV services, combining their Pay TV service with one or more SVoD services, are twice as likely to be strongly considering leaving their main TV provider in the next six months.”

In the meantime, consumers are spending more money than ever on television services. In North America, the average money spent on subscription television for 12 months in 2016 was $311; this can include services like Netflix, Hulu and Amazon, as well as cable and satellite services like Comcast or DirecTV. Ampere reports that this is an increase of $30 per person per year from five years ago. The number is less in Western Europe at $95 per year, but that is still an increase from five years ago from $78.

Netflix and Amazon are the big SVoD players, though many subscribers have at least two services, i.e. in the U.S. four in five Hulu subscribers have Netflix and two thirds have Amazon Prime. Two thirds of Amazon Prime users also subscribe to Netflix in areas like the U.S., Germany and the U.K. The reason for overlap is content, 94 percent of titles are exclusive to a specific service.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“While a degree of cannibalization of subscription TV services is undoubtedly occurring as some customers decide to cut the Pay TV cord, the general trend is more, not less, access to television services,” Broughton reported. “That suggests broadly positive outcomes for content owners and distributors, who can expect greater levels of spending on good quality television content.”