Report: Growth of Fixed Broadband Traffic Will Slow

Strategy Analytics predicts that growth rate will fall by 82% by 2028

BOSTON—A new report challenges the commonly held assumption that the explosive growth in consumer broadband internet traffic will continue at the breakneck speeds seen in recent years.

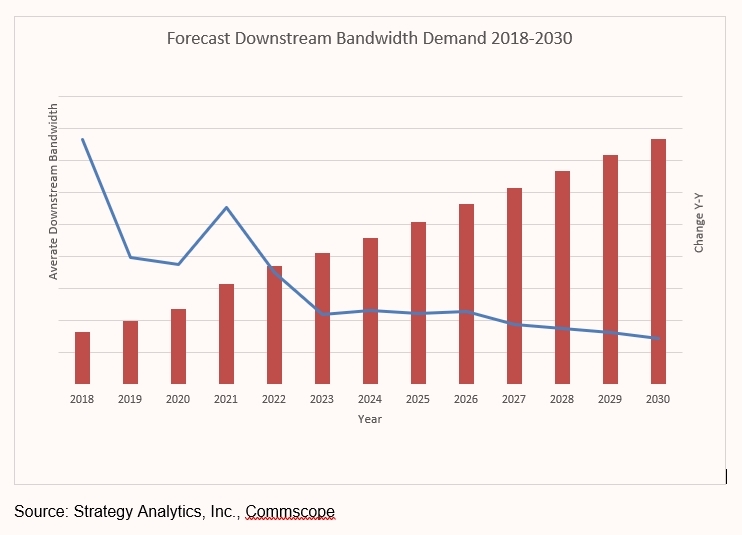

The report from Strategy Analytics finds that while fixed broadband traffic will continue to grow, the rate of that growth will slow down in upcoming years, with the annual growth rate declining by about 82% between 2018 and 2028.

If correct, that projection would have a major impact on telcos and cable operators who have seen making massive investments in their networks to accommodate streaming traffic and a healthy bump in new broadband subs, more than 1 million in Q1 2021 alone, according to the Leichtman Research Group.

To handle the widespread consumer embrace of streaming media and other broadband technologies, U.S. cable operators and the cable industry’s research consortium CableLabs are currently working on a 10G initiative that would lead to the deployment of broadband networks capable of handling 10 Gbps speeds for both downloads and uploads.

Phil McKinney, president and CEO, CableLabs has repeatedly argued that they see no slowing down in internet traffic.

The report, “Is Fixed Broadband Traffic Growth Slowing Down?” challenges that. It notes that for many years Nielsen’s Law has accurately predicted that the data rate of the highest available broadband service tier for cable consumers will grow by about 50% a year.

Strategy Analytics senior analyst and author of the report Dan Grossman argued that “growth in broadband internet traffic was driven by a handful of phenomena, most recently the rise of streaming video. As consumers become saturated, we have seen no evidence of another driver to replace it. Not 4K (UHD) or 8K (UHD2) video. Not Augmented Reality. Not Virtual Reality. Not streaming or console games. Not Smart Homes. Broadband internet is a maturing business, and the industry has to plan for that.”

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

As a result, the research company believes that there is “little evidence to suggest that a critical mass of consumers is likely to require more than 100-300 Mbps any time in the next 10 years,” said Strategy Analytics Service Director Phil Kendall. “There will be many reasons why service providers will need to offer higher headline rates, but the days of prioritizing investment in ‘speeds and feeds’ are coming to an end, to be replaced by a need to focus on latency, reliability and customer service as sources of differentiation.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.