Report: Three in Five Advertisers Spending Less in 2020

Ad spending increasing as the year progresses, according to Advertiser Perceptions

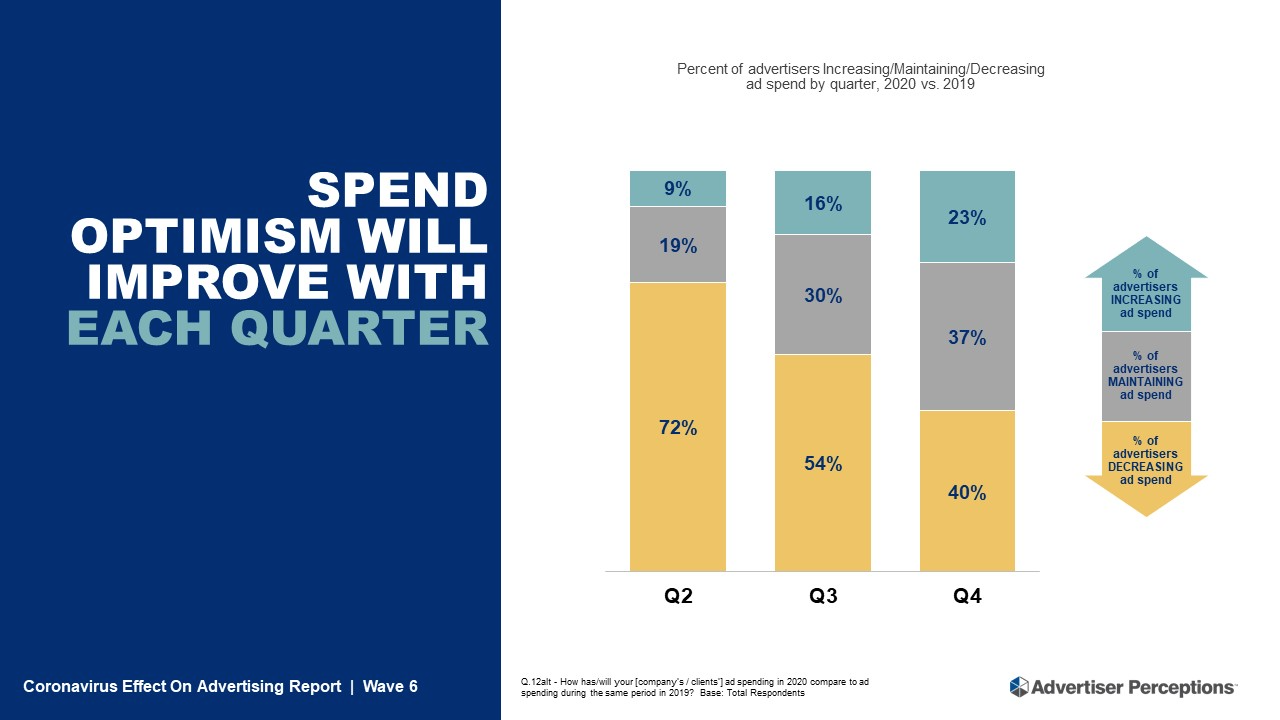

NEW YORK—The advertising landscape took a substantial hit from COVID-19, which according to Advertiser Perceptions will result in three out of five advertisers spending less in 2020 than in 2019. However, spending is expected to increase during the last two quarters of the year.

This data comes from Advertiser Perceptions' latest edition of its biweekly report, “The Coronavirus Effect on Advertising.”

In the second quarter of 2020, 72% of advertisers decreased their ad spending compared to the same period in 2019; 19% maintained ad spending levels and 9% increased. However, while budgets for Q3 and Q4 are still expected to be less year-over-year, they are getting closer to those previous levels (a 12% decrease for Q3, 7.5% for Q4).

This has Advertiser Perceptions projecting that the percentage of advertisers increasing their ad spending in Q3 will jump to 16% and 23% for Q4, while the percentage of decreased ad spending will fall to 54% in Q3 and 40% in Q4.

Helping to drive this push will be regional advertising, as there are expected to be staggered openings by state and locality. Also, two-thirds of advertisers who had earmarked ad money for the Olympics are expected to reinvest it into the second half of the year.

On the logistics side, Advertiser Perceptions found that 87% of advertisers will now negotiate for greater flexibility in media contracts, though 70% still anticipate to maintain their same budgets. In addition, 61% of advertisers are now looking for insights into how COVID-19 is changing the advertising landscape.

“Perhaps the greatest impact of COVID-19 on media is the way it will be bought and sold,” said Lauren Fisher, vice president, Business Intelligence, at Advertiser Perceptions. “Everyone now operates in a faster-moving marketplace, and that means two things. First, advertisers need more insights into changing consumer appetites and connection opportunities. Second, they need the ability to change plans and buys more often.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“Moving forward, all signs point to increased spending on CTV/OTT and ecommerce, emphasizing more integrated, holistic programs,” continued Fisher. “As the economy reopens and recloses at various speeds and to different extents across the country, the right message at the right time becomes even more important. Media that answer these critical questions will gain in engagement, spending and trust.”

For more information, visit www.advertiserperceptions.com.